Commvault Systems - Scaling SaaS Business At Double-Digits

Rundown

Commvault Systems CVLT is a data recovery and cybersecurity company. The industry has grown tremendously the past years as ransomware is running rampant. Its addressable market has ballooned to $57 billion as companies increase their CapEx on IT security. CVLT faces tough competition from companies like IBM and Oracle (ORCL). Its underlying business is strong and it shows continued adoption of its software, especially SaaS types.

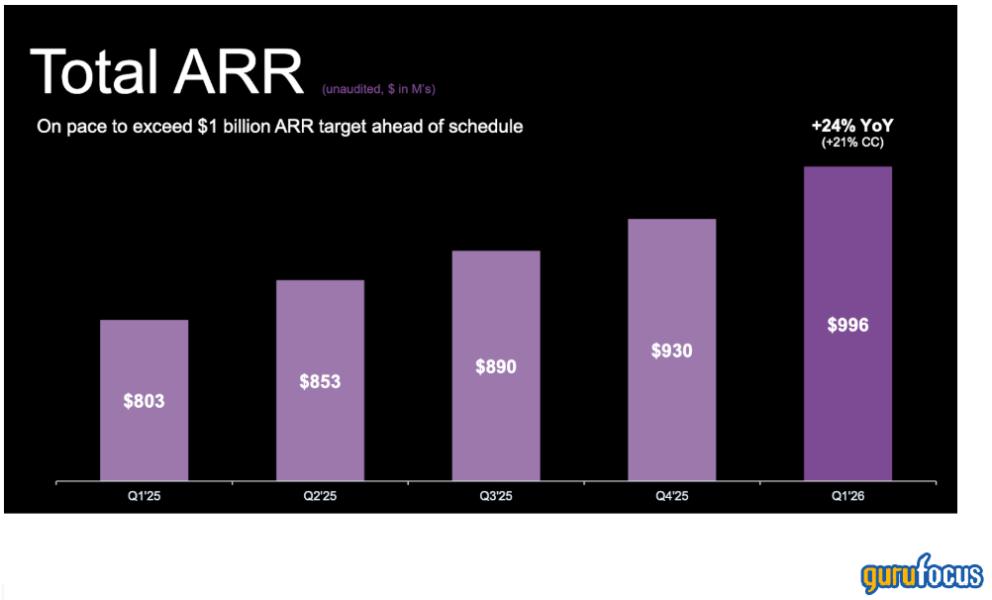

Because of this ARR has grown 63%. The momentum is reflected in the valuation right now, trading at 47x FY26 earnings. But think about what you are buying here. You get a business growing its bottom line by 20 - 30% annually. I'd argue there is plenty more room for net margins to expand, ultimately settling in the 25 - 30% range, which is similar to most SaaS heavy business. That's about 220% more net earnings based on today's net margins. If adoption keeps up like this I think you'd be surprised by how soon we can see that margin range.

Suite of products

Generally speaking, data recovery companies are highly personal in the sense that their software is an integral part of a business. The cost of switching or migrating data over to a new platform is costly, time consuming and many times you won't see the benefit until many years into the future. So once a client is using CVLT's software it's highly unlikely they will switch to something else in the short-term. This gives the company an implied MOAT.

Its core product is the Metallic Suite which is used for clients like Microsoft (MSFT) for its Microsoft 365/Office platform. It has coverage across OneDrive, SharePoint, Groups or Teams. The two companies have 27 years of partnership and if MSFT would see it as worthwhile to develop their own data backup they would have done so by now. This is a BaaS platform, where revenues are recognized under the perpetual license type. With the rise of cloud companies the need for a different data recovery type naturally came along.

CVLT's Air Gap Protect fills this hole. It's primarily aimed at large scale businesses that need more flexibility which at the same time does not hinder scalability. The software basically ensures that data is isolated for the main network meaning ransomware has a much harder time reaching this data. Since its cloud based data can be recovered from anywhere at any time too.

To further solidify its market position CVLT has some of the industry heavy hitters as customers, like AWS (AMZN) and Google Cloud (GOOG). According to Gartner which is an industry ranking site, (similar to rating agencies in fact) CVLT has been the best performing data and recovery option for 14 years now. This gives some perspective on just how well established it is in the industry.

