OPEN-SOURCE SCRIPT

更新済 [SGM VaR Stats VS Empirical]

Main Functions

Logarithmic Returns & Historical Data

Calculates logarithmic returns from closing prices.

Stores these returns in a dynamic array with a configurable maximum size.

Approximation of the Inverse Error Function

Uses an approximation of the erfinv function to calculate z-scores for given confidence levels.

Basic Statistics

Mean: Calculates the average of the data in the array.

Standard Deviation: Measures the dispersion of returns.

Median: Provides a more robust measure of central tendency for skewed distributions.

Z-Score: Converts a confidence level into a standard deviation multiplier.

Empirical vs. Statistical Projection

Empirical Projection

Based on the median of cumulative returns for each projected period.

Applies an adjustable confidence filter to exclude extreme values.

Statistical Projection

Relies on the mean and standard deviation of historical returns.

Incorporates a standard deviation multiplier for confidence-adjusted projections.

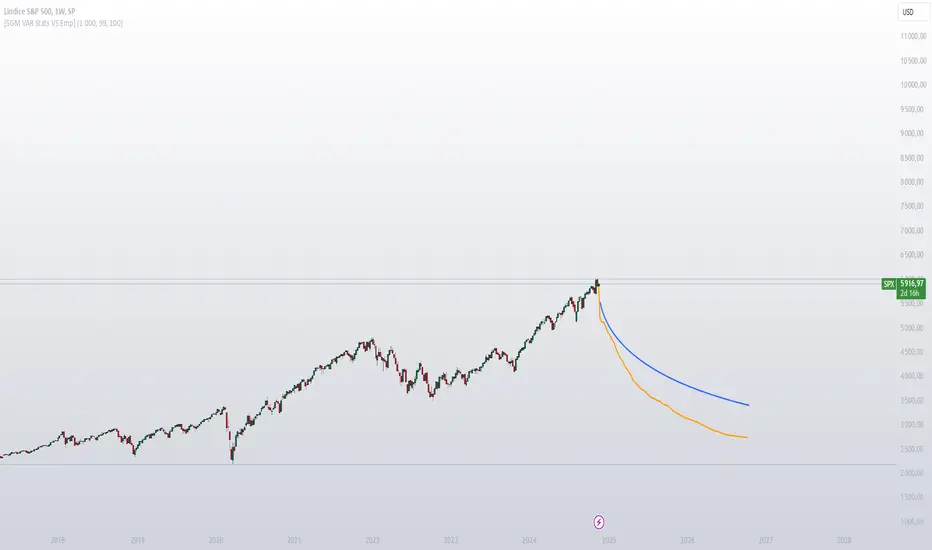

PolyLines (Graphs)

Generates projections visually through polylines:

Statistical Polyline (Blue): Based on traditional statistical methods.

Empirical Polyline (Orange): Derived from empirical data analysis.

Projection Customization

Maximum Data Size: Configurable limit for the historical data array (max_array_size).

Confidence Level: Adjustable by the user (conf_lvl), affects the width of the confidence bands.

Projection Length: Configurable number of projected periods (length_projection).

Key Steps

Capture logarithmic returns and update the historical data array.

Calculate basic statistics (mean, median, standard deviation).

Perform projections:

Empirical: Based on the median of cumulative returns.

Statistical: Based on the mean and standard deviation.

Visualization:

Compare statistical and empirical projections using polylines.

Utility

This script allows users to compare:

Traditional Statistical Projections: Based on mathematical properties of historical returns.

Empirical Projections: Relying on direct historical observations.

Divergence or convergence of these lines also highlights the presence of skewness or kurtosis in the return distribution.

Ideal for traders and financial analysts looking to assess an asset’s potential future performance using combined statistical and empirical approaches.

Logarithmic Returns & Historical Data

Calculates logarithmic returns from closing prices.

Stores these returns in a dynamic array with a configurable maximum size.

Approximation of the Inverse Error Function

Uses an approximation of the erfinv function to calculate z-scores for given confidence levels.

Basic Statistics

Mean: Calculates the average of the data in the array.

Standard Deviation: Measures the dispersion of returns.

Median: Provides a more robust measure of central tendency for skewed distributions.

Z-Score: Converts a confidence level into a standard deviation multiplier.

Empirical vs. Statistical Projection

Empirical Projection

Based on the median of cumulative returns for each projected period.

Applies an adjustable confidence filter to exclude extreme values.

Statistical Projection

Relies on the mean and standard deviation of historical returns.

Incorporates a standard deviation multiplier for confidence-adjusted projections.

PolyLines (Graphs)

Generates projections visually through polylines:

Statistical Polyline (Blue): Based on traditional statistical methods.

Empirical Polyline (Orange): Derived from empirical data analysis.

Projection Customization

Maximum Data Size: Configurable limit for the historical data array (max_array_size).

Confidence Level: Adjustable by the user (conf_lvl), affects the width of the confidence bands.

Projection Length: Configurable number of projected periods (length_projection).

Key Steps

Capture logarithmic returns and update the historical data array.

Calculate basic statistics (mean, median, standard deviation).

Perform projections:

Empirical: Based on the median of cumulative returns.

Statistical: Based on the mean and standard deviation.

Visualization:

Compare statistical and empirical projections using polylines.

Utility

This script allows users to compare:

Traditional Statistical Projections: Based on mathematical properties of historical returns.

Empirical Projections: Relying on direct historical observations.

Divergence or convergence of these lines also highlights the presence of skewness or kurtosis in the return distribution.

Ideal for traders and financial analysts looking to assess an asset’s potential future performance using combined statistical and empirical approaches.

リリースノート

changing initial settingsリリースノート

-オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

Sigaud | Junior Quantitative Trader & Developer

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

Sigaud | Junior Quantitative Trader & Developer

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

Combining technical expertise with analytical precision.

Gaining experience and growing in the field.

📧 Contact: from the website

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。