OPEN-SOURCE SCRIPT

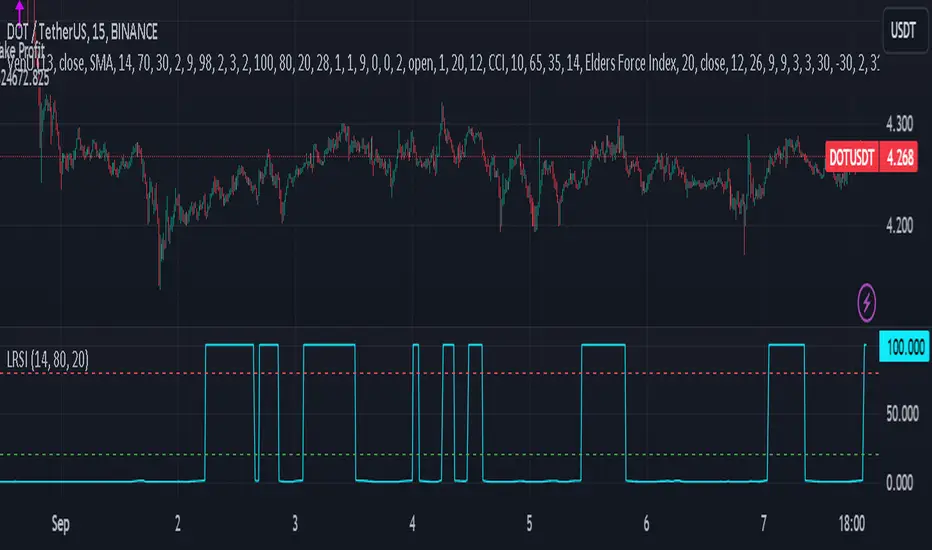

Laguerre RSI - non repainting

It seems that the traditional Laguerre* functions repaint due to the gamma parameter.

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。