INVITE-ONLY SCRIPT

更新済 Premium Dashboard [TFO]

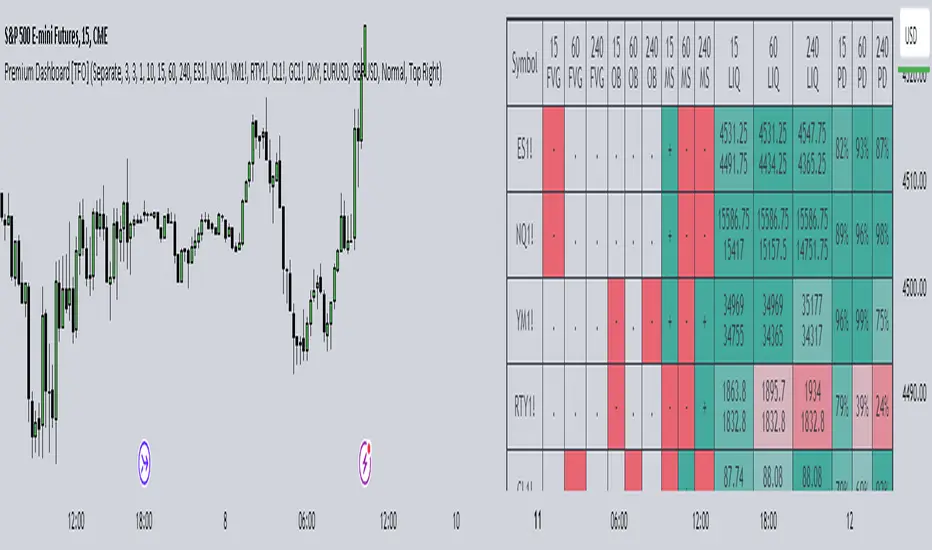

The purpose of this indicator is to serve as a scanner/dashboard for several symbols across multiple timeframes. At the time of release, the scanner looks for the following criteria on all selected timeframes:

- Whether price is in a Fair Value Gap (FVG)

- Whether price is in an Order Block (OB)

- Current Market Structure

- Nearest Liquidity Pivots

- Proximity to said Liquidity Pivots

For FVGs, the user selects a Displacement Strength to validate FVGs from the selected timeframes; larger values require greater displacement. The table will indicate whether price is presently trading in a valid bullish FVG, bearish FVG, or none.

With OBs, the user selects a similar Displacement Strength to validate OBs from the selected timeframes. Again, larger values require greater displacement to validate an OB. The table will indicate whether price is presently trading in a bullish OB, bearish OB, or none.

For Market Structure, the table will indicate whether the current structure is bullish or bearish on each respective timeframe. A pivot strength parameter is used to determine which swing highs and swing lows warrant valid Market Structure Shifts (reversals) or Breaks of Structure (continuations).

The Liquidity section of the dashboard displays the nearest Buyside and Sellside Liquidity (major highs and lows) from each respective timeframe. A similar pivot strength parameter is used to determine how "strong" the highs and lows must be in order to be considered valid.

The Premium / Discount section offers an alternative view of the nearest Liquidity Pivots, where it will instead display a percent value to describe how close price is to Buyside or Sellside Liquidity. Values approaching 100% imply price is trading close to the nearest Buyside Liquidity, while values approaching 0% imply price is trading close to Sellside Liquidity.

Users can also choose to show any of the above features on their current chart: FVGs, OBs, cumulative Market Structure, and Liquidity, all from the various selected timeframes.

- Whether price is in a Fair Value Gap (FVG)

- Whether price is in an Order Block (OB)

- Current Market Structure

- Nearest Liquidity Pivots

- Proximity to said Liquidity Pivots

For FVGs, the user selects a Displacement Strength to validate FVGs from the selected timeframes; larger values require greater displacement. The table will indicate whether price is presently trading in a valid bullish FVG, bearish FVG, or none.

With OBs, the user selects a similar Displacement Strength to validate OBs from the selected timeframes. Again, larger values require greater displacement to validate an OB. The table will indicate whether price is presently trading in a bullish OB, bearish OB, or none.

