INVITE-ONLY SCRIPT

Moving Average Slope Strategy - Level 1

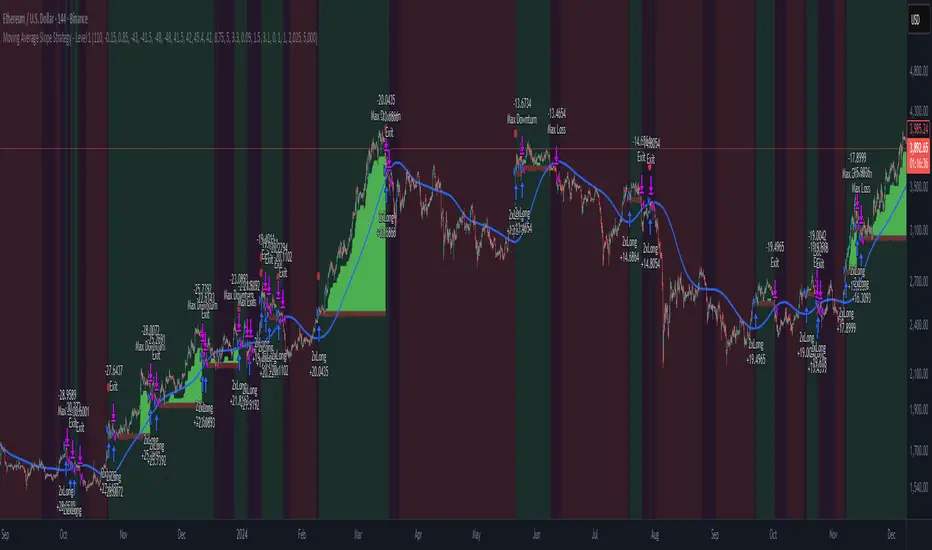

This strategy applies a Laguerre filter moving average as the core signal generator. Unlike standard moving averages, which can introduce significant lag, the Laguerre filter is designed to react more smoothly and quickly to price changes, making it suitable for building regime-based strategies.

The script classifies the market into three possible regimes:

To determine the transition between these regimes, two threshold parameters are used: one for the bull–range transition and another for the bear–range transition. These effectively control how much bull, bear, and range activity the strategy detects.

The user can configure the strategy to run long-only, short-only, or both directions, depending on the market or preference.

In addition to the core regime logic, the strategy includes several risk and trade management controls that are featured in all my strategies. These include:

Four oscillators are also integrated into the logic to detect short-term overbought and oversold conditions. These help the strategy avoid entering or exiting a trade when price has already extended too far in one direction, improving timing and potentially reducing false entries and exits.

The script is designed to be flexible across different assets and timeframes. However, to achieve consistent results, it is important to optimize parameters carefully. A recommended workflow is as follows:

This strategy is published as invite-only with hidden source code. It is part of a broader collection of technical analysis strategies I have developed, which focus on regime detection and adaptive trading systems.

There are five levels of strategy complexity and performance in my collection. This script represents a Level 1 strategy, designed as a solid foundation and introduction to the framework. More advanced levels progressively add greater complexity, adaptability, and robustness.

Finally, when multiple strategies are combined under this same framework, the results become more robust and stable. In particular, combining my suite of technical analysis strategies with my macro strategies and on-chain strategies for cryptocurrencies creates a multi-layered system that adapts across regimes, timeframes, and market conditions.

This strategy requires a subscription.

The script classifies the market into three possible regimes:

- Bull (long bias): when the slope of the Laguerre filter is positive. In this state, the strategy favors long entries.

- Bear (short bias): when the slope is negative. In this case, the strategy favors short entries.

- Range (neutral / no trade): when the slope is relatively flat, suggesting sideways market conditions where the strategy avoids opening trades.

To determine the transition between these regimes, two threshold parameters are used: one for the bull–range transition and another for the bear–range transition. These effectively control how much bull, bear, and range activity the strategy detects.

The user can configure the strategy to run long-only, short-only, or both directions, depending on the market or preference.

In addition to the core regime logic, the strategy includes several risk and trade management controls that are featured in all my strategies. These include:

- A minimum loss threshold for all trades

- A minimum profit threshold

- A maximum loss limit

- A maximum drawdown limit (from peak profits)

- A minimum drawdown limit (from peak profits)

Four oscillators are also integrated into the logic to detect short-term overbought and oversold conditions. These help the strategy avoid entering or exiting a trade when price has already extended too far in one direction, improving timing and potentially reducing false entries and exits.

The script is designed to be flexible across different assets and timeframes. However, to achieve consistent results, it is important to optimize parameters carefully. A recommended workflow is as follows:

- Disable the walk-forward option during the optimization phase.

- Optimize the first main parameter while keeping others fixed.

- Once a satisfactory value is found, move to the second parameter.

- Continue the process for subsequent parameters.

- Optionally, repeat the full sequence once more to refine the results.

- Finally, activate walk-forward analysis and check the out-of-sample results.

This strategy is published as invite-only with hidden source code. It is part of a broader collection of technical analysis strategies I have developed, which focus on regime detection and adaptive trading systems.

There are five levels of strategy complexity and performance in my collection. This script represents a Level 1 strategy, designed as a solid foundation and introduction to the framework. More advanced levels progressively add greater complexity, adaptability, and robustness.

Finally, when multiple strategies are combined under this same framework, the results become more robust and stable. In particular, combining my suite of technical analysis strategies with my macro strategies and on-chain strategies for cryptocurrencies creates a multi-layered system that adapts across regimes, timeframes, and market conditions.

This strategy requires a subscription.

招待専用スクリプト

こちらのスクリプトにアクセスできるのは投稿者が承認したユーザーだけです。投稿者にリクエストして使用許可を得る必要があります。通常の場合、支払い後に許可されます。詳細については、以下、作者の指示をお読みになるか、mks17に直接ご連絡ください。

スクリプトの機能を理解し、その作者を全面的に信頼しているのでなければ、お金を支払ってまでそのスクリプトを利用することをTradingViewとしては「非推奨」としています。コミュニティスクリプトの中で、その代わりとなる無料かつオープンソースのスクリプトを見つけられる可能性もあります。

作者の指示

Send me a private message to request access

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

招待専用スクリプト

こちらのスクリプトにアクセスできるのは投稿者が承認したユーザーだけです。投稿者にリクエストして使用許可を得る必要があります。通常の場合、支払い後に許可されます。詳細については、以下、作者の指示をお読みになるか、mks17に直接ご連絡ください。

スクリプトの機能を理解し、その作者を全面的に信頼しているのでなければ、お金を支払ってまでそのスクリプトを利用することをTradingViewとしては「非推奨」としています。コミュニティスクリプトの中で、その代わりとなる無料かつオープンソースのスクリプトを見つけられる可能性もあります。

作者の指示

Send me a private message to request access

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。