INVITE-ONLY SCRIPT

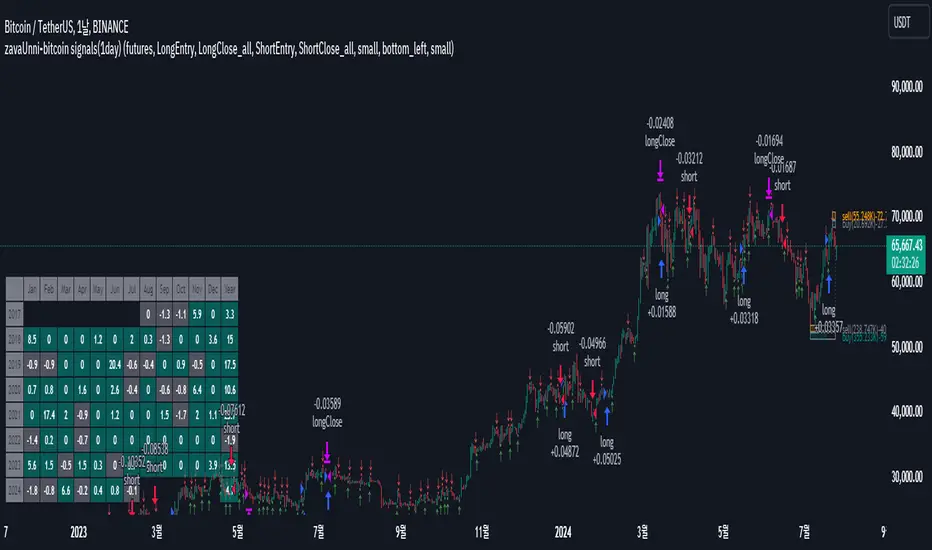

zavaUnni-bitcoin signals(1day)

📌 This strategy predicts price movements based on trading volume and enters positions accordingly. It calculates the expected price increase based on bullish volume and the expected price decrease based on bearish volume to determine the direction of the position.

Top predicted price based on declining bullish volume: top_ifpricebull

Bottom predicted price based on declining bearish volume: top_ifpricebear

Top predicted price based on increasing bullish volume: bot_ifpricebull

Bottom predicted price based on increasing bearish volume: bot_ifpricebear

Using these four values, the strategy calculates the final maxprice and minprice based on volume. If the price settles above the max value, it indicates an upward trend; if it settles below the min value, it indicates a downward trend.

📌 The indicator does not solely rely on the maxprice and minprice conditions. It incorporates complex and sophisticated analysis by considering average volume and candle size.

During a decline, if the average volume and spread of bullish candles exceed those of bearish candles and the price settles above the max value, a long position is entered.

During a rise, if the average volume and spread of bearish candles exceed those of bullish candles and the price settles below the min value, a short position is entered.

Even if the above conditions are met, if the buying pressure significantly outweighs the selling pressure, the position will be closed, but a reverse position will not be entered.

Reviewing historical data shows that while there are instances where the position switches from long to short immediately, there are also cases where the position is closed and re-entered after a few candles.

📌 Trading volume is one of the most traditional yet essential indicators, accurately reflecting price direction. This strategy, which simultaneously predicts fundamental trading volume and price changes, consistently achieves a profit factor above 3.

Characteristics and Historical Data of the Strategy

🔴 Short position entry: April 11, 2022

🟢 Long position entry after closing short: January 11, 2023

⚫ Short position holding period: 270 days

🟢 Long position entry: October 9, 2020

🔵 Long position exit: November 30, 2019

⚫ Long position holding period: 52 days

🟢 Long position entry: November 30, 2019

🔵 Long position exit: February 22, 2021

⚫ Long position holding period: 84 days

Settings Explanation

🛠️ In the input, you can choose between spot and futures. Buy and sell signals are generated in spot trading, while long and short signals are generated in futures trading.

🌈 You can configure the screen view.

Fibonacci Trend

Falling Fibonacci levels from the top: 382 and 618 levels (Red lines)

Rising Fibonacci levels from the bottom: 382 and 618 levels (Green lines)

When the price stays within the 382 and 618 levels of the falling Fibonacci, the background turns red; when it stays within the 382 and 618 levels of the rising Fibonacci, the background turns green.

Real-time Volume Strength of Bullish and Bearish Candles

Red arrow: Appears when the strength of bearish candles increases

Green arrow: Appears when the strength of bullish candles increases

Cumulative Volume of Bullish and Bearish Candles during the Trend

Cumulative data of falling bullish and bearish candles from the top

Cumulative data of rising bullish and bearish candles from the bottom

Profit Table

Provides annual and monthly profit tables.

Setting Options

You can change the options in the attributes to test different configurations.

📌 Trading Data

Although Binance data starts from 2017, limiting the number of trades to 60 as of July 2024, this does not undermine the validity of the strategy. Binance provides reliable volume data, which is crucial for evaluating the strategy's performance. In contrast, exchanges like Bitstamp may have longer trading histories but insufficient volume to properly assess the strategy's actual performance. A volume-based strategy cannot be reliably tested on an exchange with low trading volume. Therefore, despite the limited number of trades on Binance, its reliable volume data justifies its use for this strategy.

► Backtesting Details:

Timeframe: 1D / Bitcoin / TetherUS

Initial Balance: $50,000 (Enter the initial capital you will invest)

Order Size: 10% (Enter the percentage of your account balance you will trade)

Commission: 0.04% (Enter the trading commission)

Slippage: 10 ticks (Enter the slippage you want to test)

When using the strategy:

📢 Timeframe: While the strategy performs well on timeframes lower than daily, it is particularly profitable on the daily timeframe.

📢 Exchange: It is recommended to use Binance due to its reliable volume data.

📢 This strategy is suitable for traders who have the patience to hold positions for extended periods, as it calculates the size of bullish and bearish candles carefully and does not change positions easily.

📢 Spot trading is recommended over futures, and if using futures, leverage should be limited to a maximum of 2x.

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、zavaUnniに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

If you would like to test this indicator for free, please leave your TradingView ID on Telegram. 📢 t.me/zavaunni

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、zavaUnniに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

If you would like to test this indicator for free, please leave your TradingView ID on Telegram. 📢 t.me/zavaunni

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。