Revenue breakdown and 3-year margin trends

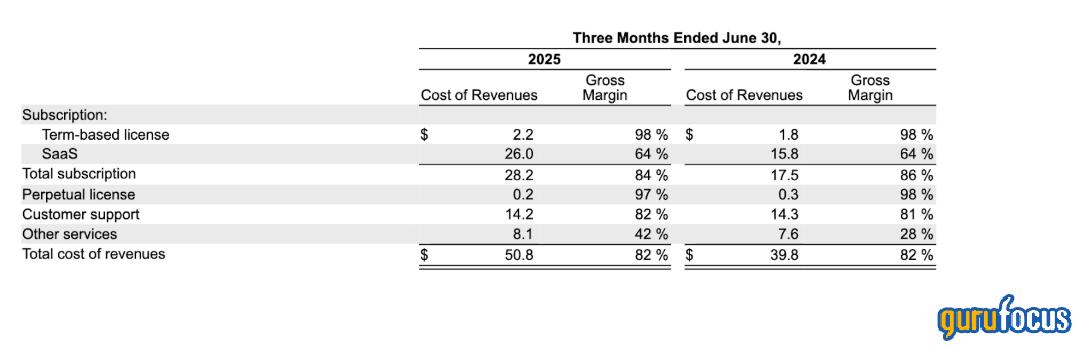

There are five different types of revenues for CVLT, these being: Term-based licensing, SaaS, Perpetual License, Customer Support and Other Services. Subscription revenues remain the main growth driver for the company right now, posting a 37% YoY increase. In this category SaaS accounts for 39,8% of revenues, up from 35,2% a year earlier. Partly due to scaling and gaining more customers, but much because of increased SaaS reliance the net income grew by 26,8% since 2024. The one revenue segment which saw a loss is the perpetual license, posting $6 million lower revenues. The revenue type just accounts for 2,6% of all revenues so the impact was minimal.

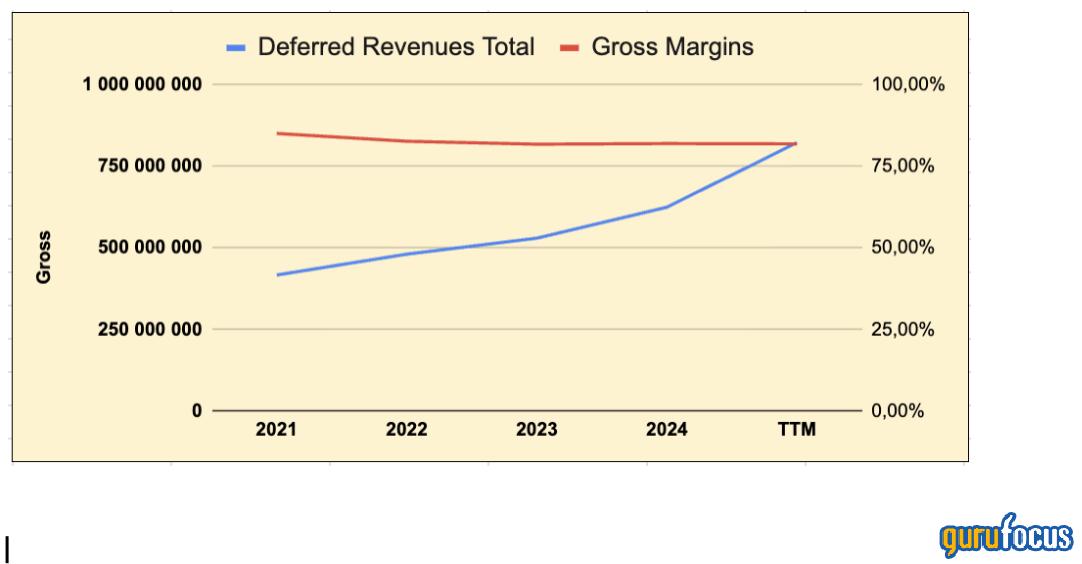

Part of CVLT's accounting approach is recognizing a large portion of deferred revenues. The company classifies this as performance obligations, essentially the result of new customers paying for a software, but CVLT not recognizing the payment until it has met its obligations. I like this approach a lot because it gives a lot of future revenue visibility. Between 2021 and the last quarter deferred revenues have grown 97%. In the SEC filing CVLT mentions 62% of this will be recognized over the next 12 months, $510 million. Seeing 50% of trailing revenues already in the books lets us know revenue growth will be a small issue going forward.

You can see gross margins declining too. CVLT says this is due to higher hosting costs in SaaS, largely due to increasing its offerings in this area. As it matures I expect margins will begin climbing higher. Most SaaS businesses seem to settle at around 20 - 30% margins, referring to Fortinet (FTNT)(30.6% TTM) or Palantir (PLTR)(22,18% TTM).

