PROTECTED SOURCE SCRIPT

Turning Point Indicator

Introduction

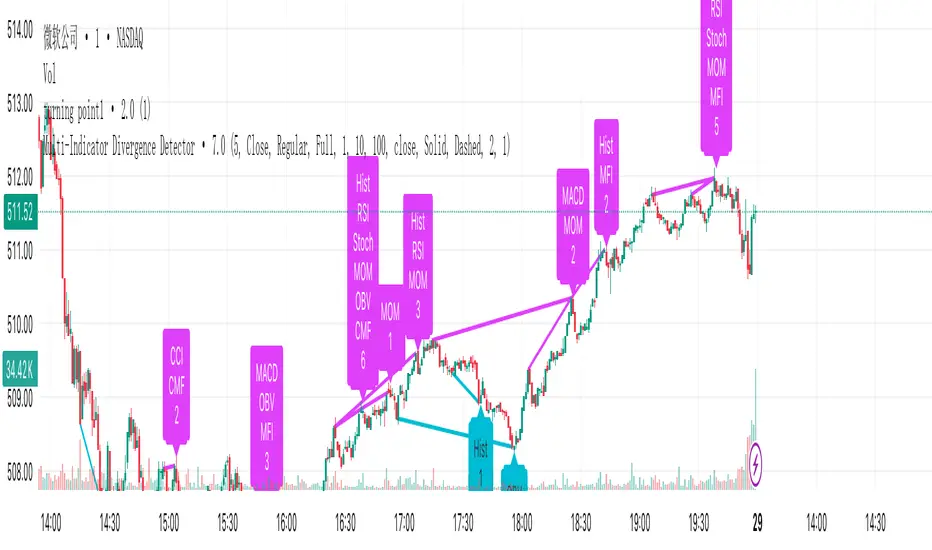

This is a powerful technical analysis indicator designed to detect divergences between multiple technical indicators and price. It can monitor up to 10 different technical indicators simultaneously, helping traders identify potential price reversal signals. Key Features

Multi-Indicator Support: Simultaneously detect divergences across multiple indicators, including MACD, RSI, Stochastics, CCI, Momentum, OBV, VW-MACD, CMF, and MFI.

Dual Divergence Type: Supports both regular and hidden divergences.

Smart Filtering: Set a minimum number of divergences to filter out weak signals.

Visual Display: Clearly displays divergence locations and related indicators using connecting lines and labels.

Flexible Configuration: Supports a variety of display options and color customization.

Core Features: Divergence Detection

Regular Divergence: When prices reach new highs/lows but indicators haven't confirmed them, it signals a possible trend reversal.

Hidden Divergence: When prices pull back but indicators show a trend continuation, it signals a possible trend continuation.

How to Use:

Add Indicator: Apply the script to a chart.

Configure Parameters: Adjust parameters such as the pivot point period and the maximum number of candlesticks to detect as needed.

Select Indicator: Enable or disable divergence detection for specific technical indicators in the settings.

Watch Signal: Displays a signal on the chart when a sufficient number of divergences are detected. Connecting Lines and Labels

Parameter Description

Pivot Point Period: Defaults to 5, used to identify highs and lows

Minimum Divergences: Defaults to 1, sets the minimum number of divergences required to trigger a signal

Maximum Pivot Points: Defaults to 10, limits the detection range

Maximum Candlesticks Detected: Defaults to 100, controls the number of candlesticks detected forward

Signal Interpretation

Bottom Label (upward arrow): Positive divergence, a possible buy signal

Top Label (downward arrow): Negative divergence, a possible sell signal

Connecting Line Color:

Cyan: Positive regular divergence

Purple: Negative regular divergence

Green: Positive hidden divergence

Red: Negative hidden divergence

Usable Scenarios

Trend Reversal Point Identification

Entry and Exit Timing

Multi-Time Frame Analysis

Risk Management and Stop-Loss Setting

Notes

Divergence signals should be used in conjunction with other analysis methods.

It is recommended to use them on longer time frames for better accuracy.

Setting an appropriate minimum number of divergences can reduce false signals.

Indicator sensitivity may vary under different market conditions.

This is a powerful technical analysis indicator designed to detect divergences between multiple technical indicators and price. It can monitor up to 10 different technical indicators simultaneously, helping traders identify potential price reversal signals. Key Features

Multi-Indicator Support: Simultaneously detect divergences across multiple indicators, including MACD, RSI, Stochastics, CCI, Momentum, OBV, VW-MACD, CMF, and MFI.

Dual Divergence Type: Supports both regular and hidden divergences.

Smart Filtering: Set a minimum number of divergences to filter out weak signals.

Visual Display: Clearly displays divergence locations and related indicators using connecting lines and labels.

Flexible Configuration: Supports a variety of display options and color customization.

Core Features: Divergence Detection

Regular Divergence: When prices reach new highs/lows but indicators haven't confirmed them, it signals a possible trend reversal.

Hidden Divergence: When prices pull back but indicators show a trend continuation, it signals a possible trend continuation.

How to Use:

Add Indicator: Apply the script to a chart.

Configure Parameters: Adjust parameters such as the pivot point period and the maximum number of candlesticks to detect as needed.

Select Indicator: Enable or disable divergence detection for specific technical indicators in the settings.

Watch Signal: Displays a signal on the chart when a sufficient number of divergences are detected. Connecting Lines and Labels

Parameter Description

Pivot Point Period: Defaults to 5, used to identify highs and lows

Minimum Divergences: Defaults to 1, sets the minimum number of divergences required to trigger a signal

Maximum Pivot Points: Defaults to 10, limits the detection range

Maximum Candlesticks Detected: Defaults to 100, controls the number of candlesticks detected forward

Signal Interpretation

Bottom Label (upward arrow): Positive divergence, a possible buy signal

Top Label (downward arrow): Negative divergence, a possible sell signal

Connecting Line Color:

Cyan: Positive regular divergence

Purple: Negative regular divergence

Green: Positive hidden divergence

Red: Negative hidden divergence

Usable Scenarios

Trend Reversal Point Identification

Entry and Exit Timing

Multi-Time Frame Analysis

Risk Management and Stop-Loss Setting

Notes

Divergence signals should be used in conjunction with other analysis methods.

It is recommended to use them on longer time frames for better accuracy.

Setting an appropriate minimum number of divergences can reduce false signals.

Indicator sensitivity may vary under different market conditions.

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 ただし、制限なく自由に使用できます – 詳細はこちらでご確認ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 ただし、制限なく自由に使用できます – 詳細はこちらでご確認ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。