INVITE-ONLY SCRIPT

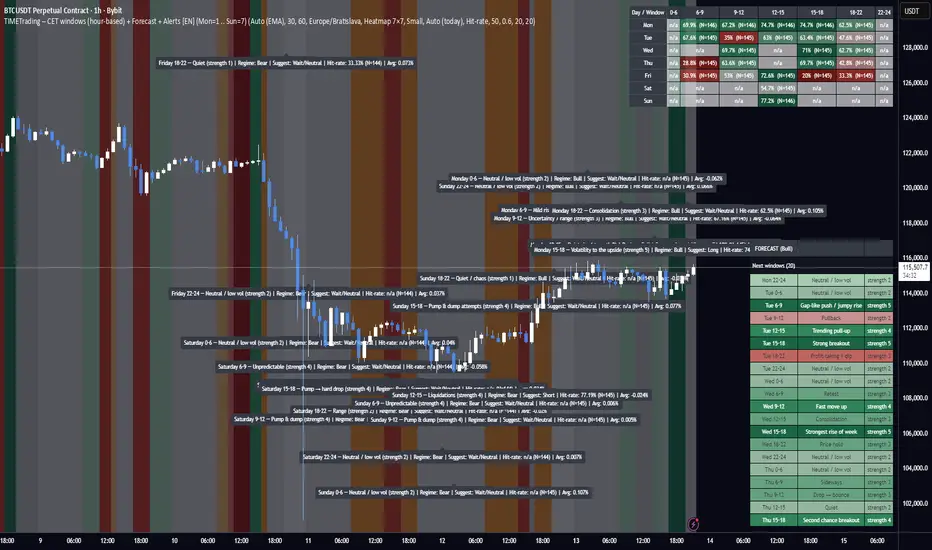

TIME Indicator – CET (hour-based) + Bias Forecast + Alerts [EN]

TIME Indicator – CET + Bias Forecast + Alerts

What it does

Splits each day (CET/CEST) into 7 fixed time windows: 0–6, 6–9, 9–12, 12–15, 15–18, 18–22, 22–24.

Detects market regime (Bull/Bear/Neutral) automatically from an HTF EMA (configurable), or you can set the regime manually.

Maps each day-of-week × window to an expected behavior (Bull/Bear/Neutral/Chop) with strength 1–5 (your research schedule).

Backtests on-the-fly: logs each finished window’s return to compute:

Hit-rate (directional accuracy on Bull/Bear calls)

Average % move (log-return → %)

t-stat (significance)

Observation counts N

Visualizes results via:

Heatmap 7×7 (Days × Windows) with selectable metric (Hit-rate / Avg% / t-stat)

Day (paged) table

Split 2× (long) tables to fit small screens

Forecast panel: shows the next N windows (default 8) with labels and color tint based on category + strength. Uses CET midday anchoring to avoid day-shift bugs.

Regime logic

HTF EMA (length configurable) on a selectable timeframe (HTF for regime/tfStats).

“Bull” when price > EMA (optionally EMA slope > 0); “Bear” when price < EMA (slope < 0); else “Neutral”.

Tip: for 1h charts use tfStats=240 (4h) for a stable bias; for 2h charts consider 240–360; swing traders can go 360–720.

Color language

Green shades = Bull (strength 1–5)

Red shades = Bear (1–5)

Orange = Chop (1–5)

Gray = Neutral/Range (1–5)

Optional: neutral/chop can be tinted by current regime (setting).

Alerts (3 modes)

Every window (baseline) – fires at the start of each window, always (for manual verification).

Qualified window – fires at window start only if stats meet your thresholds: Min N, Min Hit-rate.

Hourly ping (CET) – optional every-hour reminder (also mid-window).

Alert message example

Monday 6–9 — Mild rise (strength 2) | Regime: Bull | Suggest: Long

Hit-rate: 87.4% (N=215) | Avg: 0.23%

Key implementation details

Uses CET/CEST consistently. “Today” is stabilized by CET midday to prevent DOW misalignment across session boundaries.

Windows are computed from CET hour, not exchange sessions, so it’s robust across assets/timezones as long as you want CET logic.

Statistics are maintained in arrays (7×7); each completed window updates N, sum of returns, sum of squares, directional hits, etc.

Heatmap cells compute metric + color strength dynamically; you can switch the displayed metric from the input.

Inputs (most useful)

Market regime: Auto (EMA) / Bull / Bear / Neutral

EMA length (Auto), HTF for regime (minutes), Require slope

Results view: Heatmap 7×7 / Day (paged) / Split 2× (long)

Heatmap metric: Hit-rate / Avg % / t-stat

Forecast: number of upcoming windows, color opacity, tint neutral by regime

Alerts: enable baseline/qualified/hourly, thresholds Min N, Min Hit-rate

How to use

Pick your chart TF (e.g., 1h). Set HTF for regime (e.g., 240) and EMA length (e.g., 100). Keep Require slope = ON for cleaner bias.

