INVITE-ONLY SCRIPT

更新済 Vini Algo Strategy

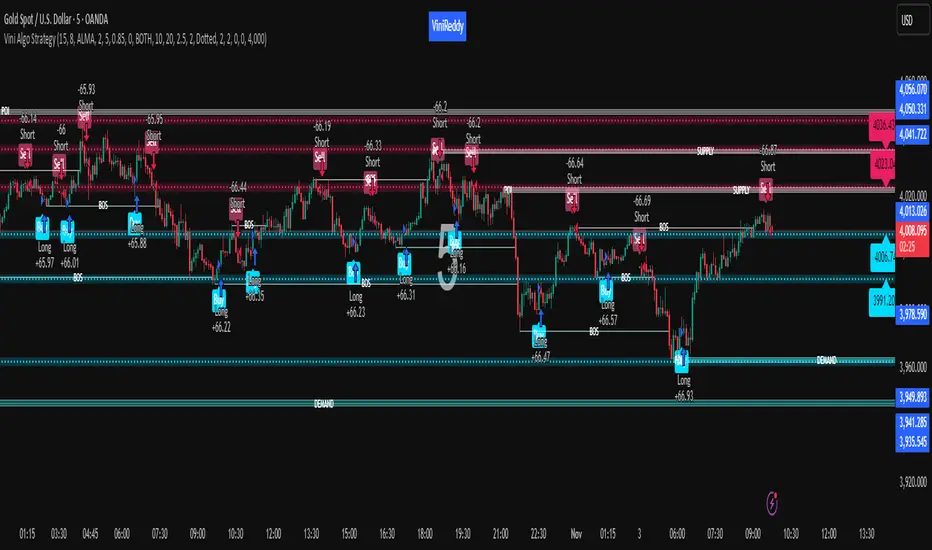

This strategy is intended to be used on an trading platform and should be run on a 5, 10, 15 minute chart for confirmations and signal relay to crypto platform.

I have spent quite a bit of time and I figured I would put it out to the community to share the work.

Ok, so let me say that I have spent some amount of time to make the indicator/Strategy not to repaint while still maintaining it's profitability. It has been a challenge so I am publishing.

What I have observed: the strategy will not repaint in real time.

Channel Balance

Bright Magenta Upper (Supply) side with Standard Deviation Interpretation +1σ, +2σ, +3σ above the mean — statistically “overbought” areas where price may reverse or slow down

Bright Cyan Lower (Demand) side with Standard Deviation Interpretation −1σ, −2σ, −3σ below the mean — “oversold” areas where buying interest may return

Supply Zone ---->> Resistance / Sell area

Demand Zone ------>> Support / Buy area

BOS ----->> Market structure break

Buy/Long markers ----->> Potential entry for long trades

Sell/Short markers ----->> Potential entry for short trades

Limitation on lower timeframe chart

That is, if you have the chart open and keep it open, the signals are the same as the ones that are sent out by the strategy. In certain cases, when I reload the chart- the signals might be off from what was sent. In some ways, that is repainting, but it is repainting based on losing the real time data and recalculating from a different set of bars- since I am running it on a one minute chart then the start becomes different when you refresh.

🧠 Price Action

Price action is the study of how price moves on a chart — without relying on indicators. If you master price action, you can trade confidently even without indicators — because you’ll understand what the market is telling you through structure, momentum, and liquidity.

How to Read Price Action Step by Step

Identify Market Structure

→ Are we trending or ranging?

Mark Key Levels

→ Swing highs/lows, supply/demand, liquidity zones.

Wait for Confirmation

→ BOS / CHoCH or rejection candles.

Align With Context

→ Where are we in the larger timeframe? (Top-down analysis)

Enter on Reaction

→ Wait for a clear rejection, engulfing candle, or BOS confirmation near your zone.

Manage Risk

→ Stop-loss below swing (for longs) or above swing (for shorts).

Having a good strategy is essential, but it’s only one piece of the puzzle. To be a consistently successful trader, you need a combination of psychology, risk management, discipline, and process — the things that keep you profitable when the strategy itself faces drawdowns.

1. Trading Psychology 🧠

2. Risk & Money Management 💵

3. Trading Plan & Strategy 📈

4. Discipline & Consistency 🧩

5. Continuous Learning & Review 🔍

💬 Final Thought

“Indicators follow price.

Price follows order flow.

To understand order flow — study price action.

⚠️ Disclaimer:

This indicator is intended for educational purposes only and should not be considered financial advice. Always use proper risk management.

"Trading involves risk. Trade responsibly.

No indicator gives 100% accurate signals."

