PROTECTED SOURCE SCRIPT

更新済 Sweep + BOS Alerts

//version=5

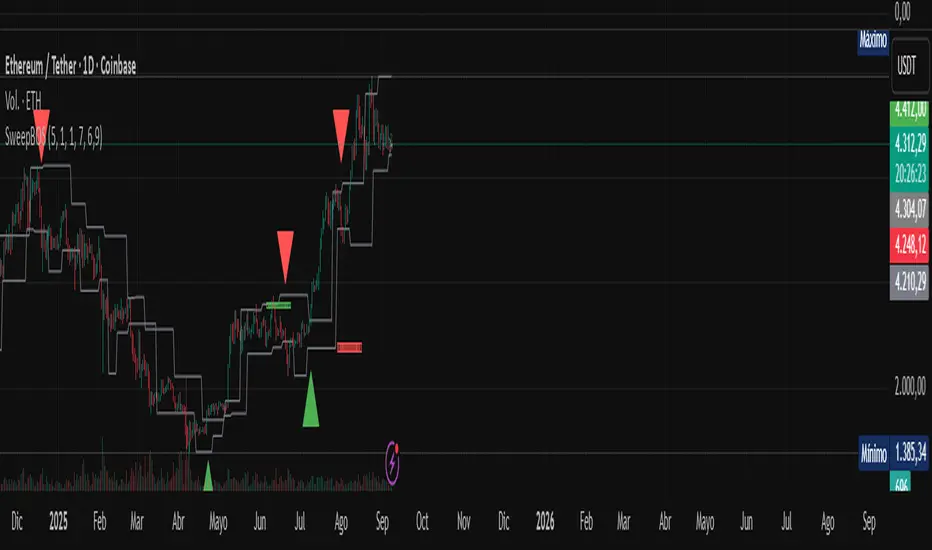

indicator("Sweep + BOS Alerts", overlay=true, shorttitle="SweepBOS")

// === User inputs ===

// Lookback length for pivot highs/lows. Higher values produce fewer swings/signals.

length = input.int(5, title="Pivot length", minval=1, maxval=50)

// Minimum relative wick size to qualify as a sweep (ratio of wick to body)

minWickMult = input.float(1.5, title="Min wick‑to‑body ratio", minval=0.0)

// Volume confirmation multiplier: volume must be at least this multiple of average volume

volMult = input.float(1.0, title="Volume multiple for BOS confirmation", minval=0.0)

// Maximum signals per month (to limit to ~5–7 as requested)

maxSignals = input.int(7, title="Max signals per month", minval=1, maxval=20)

// Only alert once per sweep/BOS pair

onlyFirst = input.bool(true, title="Only first BOS after sweep")

// === Helpers ===

// Identify pivot highs/lows using built‑in pivot functions

pivotHighPrice = ta.pivothigh(high, length, length)

pivotLowPrice = ta.pivotlow(low, length, length)

// Track the most recent swing high/low and their bar indices

var float lastSwingHigh = na

var float lastSwingLow = na

var int lastSwingHighBar = na

var int lastSwingLowBar = na

if not na(pivotHighPrice)

lastSwingHigh := pivotHighPrice

lastSwingHighBar := bar_index - length

if not na(pivotLowPrice)

lastSwingLow := pivotLowPrice

lastSwingLowBar := bar_index - length

// Calculate average volume for confirmation

avgVol = ta.sma(volume, 20)

// === Sweep detection ===

// Flags to signal a sweep occurred and BOS expected

var bool awaitingBearBOS = false

var bool awaitingBullBOS = false

// Check for sell sweep (buyside liquidity sweep)

// Condition: current high breaks previous swing high and closes back below the swing high with a long upper wick

bearSweep = false

if (not na(lastSwingHigh) and high > lastSwingHigh)

// compute candle components

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

isLongUpperWick = bodySize > 0 ? upperWick / bodySize >= minWickMult : false

// price closes below the last swing high (reversion inside range)

closesInside = close < lastSwingHigh

bearSweep := isLongUpperWick and closesInside

// Check for buy sweep (sellside liquidity sweep)

bullSweep = false

if (not na(lastSwingLow) and low < lastSwingLow)

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

isLongLowerWick = bodySize > 0 ? lowerWick / bodySize >= minWickMult : false

closesInside = close > lastSwingLow

bullSweep := isLongLowerWick and closesInside

// When sweep occurs, set awaiting BOS flags

if bearSweep

awaitingBearBOS := true

awaitingBullBOS := false

if bullSweep

awaitingBullBOS := true

awaitingBearBOS := false

// === BOS detection ===

// Evaluate BOS only if a sweep has happened

autoSellSignal = false

autoBuySignal = false

if awaitingBearBOS

// Look for break of structure to downside: close lower than last swing low.

