PROTECTED SOURCE SCRIPT

Asian Session Sweep Reversal

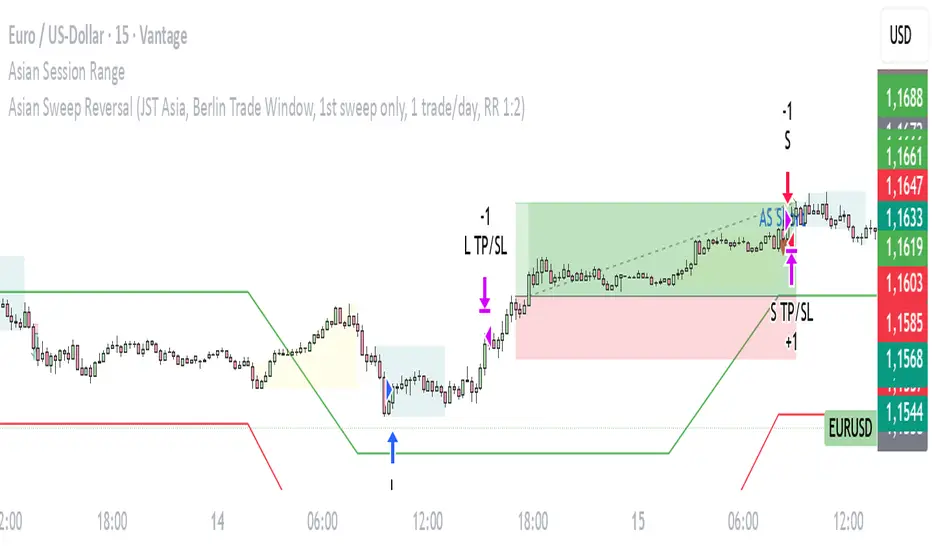

This strategy identifies liquidity sweeps of the Asian session range (09:00–15:00 JST) and trades the first confirmed reversal in the opposite direction — but only within the London morning window (08:00–12:00 Europe/Berlin).

Core Logic:

Marks the Asian session high and low (fixed Tokyo timezone, no DST).

After the Asian range ends, the first sweep of either the high or low triggers a watch for a reversal candle.

When a bearish candle forms after a high sweep, a Sell Stop is placed below the candle’s wick.

When a bullish candle forms after a low sweep, a Buy Stop is placed above the candle’s wick.

Orders are valid for 1 bar only; unfilled trades are canceled automatically.

Each day allows only one trade, taking the direction of the first sweep (either long or short).

The fixed risk/reward ratio is 1:2 (Take Profit = 2× Stop Loss).

Features:

Automatically detects and visualizes the Asian range.

Works consistently year-round (using Tokyo time).

Optional box display for the range.

Clear signal markers for entries.

Designed for clean backtesting with daily trade control.

Core Logic:

Marks the Asian session high and low (fixed Tokyo timezone, no DST).

After the Asian range ends, the first sweep of either the high or low triggers a watch for a reversal candle.

When a bearish candle forms after a high sweep, a Sell Stop is placed below the candle’s wick.

When a bullish candle forms after a low sweep, a Buy Stop is placed above the candle’s wick.

Orders are valid for 1 bar only; unfilled trades are canceled automatically.

Each day allows only one trade, taking the direction of the first sweep (either long or short).

The fixed risk/reward ratio is 1:2 (Take Profit = 2× Stop Loss).

Features:

Automatically detects and visualizes the Asian range.

Works consistently year-round (using Tokyo time).

Optional box display for the range.

Clear signal markers for entries.

Designed for clean backtesting with daily trade control.

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。