Please forward test first and use at your own risk.

If you spot repaint issues, please Read the the Limitations again.

I have spent quite a bit of time and I figured I would put it out to the community to share the work.

Ok, so let me say that I have spent some amount of time to make the indicator/Strategy not to repaint while still maintaining it's profitability. It has been a challenge so I am publishing.

What I have observed: the strategy will not repaint in real time.

Channel Balance

Bright Magenta Upper (Supply) side with Standard Deviation Interpretation +1σ, +2σ, +3σ above the mean — statistically “overbought” areas where price may reverse or slow down

Bright Cyan Lower (Demand) side with Standard Deviation Interpretation −1σ, −2σ, −3σ below the mean — “oversold” areas where buying interest may return

Supply Zone ---->> Resistance / Sell area

Demand Zone ------>> Support / Buy area

BOS ----->> Market structure break

Buy/Long markers ----->> Potential entry for long trades

Sell/Short markers ----->> Potential entry for short trades

Limitation on lower timeframe chart

That is, if you have the chart open and keep it open, the signals are the same as the ones that are sent out by the strategy. In certain cases, when I reload the chart- the signals might be off from what was sent. In some ways, that is repainting, but it is repainting based on losing the real time data and recalculating from a different set of bars- since I am running it on a one minute chart then the start becomes different when you refresh.

🧠 Price Action

Price action is the study of how price moves on a chart — without relying on indicators. If you master price action, you can trade confidently even without indicators — because you’ll understand what the market is telling you through structure, momentum, and liquidity.

How to Read Price Action Step by Step

Identify Market Structure

→ Are we trending or ranging?

Mark Key Levels

→ Swing highs/lows, supply/demand, liquidity zones.

Wait for Confirmation

→ BOS / CHoCH or rejection candles.

Align With Context

→ Where are we in the larger timeframe? (Top-down analysis)

Enter on Reaction

→ Wait for a clear rejection, engulfing candle, or BOS confirmation near your zone.

Manage Risk

→ Stop-loss below swing (for longs) or above swing (for shorts).

Having a good strategy is essential, but it’s only one piece of the puzzle. To be a consistently successful trader, you need a combination of psychology, risk management, discipline, and process — the things that keep you profitable when the strategy itself faces drawdowns.

1. Trading Psychology 🧠

2. Risk & Money Management 💵

3. Trading Plan & Strategy 📈

4. Discipline & Consistency 🧩

5. Continuous Learning & Review 🔍

💬 Final Thought

“Indicators follow price.

Price follows order flow.

To understand order flow — study price action.

⚠️ Disclaimer:

This indicator is intended for educational purposes only and should not be considered financial advice. Always use proper risk management.

"Trading involves risk. Trade responsibly.

No indicator gives 100% accurate signals."

Please forward test first and use at your own risk.

If you spot repaint issues, please Read the the Limitations again.

リリースノート

Fix招待専用スクリプト

こちらのスクリプトにアクセスできるのは投稿者が承認したユーザーだけです。投稿者にリクエストして使用許可を得る必要があります。通常の場合、支払い後に許可されます。詳細については、以下、作者の指示をお読みになるか、ViniReddyに直接ご連絡ください。

スクリプトの機能を理解し、その作者を全面的に信頼しているのでなければ、お金を支払ってまでそのスクリプトを利用することをTradingViewとしては「非推奨」としています。コミュニティスクリプトの中で、その代わりとなる無料かつオープンソースのスクリプトを見つけられる可能性もあります。

作者の指示

This indicator combines Supply-Demand zones, Break of Structure (BOS), and

Standard Deviation volatility bands to identify potential reversal and continuation

areas on specific timeframe.

Works best on Gold, Crypto, Indices, and major Forex pairs.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

招待専用スクリプト

こちらのスクリプトにアクセスできるのは投稿者が承認したユーザーだけです。投稿者にリクエストして使用許可を得る必要があります。通常の場合、支払い後に許可されます。詳細については、以下、作者の指示をお読みになるか、ViniReddyに直接ご連絡ください。

スクリプトの機能を理解し、その作者を全面的に信頼しているのでなければ、お金を支払ってまでそのスクリプトを利用することをTradingViewとしては「非推奨」としています。コミュニティスクリプトの中で、その代わりとなる無料かつオープンソースのスクリプトを見つけられる可能性もあります。

作者の指示

This indicator combines Supply-Demand zones, Break of Structure (BOS), and

Standard Deviation volatility bands to identify potential reversal and continuation

areas on specific timeframe.

Works best on Gold, Crypto, Indices, and major Forex pairs.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。