Japan's Nikkei extends record climb after BOJ refrains from rate hike

- Yen falls with JGB yields as Governor Ueda stays cautious

- Same two officials dissented in favour of raising rates

- Nikkei volatile after rapid rally, amid Trump-Xi talks

By Kevin Buckland and Rocky Swift

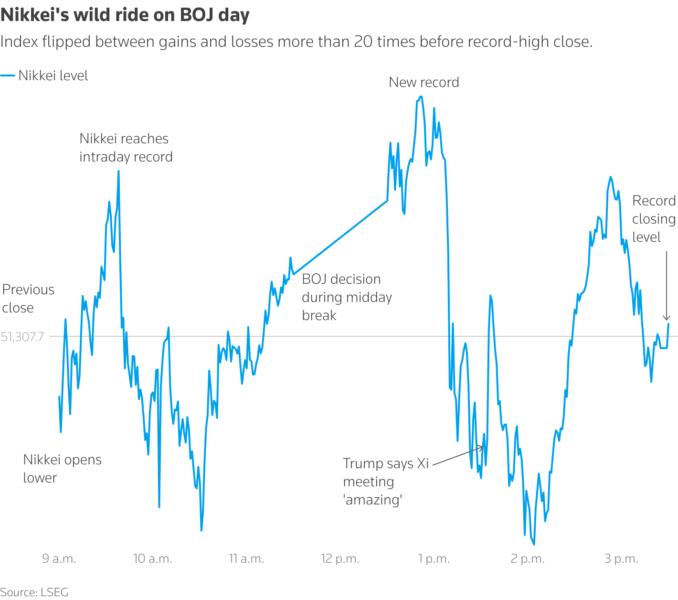

Japan's Nikkei share average climbed to a record high on Thursday after the Bank of Japan refrained from raising interest rates, in a volatile session that saw the benchmark index flip between gains and losses more than 20 times.

The yen weakened and Japanese government bonds rose following the central bank's announcement, despite traders and economists widely expecting no change to policy this time.

At a news conference immediately after the stock market had closed trading for the day, BOJ Governor Kazuo Ueda said he had no preset ideas about the timing of the next rate hike. The central bank meets in December, and again in January.

"The central bank is clearly staying cautious and it remains hard to argue for increased odds of a December rate hike," said Charu Chanana, chief investment strategist at Saxo. "Yen bears may get bolder."

The yen weakened as much as 0.5% to an eight-month low of 153.52 per U.S. dollar USDJPY and as much as 0.7% to an all-time low of 178.39 per euro

EURJPY, accelerating declines as Ueda spoke.

The Nikkei NI225 climbed as much as 0.6% to reach 51,620.79 for the first time, before succumbing to some profit taking. It ended the day up only 0.04%, but enough to set a new record closing level of 51,325.61.

The broader Topix TOPIX gained 0.7% to 3,300.79.

Trading was made more volatile by news headlines from U.S. President Donald Trump's meeting in South Korea with Chinese leader Xi Jinping as they sought a truce in their trade war.

Trump called the meeting "amazing", and said chips were discussed and rare earth issues had been settled.

At the same time, U.S. tariffs on Chinese imports were only reduced to 47% from 57%, although Trump had threatened 100% levies.

In Japan's debt market, yields on 10-year JGBs (JP10YTN=JBTC) erased an earlier advance to be down 0.5 basis point at 1.645%. The two-year yield (JP2YTN=JBTC), which is particularly sensitive to the monetary policy outlook, declined 1.5 bps to 0.925%.

In its policy statement, the BOJ repeated its pledge to continue increasing borrowing costs if the economy moves in line with its projections.

It retained the view that underlying inflation is likely to hit 2% in the latter half of the three-year projection period through March 2027, and that risks to the outlook were "roughly balanced."

The same two board members dissented in favour of a hike as at the September meeting.

Investors and analysts had been watching for whether the BOJ's statement might read more hawkish, or if additional dissenters might emerge.

"Market disappointment on the lack of a hawkish tilt saw yen bulls bail," said Christopher Wong, a currency strategist at OCBC.

"But direction of BOJ policy normalisation is for hikes nonetheless," and with the U.S. Federal Reserve cutting rates, that should meaning a stronger yen against the dollar as a trend, Wong said.