A fresh Bullish Trend Entry Zone has been detected on MCX Crude Oil DEC-25, indicating a potential upside continuation from the demand zone.

📈 Trade Setup

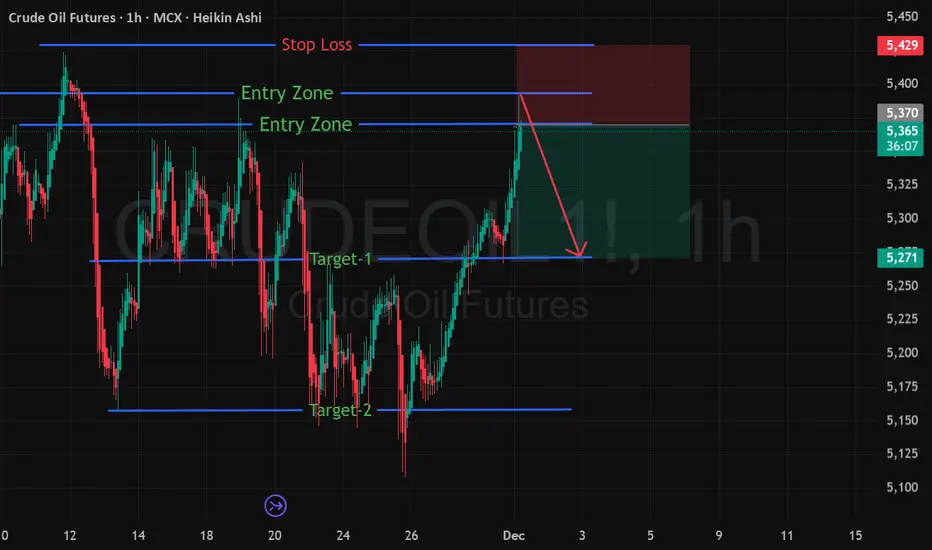

🟢 Entry Range: 5370 – 5390

🔴 Stop Loss: 5430

🎯 Target 1: 5270

🎯 Target 2: 5170

📊 Chart Explanation

Crude Oil has recently shown strong accumulation behavior near the lower demand band. Price is now entering a bullish reversal range, supported by:

Prior demand zone retest

Higher-low structure

Increasing bullish momentum

Buyers absorbing supply near 5370–5390

This setup indicates a possible swing move towards the 5270 and 5170 zones.

⚠️ Risk Management

Keep SL strictly at 5430

Position sizing is crucial as volatility remains high

This analysis is for educational purposes—trade with discipline

📌 Summary

Crude Oil DEC-25 is showing a clean bullish continuation structure. If price sustains above the entry zone, we may see a strong move toward the mentioned targets.

📈 Trade Setup

🟢 Entry Range: 5370 – 5390

🔴 Stop Loss: 5430

🎯 Target 1: 5270

🎯 Target 2: 5170

📊 Chart Explanation

Crude Oil has recently shown strong accumulation behavior near the lower demand band. Price is now entering a bullish reversal range, supported by:

Prior demand zone retest

Higher-low structure

Increasing bullish momentum

Buyers absorbing supply near 5370–5390

This setup indicates a possible swing move towards the 5270 and 5170 zones.

⚠️ Risk Management

Keep SL strictly at 5430

Position sizing is crucial as volatility remains high

This analysis is for educational purposes—trade with discipline

📌 Summary

Crude Oil DEC-25 is showing a clean bullish continuation structure. If price sustains above the entry zone, we may see a strong move toward the mentioned targets.

トレード稼働中

ノート

📘 How My Trading Plan Works I follow a strict and mechanical rule-based system, designed to protect capital and maximize returns.

Below is the exact step-by-step plan:

✅ 1. My Fixed Risk–Reward Ratio: 1 : 2

Every trade is designed to achieve minimum 1:2 RR.

If SL is 60 points → target must be at least 120 points.

This keeps the system profitable even if win-rate drops.

✅ 2. When Target = 1:1 → Move Stoploss to Cost

Example:

Entry 5380 → SL 5430 (50 points) → 1:1 = 5330

➡️ Once price hits 5330, the stoploss is shifted to 5380 (cost-to-cost).

🔒 This makes the trade risk-free.

✅ 3. When Price Completes 80% Toward Target → Trail Profit

Target-1: 5270

80% zone ≈ 5290 – 5270

At this stage:

✔ We book partial profits or

✔ Trail SL to protect majority of gains

This avoids giving back profits during pullbacks.

トレード終了: 利益確定目標に到達

Target 1 is nearly achieved (Low: 5281)🎯 Target 1: 5270

(Already almost achieved) (If Follow 80% Trail profit rule)

🎯 Target 2: 5170

(Advanced continuation target)

🎯 4. Holding Plan for Advanced Traders

If you are an experienced trader:

➡️ Hold the remaining position

➡️ SL stays at Cost-to-Cost

➡️ Let price move naturally toward Target-2 (5170)

This is where trend followers capture the bigger move.

🔍 Market Outlook

The price reaction confirms the bearish continuation structure.

If the candles close below 5300, momentum toward 5170 becomes stronger.

Trend traders should track:

Supply zones forming on lower timeframes

Volatility expansion

Pullback rejection candles

✅ Conclusion

Target-1 has almost been hit exactly as per plan.

Now the trade is risk-free for those who followed the rules.

📌 Next Focus:

Trail properly

Manage position size

Track price behavior around 5250–5270 zone.

(Please follow and boost)

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。