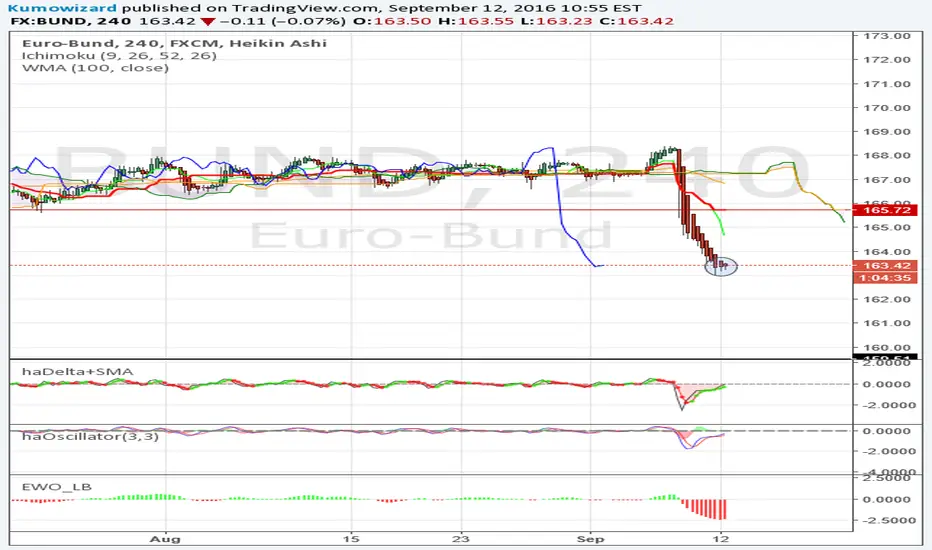

As this is a continous chart, indicators are distorted a bit due to previous change between front contracts, where we had a gap down between U6 and Z6 (Sept and Dec) Bund futures contracts.

If you look only at Heikin-Ashi candle itself, then the message is: short term consolidation or pull back ahead. Bearish support is between 165-165,50 (as Kijun Sen will come lower soon). Should market spike up above 165, we can start to look for sell signals. For now cover some shorts, or if you have nerves, then open small swing long with tight stop at 162,95.

If you look only at Heikin-Ashi candle itself, then the message is: short term consolidation or pull back ahead. Bearish support is between 165-165,50 (as Kijun Sen will come lower soon). Should market spike up above 165, we can start to look for sell signals. For now cover some shorts, or if you have nerves, then open small swing long with tight stop at 162,95.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。