PROTECTED SOURCE SCRIPT

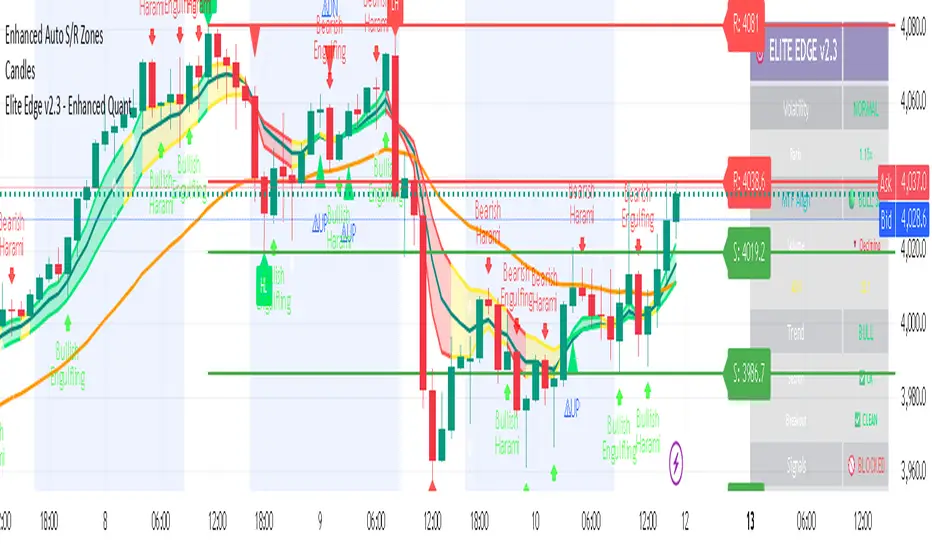

Elite Edge v2.3 - Enhanced Quant

This is an updated version of my previous indicator- Probability Score & UP/DOWN signals. I want to emphasize that "when not to trade".

Purpose: Make good trades obvious—and make bad trades easy to skip.

On-Chart Elements:

EMA 8 & EMA 34

Madrid Trend Ribbon (color = trend state)

Signal Arrows (BUY / SELL)

Signal Labels (shows setup quality)

Structure Labels (HH/HL/LH/LL — optional)

The Golden Rule: When Not to Trade

Skip the trade if any of the following are true:

Volatility Warning shows “🛑 EXTREME VOLATILITY”

Score < 70

MTF < 3/3

Signal quality is below GOOD

Dashboard is not ✅ ACTIVE or shows mixed/“not all green”

Chart is messy (overlapping signals, choppy price, no clean structure)

Quick Trading Flow (3 Checks)

See a Signal Arrow? (BUY/SELL on a clean chart)

Read the Signal Label:

Quality = ELITE / EXCELLENT / GOOD

Score ≥ 70

MTF = 3/3

Open the Dashboard:

Signals: ✅ ACTIVE

Statuses: all green (no warnings)

All 3 pass → Enter.

Any one fails → Skip.

Critical System Messages

Purple Label — “🛑 EXTREME VOLATILITY”

Meaning: Market regime is unstable (ratio > 2.5×)

Do: Stop trading; step away 30+ minutes

Dashboard: Volatility = EXTREME, Signals = 🚫 BLOCKED

Green Label — “✅ CLEAR TO TRADE”

Meaning: Volatility normalized; conditions OK

Do: Resume scanning for setups

Dashboard: Volatility = NORMAL, Signals = ✅ ACTIVE

What “Clean Chart” Means (at a glance)

Price respects EMA 8/34 and ribbon trend

Clear swing structure (HH/HL in uptrends, LH/LL in downtrends)

Few conflicting arrows; no chop cluster

No extreme spikes or gaps around signal

Signal Quality Cheatsheet

ELITE: Strong trend + structure + confluence → priority trade

EXCELLENT: Solid alignment, slight imperfection → tradable

GOOD: Meets minimum standards → optional; be strict with risk

Below GOOD: Do not trade

Risk & Discipline Nudge

Default R/R ≥ 1:2

Size down in rising volatility or mixed confluence

No FOMO: You will see another signal.

