INVITE-ONLY SCRIPT

更新済 LuxAlgo® - Screener (PAC)

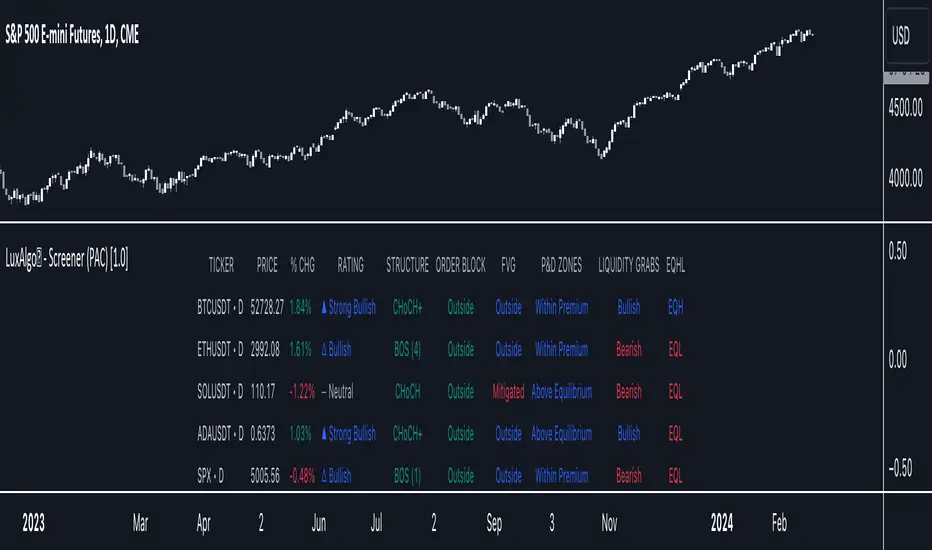

The LuxAlgo® - Screener (PAC) is a complete tool allowing users to check returned information from the Price Action Concepts™ toolkit's features for various user selected tickers and timeframes.

Users can customize the returned information by the screener, as well as filtering out displayed tickers based on custom user set rules.

🔶 FEATURES

Users can place the location of the screener everywhere they want, multiple locations are supported, you can even have it on your chart by drag and dropping the screener to your chart, allowing you to analyze them alongside your favorite indicators.

Keeping track of various tickers is crucial to have a deeper understanding of the overall market activity.

Our screener let you quickly access your preferred information in a convenient way thanks to the described features below:

The LuxAlgo® - Screener (PAC) returns the following information:

🔹Rating

Users can quickly check the overall sentiment based on the screeners returned information by looking at the Rating column. Tickers can be rated as follows:

This can be a quick way to asses the confluence between all the returned information on the screener for a specific ticker.

🔹Filtering

Thanks to the integrated filtering capabilities of the LuxAlgo® - Screener (PAC) you will be able to keep track of the information from tickers that return specific information you want to see.

For example do you want to only see the information from up trending tickers? Nothing easier, all you need is to select the up trending related options (▲ Strong Bullish or △ Bullish) in the rating dropdown menu.

However, you don't have to stop at 1 filtering condition, create more complex ones that fits your trading style for the tickers you truly want to look at!

🔹Sorting

As traders we want to quickly spot the tickers with most volume, most volatility, with the strongest uptrend or downtrend.

The LuxAlgo® - Screener (PAC) lets you do that by sorting supported information in an ascending or descending order, letting you access the most relevant information faster.

Users can customize the returned information by the screener, as well as filtering out displayed tickers based on custom user set rules.

🔶 FEATURES

Users can place the location of the screener everywhere they want, multiple locations are supported, you can even have it on your chart by drag and dropping the screener to your chart, allowing you to analyze them alongside your favorite indicators.

Keeping track of various tickers is crucial to have a deeper understanding of the overall market activity.

Our screener let you quickly access your preferred information in a convenient way thanks to the described features below:

- Screening of the main Price Action Concepts™ features on up to 10 user selected tickers and timeframes.

- Ticker filtering based on custom user set rules.

- Ticker sorting based on ascending/descending user selected data returned by the screener.

The LuxAlgo® - Screener (PAC) returns the following information:

- Current price

- Current volume

- Current price percent change (% CHG)

- Current price change (CHG)

- Current rating

- Most recent market structure

- Most recent Order Block type and relative position to price

- Order Block buy volume

- Order Block sell volume

- Order Block total volume

- Most recent user set imbalance type status. Options include screening for FVG, Inverse FVG, Double FVG, Volume Imbalance and Opening Gap

- Price position relative to Premium/Discount zones

- Most recent liquidity grab

- Most recent equal high/low

🔹Rating

Users can quickly check the overall sentiment based on the screeners returned information by looking at the Rating column. Tickers can be rated as follows:

- ▲ Strong Bullish (more than 80% of the returned information is bullish)

- △ Bullish (60% to 80% of the returned information is bullish)

- ― Neutral (40% to 60% of the returned information is bullish)

- ▽ Bearish (20% to 60% of the returned information is bullish)

- ▼ Strong Bearish (less than 20% of the returned information is bullish)

This can be a quick way to asses the confluence between all the returned information on the screener for a specific ticker.

🔹Filtering

Thanks to the integrated filtering capabilities of the LuxAlgo® - Screener (PAC) you will be able to keep track of the information from tickers that return specific information you want to see.

For example do you want to only see the information from up trending tickers? Nothing easier, all you need is to select the up trending related options (▲ Strong Bullish or △ Bullish) in the rating dropdown menu.

However, you don't have to stop at 1 filtering condition, create more complex ones that fits your trading style for the tickers you truly want to look at!

🔹Sorting

As traders we want to quickly spot the tickers with most volume, most volatility, with the strongest uptrend or downtrend.

The LuxAlgo® - Screener (PAC) lets you do that by sorting supported information in an ascending or descending order, letting you access the most relevant information faster.

リリースノート

- - Added option to disable specific tickers

- - Added option to select “Any Bullish or “Any Bearish” rating in Rating filter

- - Added option to select “Any Bullish or “Any Bearish” structure in Structure filter

- - Added option to use the same ticker as the one active on the chart for individual screener tickers

- - Changed ticker/timeframe selection layout

- - Minor changes

リリースノート

- Fixed inconsistent indications being returned for market structures- New "Middle" locations

リリースノート

- Added way to prevent errors on unavailable screener data on specific tickers- Significantly improved script computation time/memory handling

- Fixed incorrect premium/discount information returned on specific occasions

- Fixed incorrect CHoCH+ classification being returned on specific occasions

リリースノート

- Fixed issue preventing sorting by specific columns if these were not visibleリリースノート

- New "Absolute" sorting for market structures- Fixed issue with sorting for structures and order block volume

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、LuxAlgoに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Get instant access: https://luxalgo.com

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、LuxAlgoに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Get instant access: https://luxalgo.com

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。