The pivot into subscription based revenues has come quickly. Just 3 years ago the (Q1 2023) subscription revenues represented 46% of all. Now at 64,4% shows CVLT willingness to lean into this more to drive earnings growth going forward. Despite SaaS growing the fastest, the highest earning (98% gross) revenue type term-based license" grew 36% YoY. QoQ ARR grew 4,1% and if it keeps it up Q2 FY26 will show over $1 billion in ARR. The biggest benefit this has on performance has been rising operating margins, growing 70 bps YoY to 8.9%.

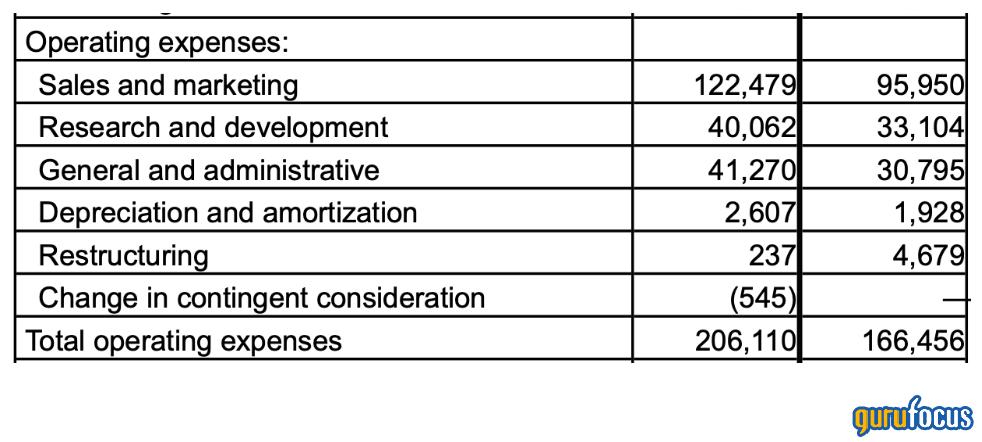

One one hand you have high gross margins but the operating margins are far below this. It comes down to high SG&A costs which I think is a "transitionary" part of the business as it continues to scale. Sales and market is the largest portion, but all parts are growing at a relativly equal rate YoY. OPEX rose 24% YoY, but revenues grew 25.8%. By having the top-line outpace OPEX growth there is a clear operational leverage here for CVLT. In time as it matures I expect SG&A, especially sales & marketing to consolidate, much due to it getting more recognition, growing its reputation and building upon existing customer relations.

Compared to Q2 FY2022 vs Q2 FY2021 OPEX grew by 9.8% YoY, revenues grew by 7.6%. This has not shifted as stated earlier, which shows that it's capable of scaling better now then earlier years. By increasing the OPEX it directly affected the top line as seen last quarter, this highlights much of the OPEX is controllable (sales & marketing) and adjustable to the current market environment.

The pivot comes as CVLT began making bundles of its software, compiling several into the Commvault Cloud brand.

Capital Allocations

As discussed, much of the costs are buried in the SG&A line, but CVLT has made meaningfull progress over the span of the last 3 years, going from having OPEX grow faster, to revenues now being ahead, underscoring the scalbility of its SaaS business.

Nonehtless there are concerns with part of the capital allocations strategy. During Q2 FY2025 it recored $30 million in stock-based compensation, up from $26.4 million a year earlier. It then spent $15 million on repuchasing shares compared to $51 million last year. Between the quarters the weighted avergae share also grew by 1.48% to 44.326 million (basic). Large compensations along with diluting share holders, but utilizing FCF to cover up some of this is not the strong point of the business. It does harm stockholder value.

The SBC are buried in the operating expense lines on the SEC filings, but if we flat exclude the amount from the OPEX CVLT would report $176 million in OPEX for the quarter. Adding the SBC to operating income raises it from $25 million to $55 million last quarter, effectivly also raising the operating margin from 8.9% to 19.5%. So there is a considerable amount of earnings going to SBC. At the end of the day it's what makes this case go from a fantastic one to a great one. It's negative but not enough to erode the bull case.

Still room to the upside

One advantage of CVLT is the debt free balance sheet. It still holds zero debt except for a few capital leases valued at $25 million. Total liabilities are $811 million. But here's the good part. Its cash position is $363 million, covering 44,7% of all liabilities. That is a fantastic position to operate from.

But then you ask me: What about equity financing? If there's no debt how does it support growth? Everything has been through cash. Its cash flows are incredibly strong and it continues to support its growth. OCF was $194 million in the last 12 months. Since its investment activities are generally quite low, underlying the scalability of its software (no need to buy new infrastructure to support growth) the cash mostly goes to shareholders. CVLT spent $165 million in 2025 on buybacks. This accounts for about 1,9% of today's market cap.