Polished LLM Prompt (for Claude or any LLM)

You are an experienced quantitative trader and technical analyst. I’m sharing a single chart (regular session only).

Analyze price action, trend structure, volume, key levels, candlestick patterns, moving averages, momentum, and support/resistance.

Deliver a clear plan:

Direction Bias: Bullish, Bearish, or Neutral — with reasoning.

Entry Zone(s): Price ranges with structure/indicator confluence.

Exit Plan: Target(s) and stop level with justification.

Short-Term vs. Medium-Term Outlook: e.g., continuation, reversal, consolidation.

Risk Management: Suggested position sizing or minimum R/R ≥ 1:2, with probability and confidence.

Assume standard market hours (no after-hours). Avoid mere description; give actionable guidance with probabilities and confidence. Now evaluate the attached chart and advise.

Purpose: Make good trades obvious—and make bad trades easy to skip.

On-Chart Elements:

EMA 8 & EMA 34

Madrid Trend Ribbon (color = trend state)

Signal Arrows (BUY / SELL)

Signal Labels (shows setup quality)

Structure Labels (HH/HL/LH/LL — optional)

The Golden Rule: When Not to Trade

Skip the trade if any of the following are true:

Volatility Warning shows “🛑 EXTREME VOLATILITY”

Score < 70

MTF < 3/3

Signal quality is below GOOD

Dashboard is not ✅ ACTIVE or shows mixed/“not all green”

Chart is messy (overlapping signals, choppy price, no clean structure)

Quick Trading Flow (3 Checks)

See a Signal Arrow? (BUY/SELL on a clean chart)

Read the Signal Label:

Quality = ELITE / EXCELLENT / GOOD

Score ≥ 70

MTF = 3/3

Open the Dashboard:

Signals: ✅ ACTIVE

Statuses: all green (no warnings)

All 3 pass → Enter.

Any one fails → Skip.

Critical System Messages

Purple Label — “🛑 EXTREME VOLATILITY”

Meaning: Market regime is unstable (ratio > 2.5×)

Do: Stop trading; step away 30+ minutes

Dashboard: Volatility = EXTREME, Signals = 🚫 BLOCKED

Green Label — “✅ CLEAR TO TRADE”

Meaning: Volatility normalized; conditions OK

Do: Resume scanning for setups

Dashboard: Volatility = NORMAL, Signals = ✅ ACTIVE

What “Clean Chart” Means (at a glance)

Price respects EMA 8/34 and ribbon trend

Clear swing structure (HH/HL in uptrends, LH/LL in downtrends)

Few conflicting arrows; no chop cluster

No extreme spikes or gaps around signal

Signal Quality Cheatsheet

ELITE: Strong trend + structure + confluence → priority trade

EXCELLENT: Solid alignment, slight imperfection → tradable

GOOD: Meets minimum standards → optional; be strict with risk

Below GOOD: Do not trade

Risk & Discipline Nudge

Default R/R ≥ 1:2

Size down in rising volatility or mixed confluence

No FOMO: You will see another signal.

Polished LLM Prompt (for Claude or any LLM)

You are an experienced quantitative trader and technical analyst. I’m sharing a single chart (regular session only).

Analyze price action, trend structure, volume, key levels, candlestick patterns, moving averages, momentum, and support/resistance.

Deliver a clear plan:

Direction Bias: Bullish, Bearish, or Neutral — with reasoning.

Entry Zone(s): Price ranges with structure/indicator confluence.

Exit Plan: Target(s) and stop level with justification.

Short-Term vs. Medium-Term Outlook: e.g., continuation, reversal, consolidation.

Risk Management: Suggested position sizing or minimum R/R ≥ 1:2, with probability and confidence.

Assume standard market hours (no after-hours). Avoid mere description; give actionable guidance with probabilities and confidence. Now evaluate the attached chart and advise.

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

保護スクリプト

このスクリプトのソースコードは非公開で投稿されています。 しかし、無料かつ制限なしでご利用いただけます ― 詳細についてはこちらをご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。