OPEN-SOURCE SCRIPT

更新済 KST-Based MACD

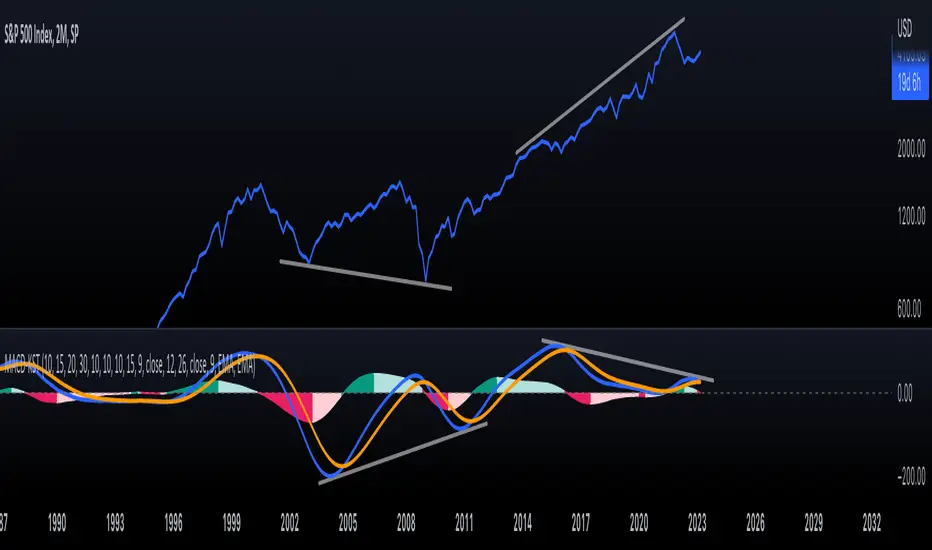

As a follow-up to my previous script:

I am posting a stand-alone KST-based MACD.

Note that this indicator is highly laggy. Specific care must be taken when using it.

The MACD-Signal crossing is quite delayed but it is a definite confirmation.

For earlier signs, the Histogram must be analyzed. A shift from Green-White signals the 1st Bear Signal.

A MACD-Signal crossing signals the 2nd Bear SIgnal.

The same applies for bull-signs.

This indicator is useful for long-term charts on which one might want to pinpoint clear, longterm divergences.

Standard RSI, Stochastic RSI and MACD are notoriously problematic when trying to pinpoint long-term divergences.

Finally, this indicator is not meant for pinpointing entry-exit positions. I find it useful for macro analysis. In my experience, the decreased sensitivity of this indicator can show very strong signs, that can be quite laggy.

Inside the indicator there is a setting for "exotic calculations". This is an attempt to make this chart work in both linear/negative charts (T10Y2Y) and log charts (SPX)

Tread lightly, for this is hallowed ground.

-Father Grigori

I am posting a stand-alone KST-based MACD.

Note that this indicator is highly laggy. Specific care must be taken when using it.

The MACD-Signal crossing is quite delayed but it is a definite confirmation.

For earlier signs, the Histogram must be analyzed. A shift from Green-White signals the 1st Bear Signal.

A MACD-Signal crossing signals the 2nd Bear SIgnal.

The same applies for bull-signs.

This indicator is useful for long-term charts on which one might want to pinpoint clear, longterm divergences.

Standard RSI, Stochastic RSI and MACD are notoriously problematic when trying to pinpoint long-term divergences.

Finally, this indicator is not meant for pinpointing entry-exit positions. I find it useful for macro analysis. In my experience, the decreased sensitivity of this indicator can show very strong signs, that can be quite laggy.

Inside the indicator there is a setting for "exotic calculations". This is an attempt to make this chart work in both linear/negative charts (T10Y2Y) and log charts (SPX)

Tread lightly, for this is hallowed ground.

-Father Grigori

リリースノート

Minor code change.リリースノート

Added a ribbon, I love that stuff...リリースノート

Aesthetic changes.リリースノート

Updates in default values to make the indicator more responsive, while keeping it beautiful.リリースノート

Added copyright. I love that indicator.リリースノート

Now KST is calculated using EMA by default. This is done for increased sensitivity. You can always revert back to SMA.オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。