PROTECTED SOURCE SCRIPT

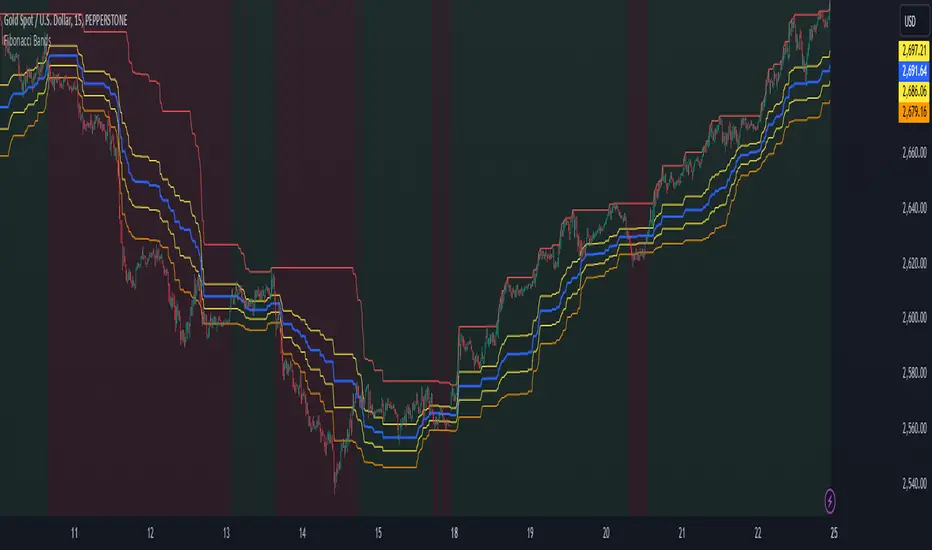

Fibonacci Bands

This Pine Script is designed to help traders identify key support and resistance levels, as well as discern the broader market trend (bullish or bearish) while catching trend following moves. The code incorporates Fibonacci retracement levels to define potential areas of support and resistance, which are crucial for making informed trading decisions.

How It Helps in Finding Support and Resistance:

Fibonacci Retracement Levels: The core of this script lies in calculating Fibonacci retracement levels over the last 100 candles. These levels are widely used by traders to identify potential areas where the price may reverse or stall, based on historical price action. Specifically:

0.236, 0.382, and 0.618 are considered significant retracement levels that often act as dynamic support and resistance.

0.5 serves as a crucial dividing line, where the market is considered to be in a neutral state between the premium (above 0.5) and discounted (below 0.5) zones.

0.0 (low) and 1.0 (high) mark the extreme ends of the range and can act as major support or resistance levels in extreme market conditions.

By plotting these levels on the chart, the script visually highlights where the price is relative to these key Fibonacci points, allowing traders to spot areas where the market may reverse (resistance) or find support. This is especially useful for identifying where the price might bounce back up or face selling pressure.

Strong Support/Resistance: When the Fibonacci lines are extremely close together, it can indicate a stronger support or resistance zone. This happens because multiple Fibonacci levels are concentrated in a small price range, making that area more likely to act as a significant barrier to price movement. In such scenarios, the market may experience stronger reversals or pauses, as the confluence of levels creates a stronger resistance or support zone.

How It Helps in Determining the Market Trend (Bullish or Bearish):

Premium vs Discount Areas: The script defines the premium and discounted areas based on the 0.5 Fibonacci retracement level.

Premium Area (Above 0.5): When the price is above the 0.5 level, it indicates that the market is trading in a bullish zone, where buyers are in control, and the price is considered "expensive" or in an overbought condition.

Discounted Area (Below 0.5): When the price is below the 0.5 level, it signals a bearish trend, where the market is in a "discounted" state, and buyers may start to look for potential buying opportunities.

Trend Direction: By observing whether the price is in the premium or discounted zone, traders can assess the overall market sentiment:

If the price is consistently above 0.5, it may suggest a bullish trend, indicating that the market is trending upwards.

Conversely, if the price is staying below 0.5, it may imply a bearish trend, suggesting a downward move or market weakness.

As well the 0.382 band could be used to trail a stop loss for a specific trade and keep moving with the unfolding trend.

Summary:

This script combines Fibonacci retracement levels and price action analysis to determine key support and resistance levels and market trend direction. By identifying areas of premium and discount based on the 0.5 Fibonacci level, traders can gauge market sentiment and make more informed decisions about long or short positions. Furthermore, by using the Fibonacci retracements, traders are equipped with crucial levels that are often respected by the market, improving the accuracy of identifying potential trend reversals and price reactions. When Fibonacci lines are close together, they act as stronger support or resistance, further enhancing the reliability of these key zones.

How It Helps in Finding Support and Resistance:

Fibonacci Retracement Levels: The core of this script lies in calculating Fibonacci retracement levels over the last 100 candles. These levels are widely used by traders to identify potential areas where the price may reverse or stall, based on historical price action. Specifically:

0.236, 0.382, and 0.618 are considered significant retracement levels that often act as dynamic support and resistance.

0.5 serves as a crucial dividing line, where the market is considered to be in a neutral state between the premium (above 0.5) and discounted (below 0.5) zones.

0.0 (low) and 1.0 (high) mark the extreme ends of the range and can act as major support or resistance levels in extreme market conditions.

By plotting these levels on the chart, the script visually highlights where the price is relative to these key Fibonacci points, allowing traders to spot areas where the market may reverse (resistance) or find support. This is especially useful for identifying where the price might bounce back up or face selling pressure.

Strong Support/Resistance: When the Fibonacci lines are extremely close together, it can indicate a stronger support or resistance zone. This happens because multiple Fibonacci levels are concentrated in a small price range, making that area more likely to act as a significant barrier to price movement. In such scenarios, the market may experience stronger reversals or pauses, as the confluence of levels creates a stronger resistance or support zone.

How It Helps in Determining the Market Trend (Bullish or Bearish):

Premium vs Discount Areas: The script defines the premium and discounted areas based on the 0.5 Fibonacci retracement level.

Premium Area (Above 0.5): When the price is above the 0.5 level, it indicates that the market is trading in a bullish zone, where buyers are in control, and the price is considered "expensive" or in an overbought condition.

Discounted Area (Below 0.5): When the price is below the 0.5 level, it signals a bearish trend, where the market is in a "discounted" state, and buyers may start to look for potential buying opportunities.

Trend Direction: By observing whether the price is in the premium or discounted zone, traders can assess the overall market sentiment:

If the price is consistently above 0.5, it may suggest a bullish trend, indicating that the market is trending upwards.

Conversely, if the price is staying below 0.5, it may imply a bearish trend, suggesting a downward move or market weakness.

As well the 0.382 band could be used to trail a stop loss for a specific trade and keep moving with the unfolding trend.

Summary:

This script combines Fibonacci retracement levels and price action analysis to determine key support and resistance levels and market trend direction. By identifying areas of premium and discount based on the 0.5 Fibonacci level, traders can gauge market sentiment and make more informed decisions about long or short positions. Furthermore, by using the Fibonacci retracements, traders are equipped with crucial levels that are often respected by the market, improving the accuracy of identifying potential trend reversals and price reactions. When Fibonacci lines are close together, they act as stronger support or resistance, further enhancing the reliability of these key zones.

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 ただし、制限なく自由に使用できます – 詳細はこちらでご確認ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 ただし、制限なく自由に使用できます – 詳細はこちらでご確認ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。