Start on Heatmap 7×7 to spot strong day×window pockets. Then use Forecast to see what’s next today/tomorrow.

Turn on ALERT: Every window to get a message at the start of every window; optionally add Qualified for filtered calls.

In TradingView Alerts dialog choose “Any alert() function call” to receive all alert types.

Limitations / notes

This is a statistical bias tool, not a signal generator. Combine with price action, liquidity zones, vol regime, news.

Hit-rates and averages depend on your symbol/timeframe history; results differ across assets and time ranges.

EMA-based regime is HTF-closed; bias flips only after the higher-timeframe bar confirms.

Changelog snapshot (current build)

Pine v6; fixed DOW alignment via CET midday; refactored forecast (next N windows), new baseline/qualified/hourly alerts, color-tinted neutral/chop, improved table layout and text sizing.

If you want, I can also write a short “How to request access” blurb for your private/hidden publication page.

Instructions to Traders

What this tool shows

Day split (CET/CEST): 0–6, 6–9, 9–12, 12–15, 15–18, 18–22, 22–24.

For each Day × Window it displays the expected behavior (Bull/Bear/Neutral/Chop) and strength 1–5 based on historical stats.

Heatmap metrics: Hit-rate, Avg % move, or t-stat.

Quick setup

Chart TF: start on 1h (works on 30m–2h too).

HTF for regime (EMA bias):

1h chart → 240 (4h) recommended

2h chart → 240–360

Swing (4h/1D) → 360–720

EMA length: 100 (default). Keep Require slope = ON for cleaner Bull/Bear bias.

View: start with Heatmap 7×7, then try Forecast to see the next windows.

Forecast panel

Shows the next N upcoming windows (default 8), with labels and color by category + strength.

Uses CET midday anchoring to keep weekdays correct (no “day shift” at midnight).

Alerts

Enable ALERT: Every window (no filters) to get a message at the start of every window.

Optionally enable ALERT: Only when N & Hit-rate ok (filtered alerts) and ALERT: Every hour (CET) ping (hourly reminder).

In TradingView’s Create Alert dialog, select “Any alert() function call” to receive all alert types.

Alert text includes: Day + Window, regime, suggestion (Long/Short/Wait), Hit-rate, N, Avg %.

How to use the bias

Treat it as a context/expectation map, not a blind signal.

Combine with structure (HH/HL, S/R), liquidity, volatility regime, and risk management.

Stronger shades (4–5) = stronger historical tendency; still validate with live price action.

Troubleshooting

Day names wrong? Ensure Timezone = Europe/Bratislava (CET/CEST) in inputs.

“No data / n/a”: load more chart history or switch to a symbol with longer data.

Regime feels too jumpy/laggy: adjust HTF for regime and/or EMA length.

Access / contact

If this script is private and you need access, send your TradingView username with the subject “TIMETrading access”.

For support/feedback: describe your symbol, chart TF, HTF setting, and a screenshot.

Disclaimer: Statistical tendencies ≠ certainty. This is educational research, not financial advice. Always use stops and size risk responsibly.

What it does

Splits each day (CET/CEST) into 7 fixed time windows: 0–6, 6–9, 9–12, 12–15, 15–18, 18–22, 22–24.

Detects market regime (Bull/Bear/Neutral) automatically from an HTF EMA (configurable), or you can set the regime manually.

Maps each day-of-week × window to an expected behavior (Bull/Bear/Neutral/Chop) with strength 1–5 (your research schedule).

Backtests on-the-fly: logs each finished window’s return to compute:

Hit-rate (directional accuracy on Bull/Bear calls)

Average % move (log-return → %)

t-stat (significance)

Observation counts N

Visualizes results via:

Heatmap 7×7 (Days × Windows) with selectable metric (Hit-rate / Avg% / t-stat)

Day (paged) table

Split 2× (long) tables to fit small screens

Forecast panel: shows the next N windows (default 8) with labels and color tint based on category + strength. Uses CET midday anchoring to avoid day-shift bugs.

Regime logic

HTF EMA (length configurable) on a selectable timeframe (HTF for regime/tfStats).

“Bull” when price > EMA (optionally EMA slope > 0); “Bear” when price < EMA (slope < 0); else “Neutral”.

Tip: for 1h charts use tfStats=240 (4h) for a stable bias; for 2h charts consider 240–360; swing traders can go 360–720.

Color language

Green shades = Bull (strength 1–5)

Red shades = Bear (1–5)

Orange = Chop (1–5)

Gray = Neutral/Range (1–5)

Optional: neutral/chop can be tinted by current regime (setting).

Alerts (3 modes)

Every window (baseline) – fires at the start of each window, always (for manual verification).

Qualified window – fires at window start only if stats meet your thresholds: Min N, Min Hit-rate.

