PROTECTED SOURCE SCRIPT

QuantTrader MTF Momentum — QUIET v6 (TG + Status Panel)

Here’s a clear, copy-friendly description for your latest script.

# QuantTrader MTF Momentum — QUIET v6 (TG + Status Panel)

## What it does (in one line)

Fires bar-close BUY/SELL signals only when **trend**, **multi-timeframe confirmation**, **momentum confluence**, and **market-quality filters** all align—then draws ATR-based stops/targets and (optionally) sends **Telegram** payloads via TradingView webhooks.

## Signal recipe

* **Trend**: Price vs a baseline (EMA/HMA/Supertrend).

* **HTF confirm** (optional): Higher-TF EMA must slope **up** & price above for longs (down/below for shorts).

* **Momentum score (0–3)**:

* RSI (level + 3-bar rising/falling)

* MACD (line cross + histogram sign)

* Stochastic (K/D cross from OS/OB)

You choose **Min Momentum Signals** (default 2).

* **Market-quality gates**: ATR regime (vs median ATR), ADX threshold, Choppiness ceiling, and **Min body vs ATR** (filters tiny/noise bars).

* **Breakout filter** (optional): Donchian close > prior High (long) or < prior Low (short).

* **Sessions** (optional): Only trade in enabled (Asian/London/NY) windows.

## Quiet vs Loose mode

* **Quiet ON (default)**: All gates must be OK (trend+HTF, momentum ≥ min, ATR/ADX/Chop/Body, and Donchian if enabled).

* **Quiet OFF**: Easier entry—Trend OK + Momentum ≥1 + ATR regime OK.

## Presets

* **Forex Fast / Balanced 5m London / Strict 5m London / 15m London** (legacy choices).

* Each preset nudges RSI levels, ATR band, ADX, Chop, Min body, HTF TF, and Min-Momentum so behavior matches the instrument/timeframe. You can override any input.

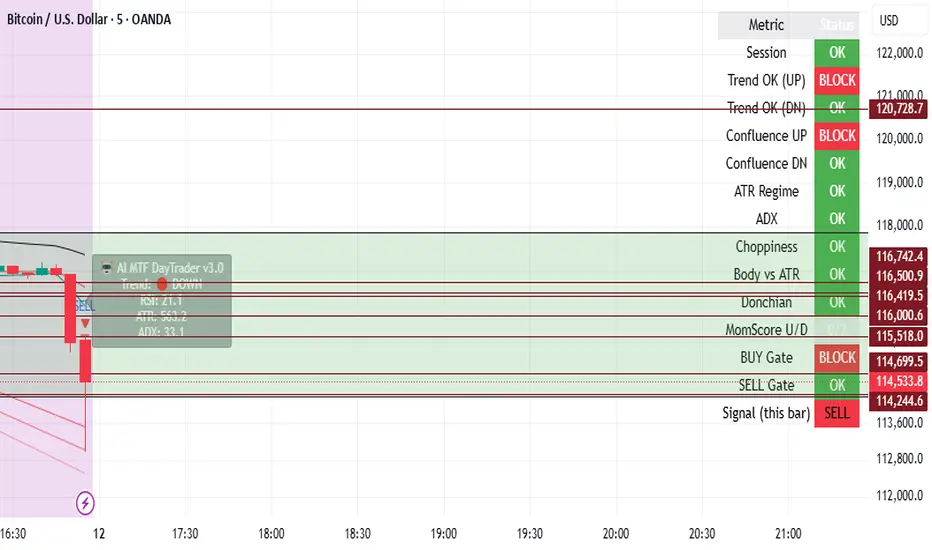

## Status Panel (on-chart)

A live checklist showing why a trade is (not) allowed:

* Session, Trend OK (UP/DN), Confluence (UP/DN), ATR Regime, ADX, Choppiness, Body vs ATR, Donchian, **MomScore U/D**.

* **BUY Gate / SELL Gate**: whether rules allow a trade this bar.

* **Signal (this bar)**: what actually triggered at bar close (BUY / SELL / —).

## Risk overlay

On a signal bar, plots:

* **Stop** = ATR × multiple (default 1.8) from entry,

* **Targets** = 1R / 1.5R / 2R.

The script tracks TP1/TP2/TP3/STOP “hits” afterward and can alert them.

## Alerts & Telegram

* Create one TV alert: **Condition = “Any alert() function call”**, paste your webhook URL.

* In inputs, enable **Telegram** and set your `chat_id`.

