PROTECTED SOURCE SCRIPT

SessionPrep

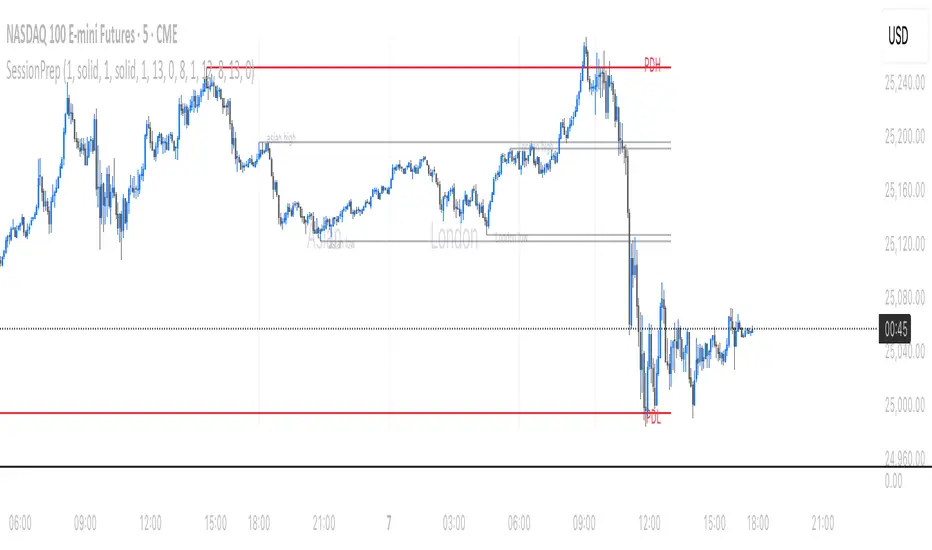

This indicator is designed for day traders, especially those who follow ICT (Inner Circle Trader) concepts and focus on session-based trading setups.

It automatically marks the key session ranges — including:

• Asian Session: 6:00 PM – 12:00 AM

• London Session: 12:00 AM – 6:00 AM

• New York Session: starting at 9:30 AM (highlighted with a pink vertical line)

Each session’s highs and lows are plotted clearly on the chart, giving traders a quick visual map of liquidity zones, potential breakout areas, and key market reactions. This helps traders identify high-probability areas where price may draw toward or reverse from, following ICT-style logic.

The indicator can also include an optional alarm at the 9:30 AM New York open, helping you stay aware of the most volatile and active trading period of the day.

Whether you’re trading indices, forex, or crypto, this tool provides a clean and ready-to-trade layout each morning — no manual drawing or guesswork needed. It’s especially useful for traders who study session highs/lows, liquidity grabs, and market structure shifts common in ICT-based strategies.

It automatically marks the key session ranges — including:

• Asian Session: 6:00 PM – 12:00 AM

• London Session: 12:00 AM – 6:00 AM

• New York Session: starting at 9:30 AM (highlighted with a pink vertical line)

Each session’s highs and lows are plotted clearly on the chart, giving traders a quick visual map of liquidity zones, potential breakout areas, and key market reactions. This helps traders identify high-probability areas where price may draw toward or reverse from, following ICT-style logic.

The indicator can also include an optional alarm at the 9:30 AM New York open, helping you stay aware of the most volatile and active trading period of the day.

Whether you’re trading indices, forex, or crypto, this tool provides a clean and ready-to-trade layout each morning — no manual drawing or guesswork needed. It’s especially useful for traders who study session highs/lows, liquidity grabs, and market structure shifts common in ICT-based strategies.

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。