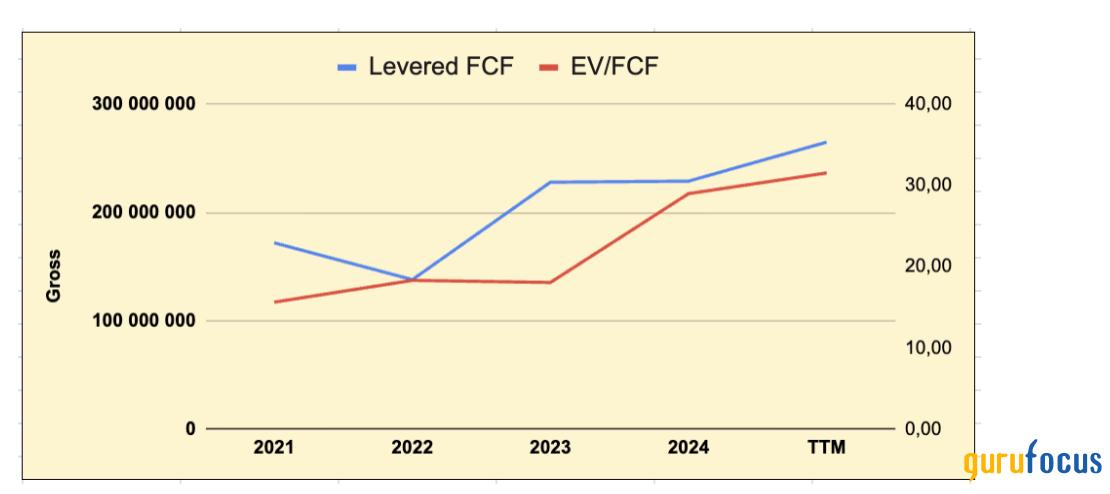

As shown in the graph, investors are willing to pay a lot more today than 3 years ago for the cash flow in the company. EV/FCF is at 31.54x up from 15.63 in 2021. But keep in mind that FCF has compounded at 13.5% annually since then. Similarly the customer growth has been equally impressive up 30,3% YoY.

So we can conclude that the market is valuing momentum here more than anything else. Without these numbers 42x FY26 earnings or 7,44x sales would be steep to pay. This is what you get with an asset light software business that requires little maintenance capital and doesn't necessarily need to buy new assets to scale its product, but rather hire more people instead. When put this way it makes sense you have to pay a premium for it.

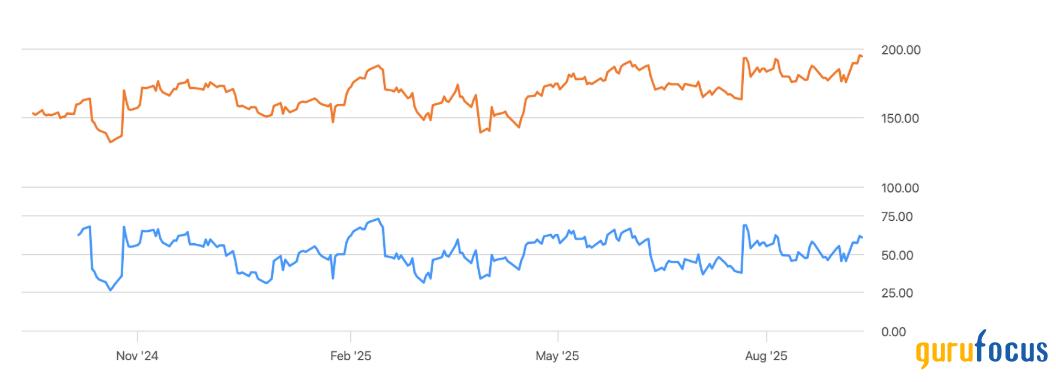

Typically you'd see the RSI spike when the shares are trading this high but it's in a relatively neutral,slightly bullish side between 50 and 65. I wouldn't consider the stock to be overbought yet and every time the stock has fallen there has been plenty of buyers in the market.