// Confirm with volume if needed: if average volume is zero (e.g. at start of data), accept any volume.

bool volOkDown = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingLow) and close < lastSwingLow and volOkDown)

autoSellSignal := true

// If only first BOS should trigger, reset flag; otherwise keep awaiting further BOS

awaitingBearBOS := not onlyFirst

if awaitingBullBOS

// Look for break of structure to upside: close higher than last swing high.

bool volOkUp = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingHigh) and close > lastSwingHigh and volOkUp)

autoBuySignal := true

awaitingBullBOS := not onlyFirst

// === Signal throttling per month ===

// Convert current date to month index (year*12 + month)

monthIndex = year * 12 + month

var int currentMonth = monthIndex

var int signalCount = 0

if monthIndex != currentMonth

currentMonth := monthIndex

signalCount := 0

// Limit number of signals per month

buyAllowed = autoBuySignal and (signalCount < maxSignals)

sellAllowed = autoSellSignal and (signalCount < maxSignals)

if buyAllowed or sellAllowed

signalCount += 1

// === Plotting signals ===

plotshape(buyAllowed, title="Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny, text="BUY")

plotshape(sellAllowed, title="Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, text="SELL")

// Plot swing levels (optional for visual reference)

plot(lastSwingHigh, title="Swing High", color=color.gray, style=plot.style_linebr)

plot(lastSwingLow, title="Swing Low", color=color.gray, style=plot.style_linebr)

// === Alerts ===

// These alertconditions allow TradingView to trigger notifications

alertcondition(buyAllowed, title="Buy Alert", message="Sweep+BOS Buy signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

alertcondition(sellAllowed, title="Sell Alert", message="Sweep+BOS Sell signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

indicator("Sweep + BOS Alerts", overlay=true, shorttitle="SweepBOS")

// === User inputs ===

// Lookback length for pivot highs/lows. Higher values produce fewer swings/signals.

length = input.int(5, title="Pivot length", minval=1, maxval=50)

// Minimum relative wick size to qualify as a sweep (ratio of wick to body)

minWickMult = input.float(1.5, title="Min wick‑to‑body ratio", minval=0.0)

// Volume confirmation multiplier: volume must be at least this multiple of average volume

volMult = input.float(1.0, title="Volume multiple for BOS confirmation", minval=0.0)

// Maximum signals per month (to limit to ~5–7 as requested)

maxSignals = input.int(7, title="Max signals per month", minval=1, maxval=20)

// Only alert once per sweep/BOS pair

onlyFirst = input.bool(true, title="Only first BOS after sweep")

// === Helpers ===

// Identify pivot highs/lows using built‑in pivot functions

pivotHighPrice = ta.pivothigh(high, length, length)

pivotLowPrice = ta.pivotlow(low, length, length)

// Track the most recent swing high/low and their bar indices

var float lastSwingHigh = na

var float lastSwingLow = na

var int lastSwingHighBar = na

var int lastSwingLowBar = na

if not na(pivotHighPrice)

lastSwingHigh := pivotHighPrice

lastSwingHighBar := bar_index - length

if not na(pivotLowPrice)

lastSwingLow := pivotLowPrice

lastSwingLowBar := bar_index - length

// Calculate average volume for confirmation

avgVol = ta.sma(volume, 20)

// === Sweep detection ===

// Flags to signal a sweep occurred and BOS expected

var bool awaitingBearBOS = false

var bool awaitingBullBOS = false

// Check for sell sweep (buyside liquidity sweep)

// Condition: current high breaks previous swing high and closes back below the swing high with a long upper wick

bearSweep = false

if (not na(lastSwingHigh) and high > lastSwingHigh)

// compute candle components

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

isLongUpperWick = bodySize > 0 ? upperWick / bodySize >= minWickMult : false

// price closes below the last swing high (reversion inside range)

closesInside = close < lastSwingHigh

bearSweep := isLongUpperWick and closesInside

// Check for buy sweep (sellside liquidity sweep)

bullSweep = false

if (not na(lastSwingLow) and low < lastSwingLow)

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

isLongLowerWick = bodySize > 0 ? lowerWick / bodySize >= minWickMult : false

closesInside = close > lastSwingLow

bullSweep := isLongLowerWick and closesInside

// When sweep occurs, set awaiting BOS flags

if bearSweep

awaitingBearBOS := true

awaitingBullBOS := false

if bullSweep

awaitingBullBOS := true

awaitingBearBOS := false

// === BOS detection ===

// Evaluate BOS only if a sweep has happened

autoSellSignal = false

autoBuySignal = false

if awaitingBearBOS

// Look for break of structure to downside: close lower than last swing low.

