3 data points that set the stage for CIO panel at Moneycontrol MF Summit

The year 2023 has been a historic year for the markets; from 16,900 on Nifty 50 in March, we managed to scale up to 20,000 for the first time ever in September. As the move was characterised by bouts of volatility, investors were left scratching their heads "How to create alpha".

At Moneycontrol's Mutual Fund Summit, we address exactly that question. The theme for the CIO panel is: Where to find alpha: Simmering economy, sizzling small-caps, stretched valuations.

Watch live stream here

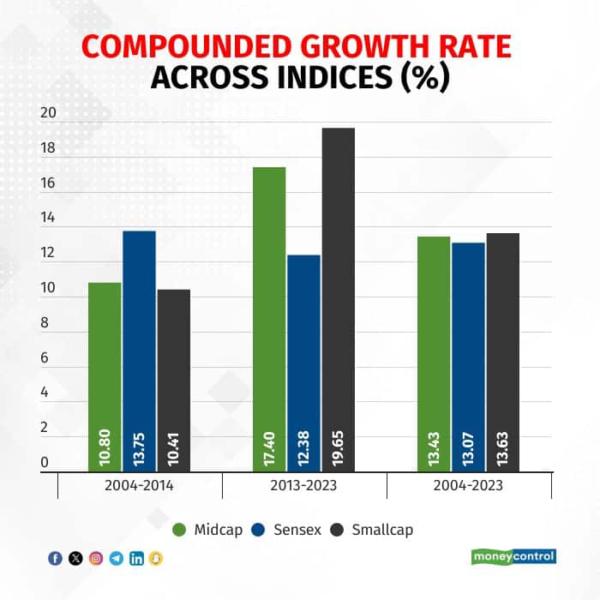

If we look at the last 10 years, then midcaps and smallcaps have outperformed largecaps by a big margin. But from a longer-term perspective, returns of largecap, midcap and smallcap indices converge. This begs the question: Is it worth investing in smallcaps? Is it worth the risk?

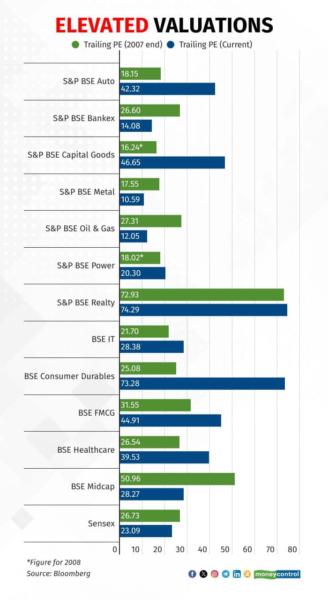

Data also shows an elevated price-to-earnings ratio for most sectors like autos, capital goods, and consumer durables compared to the 2007 market peak. In this context, which sectors hold potential?

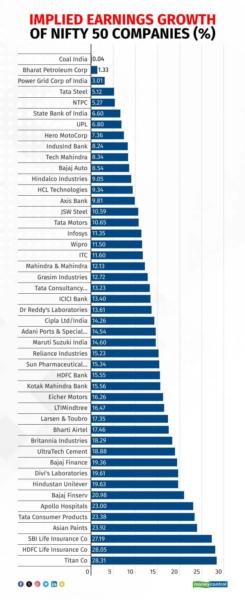

The implied growth rate shows that about 80 percent of Nifty companies will deliver less than 20 percent growth. So what are the best alpha-generation opportunities? What risks investors should be cognizant of?