OPEN-SOURCE SCRIPT

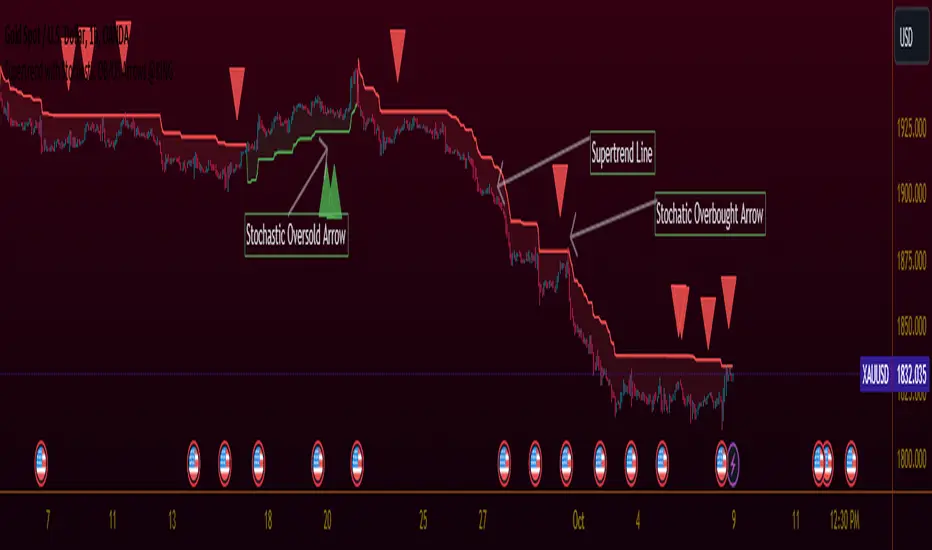

更新済 Supertrend with Stochastic OB/OS Arrows @KING

TradingView Idea: Supertrend with Stochastic Arrows KING

Overview:

- Combining the Supertrend indicator with Stochastic arrows for a comprehensive market

view, providing insights into trend direction and potential reversal points.

Supertrend Settings:

- ATR Length: The length parameter for calculating the Average True Range (ATR).

- Factor: A multiplier used to determine the distance of the Supertrend line from the

price.

Supertrend Display:

* The Supertrend is color-coded:

- During an uptrend, it is displayed in green.

- During a downtrend, it is displayed in red.

- The body of the candlesticks is filled with color during the corresponding trend direction.

Stochastic Settings:

- K Length: The period length for the %K line in the Stochastic oscillator.

- K Smoothing: Smoothing factor for %K.

- D Smoothing: Smoothing factor for %D.

- Overbought Level: The threshold indicating an overbought condition.

- Oversold Level: The threshold indicating an oversold condition.

Arrows:

- Buy arrows are displayed below the bars during a downtrend when Stochastic is below the

oversold level.

- Sell arrows are displayed above the bars during an uptrend when Stochastic is above the

overbought level.

Supertrend Display:

- The Supertrend line is plotted with a color change based on its direction.

- The body of the candlesticks is filled with green during an uptrend and red during a downtrend.

Usage:

- Traders can use this script to identify potential entry and exit points, leveraging the

insights provided by both the Supertrend indicator and Stochastic oscillator. This

combination aims to capture trend strength and potential reversal opportunities.

リリースノート

TradingView Idea: Supertrend with Stochastic Arrows KING

Overview:

- Combining the Supertrend indicator with Stochastic arrows for a comprehensive market view, providing insights into trend direction and potential reversal points.

Supertrend Settings:

- ATR Length: The length parameter for calculating the Average True Range (ATR).

- Factor: A multiplier used to determine the distance of the Supertrend line from the price.

Supertrend Display:

- The Supertrend is color-coded:

- During an uptrend, it is displayed in green.

- During a downtrend, it is displayed in red.

- The body of the candlesticks is filled with color during the corresponding trend direction.

Stochastic Settings:

- K Length: The period length for the %K line in the Stochastic oscillator.

- K Smoothing: Smoothing factor for %K.

- D Smoothing: Smoothing factor for %D.

- Overbought Level: The threshold indicating an overbought condition.

- Oversold Level: The threshold indicating an oversold condition.

Arrows:

- Buy arrows are displayed below the bars during a downtrend when Stochastic is below the oversold level.

- Sell arrows are displayed above the bars during an uptrend when Stochastic is above the overbought level.

Supertrend Display:

- The Supertrend line is plotted with a color change based on its direction.

- The body of the candlesticks is filled with green during an uptrend and red during a downtrend.

Usage:

- Traders can use this script to identify potential entry and exit points, leveraging the insights provided by both the Supertrend indicator and Stochastic oscillator. This combination aims to capture trend strength and potential reversal opportunities.

---

This format uses for bold and

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。