// Confirm with volume if needed: if average volume is zero (e.g. at start of data), accept any volume.

bool volOkDown = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingLow) and close < lastSwingLow and volOkDown)

autoSellSignal := true

// If only first BOS should trigger, reset flag; otherwise keep awaiting further BOS

awaitingBearBOS := not onlyFirst

if awaitingBullBOS

// Look for break of structure to upside: close higher than last swing high.

bool volOkUp = (avgVol == 0) or (volume >= volMult * avgVol)

if (not na(lastSwingHigh) and close > lastSwingHigh and volOkUp)

autoBuySignal := true

awaitingBullBOS := not onlyFirst

// === Signal throttling per month ===

// Convert current date to month index (year*12 + month)

monthIndex = year * 12 + month

var int currentMonth = monthIndex

var int signalCount = 0

if monthIndex != currentMonth

currentMonth := monthIndex

signalCount := 0

// Limit number of signals per month

buyAllowed = autoBuySignal and (signalCount < maxSignals)

sellAllowed = autoSellSignal and (signalCount < maxSignals)

if buyAllowed or sellAllowed

signalCount += 1

// === Plotting signals ===

plotshape(buyAllowed, title="Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny, text="BUY")

plotshape(sellAllowed, title="Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, text="SELL")

// Plot swing levels (optional for visual reference)

plot(lastSwingHigh, title="Swing High", color=color.gray, style=plot.style_linebr)

plot(lastSwingLow, title="Swing Low", color=color.gray, style=plot.style_linebr)

// === Alerts ===

// These alertconditions allow TradingView to trigger notifications

alertcondition(buyAllowed, title="Buy Alert", message="Sweep+BOS Buy signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

alertcondition(sellAllowed, title="Sell Alert", message="Sweep+BOS Sell signal on {{exchange}} {{ticker}} @ {{close}} on {{interval}}")

リリースノート

//version=5indicator("Sweep + BOS Alerts", overlay=true, shorttitle="SweepBOS")

// === User inputs ===

length = input.int(5, title="Pivot length", minval=1, maxval=50)

minWickMult = input.float(1.5, title="Min wick‑to‑body ratio", minval=0.0)

volMult = input.float(1.0, title="Volume multiple", minval=0.0)

onlyFirst = input.bool(true, title="Only first BOS after sweep")

buyColor = input.color(color.green, title="Buy arrow color")

sellColor = input.color(color.red, title="Sell arrow color")

// Liquidity detection

liqLen = input.int(7, title='Liquidity Detection Length', minval=3, maxval=13, group='Liquidity')

liqMargin = input.float(6.9, title='Liquidity Margin', minval=4, maxval=9, step=0.1, group='Liquidity')

showLiqBuy = input.bool(true, title='Show Buyside Liquidity', group='Liquidity')

showLiqSell = input.bool(true, title='Show Sellside Liquidity', group='Liquidity')

// === Helpers ===

pivotHighPrice = ta.pivothigh(high, length, length)

pivotLowPrice = ta.pivotlow(low, length, length)

var float lastSwingHigh = na

var float lastSwingLow = na

if not na(pivotHighPrice)

lastSwingHigh := pivotHighPrice

if not na(pivotLowPrice)

lastSwingLow := pivotLowPrice

avgVol = ta.sma(volume, 20)

// === Sweep detection ===

var bool awaitingBearBOS = false

var bool awaitingBullBOS = false

bearSweep = false

if not na(lastSwingHigh) and high > lastSwingHigh

bodySize = math.abs(close - open)

upperWick = high - math.max(open, close)

isLongUpper = bodySize > 0 ? upperWick / bodySize >= minWickMult : false

closesInside = close < lastSwingHigh

bearSweep := isLongUpper and closesInside

bullSweep = false

if not na(lastSwingLow) and low < lastSwingLow

bodySize = math.abs(close - open)

lowerWick = math.min(open, close) - low

isLongLower = bodySize > 0 ? lowerWick / bodySize >= minWickMult : false

closesInside = close > lastSwingLow

bullSweep := isLongLower and closesInside

if bearSweep

awaitingBearBOS := true

awaitingBullBOS := false

if bullSweep

awaitingBullBOS := true

awaitingBearBOS := false

// === BOS detection ===

autoSellSignal = false

autoBuySignal = false

if awaitingBearBOS

bool volOkDown = (avgVol == 0) or (volume >= volMult * avgVol)