Hourly ping (CET) – optional every-hour reminder (also mid-window).

Alert message example

Monday 6–9 — Mild rise (strength 2) | Regime: Bull | Suggest: Long

Hit-rate: 87.4% (N=215) | Avg: 0.23%

Key implementation details

Uses CET/CEST consistently. “Today” is stabilized by CET midday to prevent DOW misalignment across session boundaries.

Windows are computed from CET hour, not exchange sessions, so it’s robust across assets/timezones as long as you want CET logic.

Statistics are maintained in arrays (7×7); each completed window updates N, sum of returns, sum of squares, directional hits, etc.

Heatmap cells compute metric + color strength dynamically; you can switch the displayed metric from the input.

Inputs (most useful)

Market regime: Auto (EMA) / Bull / Bear / Neutral

EMA length (Auto), HTF for regime (minutes), Require slope

Results view: Heatmap 7×7 / Day (paged) / Split 2× (long)

Heatmap metric: Hit-rate / Avg % / t-stat

Forecast: number of upcoming windows, color opacity, tint neutral by regime

Alerts: enable baseline/qualified/hourly, thresholds Min N, Min Hit-rate

How to use

Pick your chart TF (e.g., 1h). Set HTF for regime (e.g., 240) and EMA length (e.g., 100). Keep Require slope = ON for cleaner bias.

Start on Heatmap 7×7 to spot strong day×window pockets. Then use Forecast to see what’s next today/tomorrow.

Turn on ALERT: Every window to get a message at the start of every window; optionally add Qualified for filtered calls.

In TradingView Alerts dialog choose “Any alert() function call” to receive all alert types.

Limitations / notes

This is a statistical bias tool, not a signal generator. Combine with price action, liquidity zones, vol regime, news.

Hit-rates and averages depend on your symbol/timeframe history; results differ across assets and time ranges.

EMA-based regime is HTF-closed; bias flips only after the higher-timeframe bar confirms.

Changelog snapshot (current build)

Pine v6; fixed DOW alignment via CET midday; refactored forecast (next N windows), new baseline/qualified/hourly alerts, color-tinted neutral/chop, improved table layout and text sizing.

If you want, I can also write a short “How to request access” blurb for your private/hidden publication page.

Instructions to Traders

What this tool shows

Day split (CET/CEST): 0–6, 6–9, 9–12, 12–15, 15–18, 18–22, 22–24.

For each Day × Window it displays the expected behavior (Bull/Bear/Neutral/Chop) and strength 1–5 based on historical stats.

Heatmap metrics: Hit-rate, Avg % move, or t-stat.

Quick setup

Chart TF: start on 1h (works on 30m–2h too).

HTF for regime (EMA bias):

1h chart → 240 (4h) recommended

2h chart → 240–360

Swing (4h/1D) → 360–720

EMA length: 100 (default). Keep Require slope = ON for cleaner Bull/Bear bias.

View: start with Heatmap 7×7, then try Forecast to see the next windows.

Forecast panel

Shows the next N upcoming windows (default 8), with labels and color by category + strength.

Uses CET midday anchoring to keep weekdays correct (no “day shift” at midnight).

Alerts

Enable ALERT: Every window (no filters) to get a message at the start of every window.

Optionally enable ALERT: Only when N & Hit-rate ok (filtered alerts) and ALERT: Every hour (CET) ping (hourly reminder).

In TradingView’s Create Alert dialog, select “Any alert() function call” to receive all alert types.

Alert text includes: Day + Window, regime, suggestion (Long/Short/Wait), Hit-rate, N, Avg %.

How to use the bias

Treat it as a context/expectation map, not a blind signal.

Combine with structure (HH/HL, S/R), liquidity, volatility regime, and risk management.

Stronger shades (4–5) = stronger historical tendency; still validate with live price action.

Troubleshooting

Day names wrong? Ensure Timezone = Europe/Bratislava (CET/CEST) in inputs.

“No data / n/a”: load more chart history or switch to a symbol with longer data.

Regime feels too jumpy/laggy: adjust HTF for regime and/or EMA length.

Access / contact

If this script is private and you need access, send your TradingView username with the subject “TIMETrading access”.

For support/feedback: describe your symbol, chart TF, HTF setting, and a screenshot.

Disclaimer: Statistical tendencies ≠ certainty. This is educational research, not financial advice. Always use stops and size risk responsibly.

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、Denyzzzzに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Send me your TradingView username and a short note about how you plan to use the script.

Use one of these channels:

TradingView DM (preferred): open my profile → “Message”.

Comment on the script page: “Requesting access – details below.”

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、Denyzzzzに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Send me your TradingView username and a short note about how you plan to use the script.

Use one of these channels:

TradingView DM (preferred): open my profile → “Message”.

Comment on the script page: “Requesting access – details below.”

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。