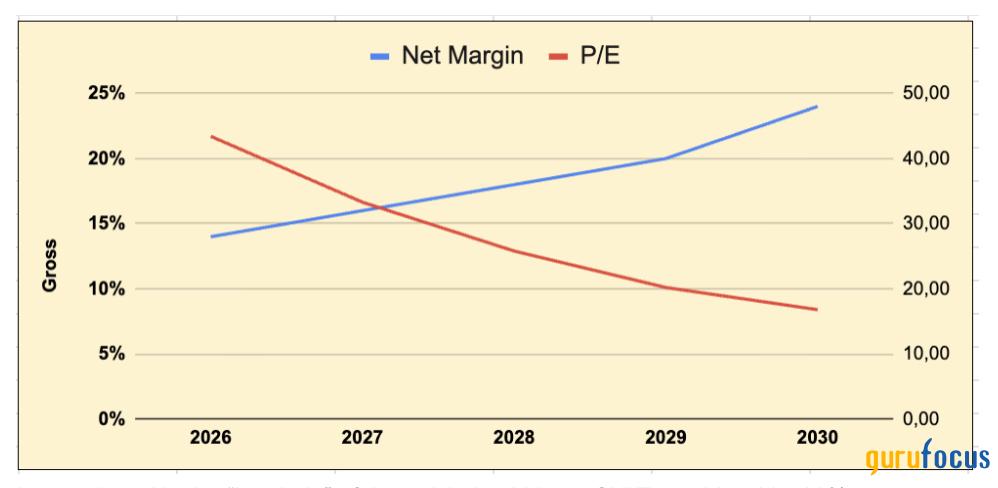

As mentioned in the interlude of the article I said I see CVLT reaching 20 - 30% net margins in at least 5 - 7 years based on its current momentum in customer acquisition and pivot in term-based licensing which carries a 98% gross margin. The chart shows the interaction between net margins and P/E until 2030 if my assumption plays out.

Seeing analysts expecting a similar pattern I feel more confident in my stance here. I've estimated revenues to grow at 15% annually, which is conservative given the past 4 quarters performance. Incrementally I've increased the net margins to ultimately ending at 24% in 2030. At today's price of $194 you'd be buying it for 16.8x 2030 earnings.

Since this is a SaaS business they often get a higher valuation due to the large amount of recurring revenues. I'd say a 10% premium to the sector seems fair which puts us in the range of 27 - 28x. At $11.5 EPS in 2030 my price target is $322, 66% above where we are now.As a disclaimer: I think the price is way too high if your time horizon is not the same as mine. In the short-term the valuation is rich, but looking beyond that it looks cheap if it can continue to scale its platform as well as in 2025. The key to the thesis here is to have a long-term mentality, otherwise you'll get burned quickly.

I wanted to include some comments on the SBC imapcts on forecasted EPS. Adjusting for this the figure declines. YoY the dilution rate was 1.48%. I've forecasted that the FY2030 EPS to be $11.5, adjusting for diltuon it comes down to $10.6 instead (1 - 0.0148 = 0.9852 x to the power of 5 = 0.9277)(11.5 x 0.9277 = 10.6). The difference is a 7.8% in EPS. With the same P/E multiple the target price drops to $291, 9.6% below my initial one. This underscores the issue that that investors have to tackle with. Earnings growth look good, but is. muted by SBC which dilutes owner earnings.

Risks to Commvault/investors

For Commvault the main risk is really a lack of adoption of customer growth. The advantage that investors have is that this will quickly be seen if deferred revenues as we covered before begin to change trajectory and either consolidate or trend down. This would imply less customer growth than before and lower revenue per customer too. We've already seen some signs of this in the NRR throughout all of 2025. It stayed at 127% but in the last quarter fell to 125%. It's still at a great rate indicating CVLT can upsell more to customers as they continue to use the platform.

The market brushed it off as the shares shot up from $163 to $193. But it is something to consider as if it continues to fall it goes against my theory that CVLT can expand margins. Moreover for investors, the main risk is valuation. I know I've talked about how I still think the stock is a buy trading at 42x FY26 earnings. But this doesn't exclude the fact that the price could fall sharply in the short-term. Seeing its 5Y average at 31x presents the case that a 35% drop might occur. If this is the type of volatility you'd like to stay away from then CVLT might not be the best choice.

Bullish

Commvault has some of the largest tech companies as customers and continues to be one of the best data recovery options in the market. It's an asset light business which doesn't require high CapEx to produce more growth, it can simply scale through increasing its sales team and acquire more customers. Its pivot into term-based licenses has been successful and lucrative seeing as gross margins are 98% here.

Strong cash flows gives investors another reason to stick around as most of it goes to buybacks. But my eyes are fixated on the net margins which I see growing to 20 - 30% by 2030, similar to where most mature SaaS companies are. Shares may look expensive in the immediate term. Looking beyond that shares actually present a decent upside of 66%. Adjusting for the dilution from the stock-based compensations the upside falls, but not enough to warrant a less bullish conclusion.

Even after the recent drop in share price the stock might not be considered cheap still, but the quality of the underlying business is still solid. I still find the stock has a lot of upside for investors looking at the long-term rather then short-term volatility which is what we have seen just now.