* Script sends JSON payloads for **BUY/SELL** signals and **TP/SL hits** (includes preset, mode Q/L, momentum score, session, HTF TF).

## How to use (quick start)

1. Choose your **symbol/timeframe** (e.g., FX 5–15m; Gold 5m/15m; BTC 5m/15m).

2. Turn **Use Preset Profile ON** and pick a profile (e.g., “Strict 5m London” for EURUSD).

3. Keep **Quiet Mode ON** for cleaner signals.

4. Enter only when a **BUY/SELL** prints at bar close and **BUY/SELL Gate** is OK.

5. Use plotted **Stop/Targets** for risk planning; optional Telegram alerts will confirm TP/SL events.

## Notes

* Signals are **bar-close**, reducing flicker/repaint behavior.

* It’s an **entry framework**—add your sizing & management.

* Tune Min-Momentum, ADX, ATR band, and Donchian per instrument to balance **frequency vs. quality**.

# QuantTrader MTF Momentum — QUIET v6 (TG + Status Panel)

## What it does (in one line)

Fires bar-close BUY/SELL signals only when **trend**, **multi-timeframe confirmation**, **momentum confluence**, and **market-quality filters** all align—then draws ATR-based stops/targets and (optionally) sends **Telegram** payloads via TradingView webhooks.

## Signal recipe

* **Trend**: Price vs a baseline (EMA/HMA/Supertrend).

* **HTF confirm** (optional): Higher-TF EMA must slope **up** & price above for longs (down/below for shorts).

* **Momentum score (0–3)**:

* RSI (level + 3-bar rising/falling)

* MACD (line cross + histogram sign)

* Stochastic (K/D cross from OS/OB)

You choose **Min Momentum Signals** (default 2).

* **Market-quality gates**: ATR regime (vs median ATR), ADX threshold, Choppiness ceiling, and **Min body vs ATR** (filters tiny/noise bars).

* **Breakout filter** (optional): Donchian close > prior High (long) or < prior Low (short).

* **Sessions** (optional): Only trade in enabled (Asian/London/NY) windows.

## Quiet vs Loose mode

* **Quiet ON (default)**: All gates must be OK (trend+HTF, momentum ≥ min, ATR/ADX/Chop/Body, and Donchian if enabled).

* **Quiet OFF**: Easier entry—Trend OK + Momentum ≥1 + ATR regime OK.

## Presets

* **Forex Fast / Balanced 5m London / Strict 5m London / 15m London** (legacy choices).

* Each preset nudges RSI levels, ATR band, ADX, Chop, Min body, HTF TF, and Min-Momentum so behavior matches the instrument/timeframe. You can override any input.

## Status Panel (on-chart)

A live checklist showing why a trade is (not) allowed:

* Session, Trend OK (UP/DN), Confluence (UP/DN), ATR Regime, ADX, Choppiness, Body vs ATR, Donchian, **MomScore U/D**.

* **BUY Gate / SELL Gate**: whether rules allow a trade this bar.

* **Signal (this bar)**: what actually triggered at bar close (BUY / SELL / —).

## Risk overlay

On a signal bar, plots:

* **Stop** = ATR × multiple (default 1.8) from entry,

* **Targets** = 1R / 1.5R / 2R.

The script tracks TP1/TP2/TP3/STOP “hits” afterward and can alert them.

## Alerts & Telegram

* Create one TV alert: **Condition = “Any alert() function call”**, paste your webhook URL.

* In inputs, enable **Telegram** and set your `chat_id`.

* Script sends JSON payloads for **BUY/SELL** signals and **TP/SL hits** (includes preset, mode Q/L, momentum score, session, HTF TF).

## How to use (quick start)

1. Choose your **symbol/timeframe** (e.g., FX 5–15m; Gold 5m/15m; BTC 5m/15m).

2. Turn **Use Preset Profile ON** and pick a profile (e.g., “Strict 5m London” for EURUSD).

3. Keep **Quiet Mode ON** for cleaner signals.

4. Enter only when a **BUY/SELL** prints at bar close and **BUY/SELL Gate** is OK.

5. Use plotted **Stop/Targets** for risk planning; optional Telegram alerts will confirm TP/SL events.

## Notes

* Signals are **bar-close**, reducing flicker/repaint behavior.

* It’s an **entry framework**—add your sizing & management.

* Tune Min-Momentum, ADX, ATR band, and Donchian per instrument to balance **frequency vs. quality**.

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。