For Market Structure, the table will indicate whether the current structure is bullish or bearish on each respective timeframe. A pivot strength parameter is used to determine which swing highs and swing lows warrant valid Market Structure Shifts (reversals) or Breaks of Structure (continuations).

The Liquidity section of the dashboard displays the nearest Buyside and Sellside Liquidity (major highs and lows) from each respective timeframe. A similar pivot strength parameter is used to determine how "strong" the highs and lows must be in order to be considered valid.

The Premium / Discount section offers an alternative view of the nearest Liquidity Pivots, where it will instead display a percent value to describe how close price is to Buyside or Sellside Liquidity. Values approaching 100% imply price is trading close to the nearest Buyside Liquidity, while values approaching 0% imply price is trading close to Sellside Liquidity.

Users can also choose to show any of the above features on their current chart: FVGs, OBs, cumulative Market Structure, and Liquidity, all from the various selected timeframes.

リリースノート

v1.1.0- Added Mean Threshold & Consequent Encroachment midpoint lines to Order Blocks and Fair Value Gaps, respectively

- Bug fixes

リリースノート

v1.2.0- The Dashboard now indicates if price is in a POI by checking if the current candle (from high to low) has interacted with said POI in any way. This replaces the previous logic which required that the current close price must be within the upper and lower POI bounds

- POI will only be mitigated by the close price of its respective timeframe, rather than that of a lower (current chart) timeframe. For example, a 15m OB on a 1m chart will only be deleted once there is a decisive 15m close through its area

- The Dashboard will now display when price last encountered a given POI, using the POI's timeframe as a reference. For example, if the table cell for NQ1! 1D FVG says "H (3)", the "H" implies that NQ1! made a 1D high in or beyond a bearish 1D FVG, and traded away from it without mitigating it; and the "(3)" implies that this occurred 3 bars ago, on the 1D timeframe

リリースノート

v1.2.1- Improved FVG and OB input sensitivity

リリースノート

v1.2.2- Bug fixes regarding MTF Structure

リリースノート

v1.3.0- Added Display POI Text option to annotate and distinguish the timeframe and POI type of an object, in addition to their unique colors

リリースノート

v1.3.1- Bug fix regarding table sizes

リリースノート

v1.3.2- Exporting all relevant factors to be usable in external indicators

リリースノート

v1.3.3- Added transparency options for midlines and labels

リリースノート

v1.4.0- Added POI options for OB flexibility and overall chart cleanup

リリースノート

v1.4.1- Bug fix regarding certain POI when liquidity options are not utilized

リリースノート

v1.5.0- Added POI Option to only show FVGs that create a BOS, MSS, or either

リリースノート

v1.5.1- Bug fixes regarding FVG POI options

リリースノート

v1.6.0- Added POI Mitigation option to specify how far price must close through a given FVG/OB in order to consider it mitigated

リリースノート

v1.7.0- Added the option to display the time of the most recent MSS within the dashboard

- Added custom alert conditions when price reaches selected POI

リリースノート

v1.8.0- Updated logic to be consistent with the Smart Money Essentials indicator

- Minor bug fixes

リリースノート

v1.9.0- Added tooltips to help explain the Dashboard table cells

リリースノート

Updated access instructions. No version change requiredリリースノート

v1.9.1- Bug fix regarding FVG midline drawings

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、tradeforoppに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Get access here: https://tradeforopp.com/

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

招待専用スクリプト

このスクリプトは作者が承認したユーザーのみアクセス可能です。使用するにはアクセス申請をして許可を得る必要があります。通常は支払い後に承認されます。詳細は下記の作者の指示に従うか、tradeforoppに直接お問い合わせください。

TradingViewは、作者を完全に信頼し、スクリプトの動作を理解していない限り、有料スクリプトの購入・使用を推奨しません。コミュニティスクリプトには無料のオープンソースの代替が多数あります。

作者の指示

Get access here: https://tradeforopp.com/

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。