if not na(lastSwingLow) and close < lastSwingLow and volOkDown

autoSellSignal := true

awaitingBearBOS := not onlyFirst

if awaitingBullBOS

bool volOkUp = (avgVol == 0) or (volume >= volMult * avgVol)

if not na(lastSwingHigh) and close > lastSwingHigh and volOkUp

autoBuySignal := true

awaitingBullBOS := not onlyFirst

// === Signals without monthly limits ===

buyAllowed = autoBuySignal

sellAllowed = autoSellSignal

// === Liquidity detection ===

liqHigh = ta.pivothigh(high, liqLen, liqLen)

liqLow = ta.pivotlow (low, liqLen, liqLen)

var float[] liq_highs = array.new<float>()

var float[] liq_lows = array.new<float>()

if not na(liqHigh)

array.unshift(liq_highs, liqHigh)

if array.size(liq_highs) > 50

array.pop(liq_highs)

if not na(liqLow)

array.unshift(liq_lows, liqLow)

if array.size(liq_lows) > 50

array.pop(liq_lows)

liqATR = ta.atr(10)

liqDetect(level, prices) =>

int count = 0

float minVal = na

float maxVal = na

for i = 0 to array.size(prices) - 1

float p = prices.get(i)

if p < level + (liqATR/liqMargin) and p > level - (liqATR/liqMargin)

count += 1

minVal := na(minVal) ? p : math.min(minVal, p)

maxVal := na(maxVal) ? p : math.max(maxVal, p)

if count > 2

[minVal, maxVal]

else

[na, na]

var box[] liqBuyZones = array.new<box>()

var box[] liqSellZones = array.new<box>()

if bar_index > 0

if array.size(liq_highs) > 2 and showLiqBuy

[liMin, liMax] = liqDetect(liq_highs.get(0), liq_highs)

if not na(liMin)

bool updated = false

if array.size(liqBuyZones) > 0

for i = 0 to array.size(liqBuyZones) - 1

box b = liqBuyZones.get(i)

if close < b.get_top() and close > b.get_bottom()

b.set_top(liMax + (liqATR/liqMargin))

b.set_bottom(liMin - (liqATR/liqMargin))

b.set_right(bar_index)

updated := true

break

if not updated

box newBox = box.new(bar_index - liqLen, liMax + (liqATR/liqMargin),

bar_index + liqLen, liMin - (liqATR/liqMargin),

bgcolor=color.new(color.green,80), border_color=color.new(color.green,0))

array.unshift(liqBuyZones, newBox)

if array.size(liqBuyZones) > 5

box oldBox = array.pop(liqBuyZones)

oldBox.delete()

if array.size(liq_lows) > 2 and showLiqSell

[liMinS, liMaxS] = liqDetect(liq_lows.get(0), liq_lows)

if not na(liMinS)

bool updatedS = false

if array.size(liqSellZones) > 0

for i = 0 to array.size(liqSellZones) - 1

box b = liqSellZones.get(i)

if close < b.get_top() and close > b.get_bottom()

b.set_top(liMaxS + (liqATR/liqMargin))

b.set_bottom(liMinS - (liqATR/liqMargin))

b.set_right(bar_index)

updatedS := true

break

if not updatedS

box newBoxS = box.new(bar_index - liqLen, liMaxS + (liqATR/liqMargin),

bar_index + liqLen, liMinS - (liqATR/liqMargin),

bgcolor=color.new(color.red,80), border_color=color.new(color.red,0))

array.unshift(liqSellZones, newBoxS)

if array.size(liqSellZones) > 5

box oldBoxS = array.pop(liqSellZones)

oldBoxS.delete()

// === Plotting ===

// Usa size.normal para flechas más grandes; puedes cambiarlo a size.small, size.large, etc.

plotshape(buyAllowed, title="Buy Signal", style=shape.arrowup, location=location.belowbar, color=buyColor, size=size.normal)

plotshape(sellAllowed, title="Sell Signal", style=shape.arrowdown, location=location.abovebar, color=sellColor, size=size.normal)

// Swing levels

plot(lastSwingHigh, title="Swing High", color=color.gray, style=plot.style_linebr)

plot(lastSwingLow, title="Swing Low", color=color.gray, style=plot.style_linebr)

// Alertas

alertcondition(buyAllowed, title="Buy Alert", message="Sweep+BOS Buy signal on {{ticker}} @ {{close}}")

alertcondition(sellAllowed, title="Sell Alert", message="Sweep+BOS Sell signal on {{ticker}} @ {{close}}")

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。