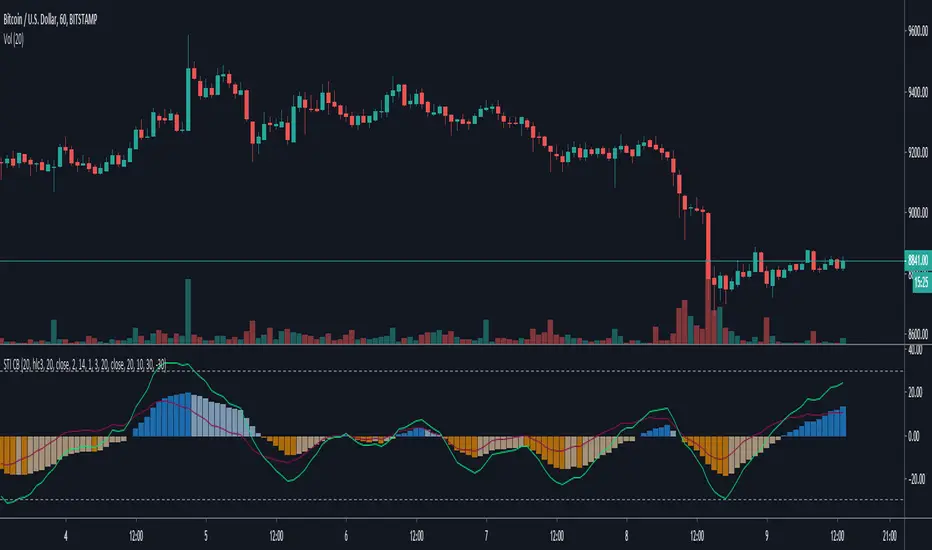

Stochastic Trend Indicator [ChuckBanger]

The indicator can be configured and operated in various ways. It can be used by simply interpret the histogram zero line crossings, or interpret the red and green line crossings alone or both together.

Operating this trend indicator is not difficult, it gives many possibilities of presenting many differnet signals, more than the usual in this type of indicators. In principle, it can be used as a regular MACD. So if you are familuar with MACD, use this the same way and you will be reworded heavily.

How to use it

When the green line is above the red line the time is positive and the price is likely to increase and the opposite is true if red line is under the green line. But the most aggressive user will quickly realize that it also offers the possibility to trade between extremes of the green line and even by divergence between the indicator histogram and price action or green line and price action. Where divergences is more power full.

Divergences

[url=docs.google.com/spreadsheets/d/1soONyyDDzjjEObNGPXgfgGbZdV60H6fDS0-H3ESXL3I/edit?usp=sharing ]docs.google.com/spreadsheets/d/1soONyyDDzjjEObNGPXgfgGbZdV60H6fDS0-H3ESXL3I/edit?usp=sharing

Divergences can easily be spotted in this Indicator but can also be spotted in several other Oscillators, such as RSI, StochRSI, MACD, CCI, OBV, etc.. and they can be Bullish or Bearish.

Price action (I’m using PA from now on) and Oscillators can follow the same path. It is when they don’t it’s called Divergence. But be aware so you don’t identify them wrongly as they can also be Convergences. Convergences is when PA follows the indicator.

The so called “Divergence” in Stock, Crypto or whatever market you trade is when PA and oscillator are following different paths = PA and Oscillator diverging. They can be strong, medium, weak or hidden, in my link above I also classified them as class A, B and C for strong, medium and weak.

While divergences (class A, B and C) is a sign of reversal being close, hidden divergences is a continuation of the trend pattern. They work 90% of the time although but there is no time frame when it will happen. Many times they create 3 legs up or down when it becomes very strong and can work as an entry as it is time to reserve or continuation of the trend. In this cases the first two is wrong but the last is often very strong.

Bullish divergence

When PA makes a flat bottom or lower low and higher low on Oscillator. The opposite is convergence.

- Pay attention to the fact that PA and Oscillator trend is measured from below.

Bearish Divergence

When Price Action makes a flat top or higher high and higher low on Oscillator. The opposite is convergence.

- Pay attention to the fact that PA and Oscillator trend is measured from above.

Hidden Bullish Divergence

When Price Action makes a higher lows and lower lows on Oscillator. Hidden Bullish Divergence is telling us that Oscillator is recharging to go back up again. Continuation of an uptrend.

- Pay attention to the fact that PA and Oscillator from below (swing lows on the way up). Normally when in uptrend.

Hidden Bearish Divergence

When PA makes higher lows and higher highs on Oscillator. Hidden Bearish Divergence is telling us that Oscillator is creating space to go back down again. Continuation of downtrend.

- Pay attention to the fact that PA and Oscillator (swing highs on the way down). Normally in downtrend.

Histogram

You can also traded this indicator with histogram crossing the zero line. When the histogram crosses down below zero line it is a bearish sign and when it crosses up it is a bullish sign

招待専用スクリプト

このスクリプトにアクセスできるのは作者から許可されたユーザーに限られており、通常は支払いが必要になります。スクリプトをお気に入りに追加することはできますが、使用するにはその作者に許可を申請し、その許可を得る必要があります ― 詳細についてはこちらをご覧ください。さらに詳しい情報が必要な場合は下記の作成者からの手引きをご覧になるか、ChuckBangerに直接お問い合わせください。

スクリプトの機能を理解し、その作者を全面的に信頼しているのでなければ、お金を支払ってまでそのスクリプトを利用することをTradingViewとしては「非推奨」としています。コミュニティスクリプトの中で、その代わりとなる無料かつオープンソースのスクリプトを見つけられる可能性もあります。

作者の指示

警告: 招待専用スクリプトへのアクセスをリクエストする前に弊社のガイドをお読みください。

BTC: 3EV8QGKK689kToo1r8pZJXbWDqzyJQtHy6

LTC: LRAikFVtnqY2ScJUR2ETJSG4w9t8LcmSdh

免責事項

招待専用スクリプト

このスクリプトにアクセスできるのは作者から許可されたユーザーに限られており、通常は支払いが必要になります。スクリプトをお気に入りに追加することはできますが、使用するにはその作者に許可を申請し、その許可を得る必要があります ― 詳細についてはこちらをご覧ください。さらに詳しい情報が必要な場合は下記の作成者からの手引きをご覧になるか、ChuckBangerに直接お問い合わせください。

スクリプトの機能を理解し、その作者を全面的に信頼しているのでなければ、お金を支払ってまでそのスクリプトを利用することをTradingViewとしては「非推奨」としています。コミュニティスクリプトの中で、その代わりとなる無料かつオープンソースのスクリプトを見つけられる可能性もあります。

作者の指示

警告: 招待専用スクリプトへのアクセスをリクエストする前に弊社のガイドをお読みください。

BTC: 3EV8QGKK689kToo1r8pZJXbWDqzyJQtHy6

LTC: LRAikFVtnqY2ScJUR2ETJSG4w9t8LcmSdh