Smallcaps tumble up to 77% as broader indices lag

The broader indices broke a three-week gaining streak and underperformed the main indices as markets remained under pressure throughout the week on worries over fresh tariffs on pharma, higher visa fees by the US, persistent trade concerns, and continued FII selling.

For the week, Nifty50 plunged 672.35 points or 2.65 percent to finish at 24,654.70, while the BSE Sensex index declined 2199.77 points or 2.66 percent to end at 80,426.46.

BSE mid, large, and smallcap indices declined 3-4.5 percent.

Foreign Institutional Investors (FIIs) remained net sellers throughout the week, extending their selling for the 13th consecutive week, as they offloaded equities worth Rs 19,570.03 crore, while Domestic Institutional Investors (DII) continued their buying in 24nd week, as they purchased equities worth Rs 17,411.40 crore.

For the month, FII sold equities worth Rs 30,141.68 crore, while DII bought equities worth Rs 55,736.09 crore.

All the sectoral indices gave a negative return during the week, with the Nifty IT index plunging 8 percent, the Nifty Realty index shedding 6 percent, the Nifty Pharma index falling 5.2 percent, the Nifty Consumer Durables slipping 4.6 percent, Nifty Defence index declining 4.4 percent.

"This week, the overall market breadth of the Indian equity markets was negative as it factored in the US announcement with respect to H1B visas and the pharma sector. The BSE Sensex and the NSE Nifty index fell in excess of 2% and the decline in the BSE Midcap and the BSE Smallcap was higher at ~4%," said Shrikant Chouhan, Head Equity Research, Kotak Securities.

"All the key sectoral indices ended the week in the red. The US announced stricter norms on H1B visas. Accenture’s FY26 revenue guidance assumes no improvement in discretionary spending at the top end and some deterioration at the bottom end. THE BSE IT index corrected by 7% this week. The BSE healthcare index corrected ~5% this week amid the US announcing 100% tariffs on branded or patented pharma products imported into the US."

"Auto stocks remained in focus as news reports indicate healthy booking and deliveries in the initial days of the current festive season. Global equity markets were mixed in the past week, with developed markets outperforming the emerging markets. The key global news-flows impacting global markets included continued uncertainty around US trade policies and the ECB maintaining a cautious outlook on growth," he added.

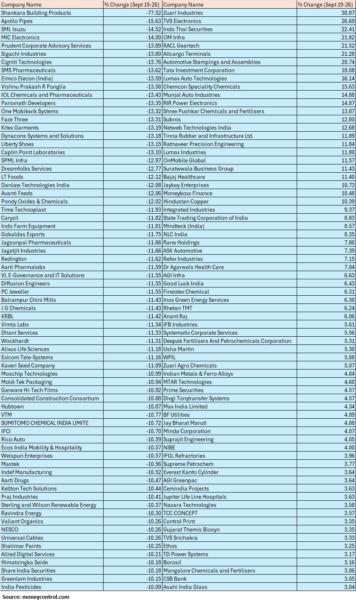

The BSE Small-cap index declined 4.2 percent with Shankara Building Products, Apollo Pipes, SML Isuzu, MIC Electronics, Prudent Corporate Advisory Services, Sigachi Industries, Cigniti Technologies, SMS Pharmaceuticals, Eimco Elecon (India), Vishnu Prakash R Punglia, IOL Chemicals and Pharmaceuticals, Parsvnath Developers shed up to 77 percent. Zuari Industries, TVS Electronics, Indo Thai Securities, OM Infra, RACL Geartech,Allcargo Terminals, Automotive Stampings and Assemblies rising between 20-30 percent.

Where is Nifty50 headed?

Ajit Mishra – SVP, Research, Religare Broking

Sustained weakness in heavyweights has accelerated the index’s decline over the past two sessions, with the Nifty now approaching its key support near the 200 DEMA around 24,400.

Meanwhile, the sharp correction in mid- and small-cap stocks has further dampened market sentiment. Given this backdrop, we recommend adopting a cautious approach—focusing on fundamentally strong stocks while avoiding aggressive directional bets until clearer signals emerge.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

A long bear candle was formed on the daily chart on Friday, which indicates a decisive breakdown of crucial supports of around 25000-24900 levels. This is not a good sign and signals more weakness in the short term. A long bear candle has been formed in Nifty on the weekly chart after three weeks of rise, which indicates a possibility of faster downside retracement in the market.

The underlying trend of Nifty is sharply negative and the market is now sliding down to the next important support of around 24400-24300 (previous swing lows and 200-day EMA) by next week. Immediate resistance is placed at 24850 levels.

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty broke below the crucial support level of 25,000, which triggered a decline and led to the breach of other intermediate supports. The sentiment remains weak, with immediate and critical support placed in the 24,550–24,500 zone. A decisive breakdown below 24,500 could extend the correction towards 24,150, which corresponds to the 38.20% Fibonacci retracement of the rally from 21,743 to 25,669. On the other hand, if the index holds above 24,500, a sharp recovery can be expected.

Amol Athawale, VP Technical Research, Kotak Securities

Technically, on weekly charts, Nifty has formed a long bearish candle. On intraday charts, it is holding a lower top formation, which supports further weakness from the current levels. We believe that the short-term market trend is weak, but due to temporary oversold conditions, we could see a pullback rally from the current levels.

For traders, 24,800/81200 would act as a key level to watch. Below this, the correction wave is likely to continue. On the downside, the market could retest the levels of 24,500/80300. Further declines may also occur, potentially dragging the index down to 24,350/79800, 24300/79600. Conversely, above 24,800/81200, a pullback formation could continue up to 25,000-25,100/81800-82200.

For Bank Nifty, the 20-day SMA or 54,750 would be a crucial zone. Below this, the chances of hitting 54,000-53,800 increase. However, if it sustains above the 20-day SMA or 54,750, it could bounce back to the 50-day SMA or 55,300-55,500.

Short-term traders should remain cautious and be very selective, as there is a risk of getting trapped at lower levels.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.