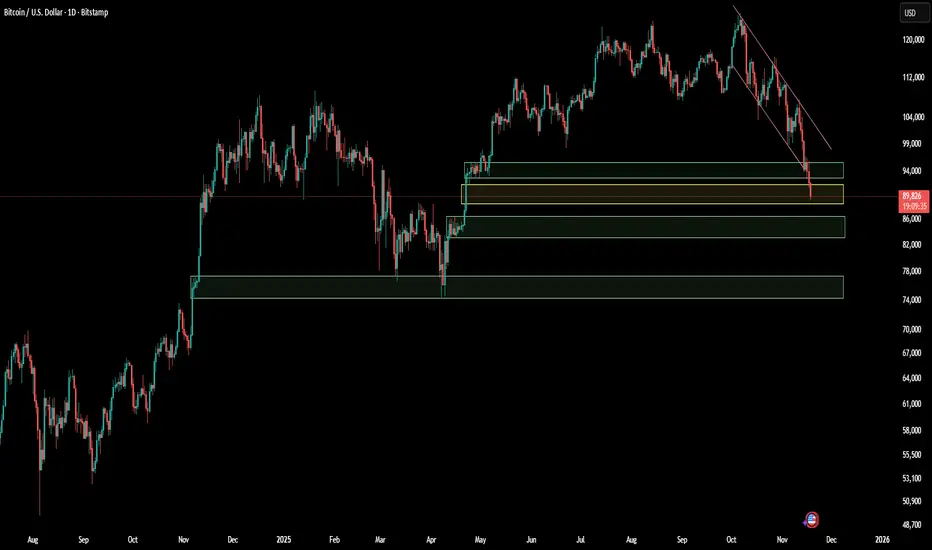

Bitcoin’s current price action shows increasing bearish momentum as it approaches the critical support at $88,000. This level has historically acted as a short-term demand zone, and a clean breakdown below it would signal that buyers are losing control of the market structure on the higher timeframe. The failure to hold this region may also confirm the continuation of the descending channel that has been guiding price over the recent weeks.

Should Bitcoin decisively close below $88,000, the next key area to monitor lies between $86,000 and $83,000. This zone represents a broader accumulation block where previous buying activity initiated upward impulses. A reaction here would indicate that long-term participants are still defending their positions. However, if this demand fails to provide sufficient support, the market could transition into a deeper corrective phase, reflecting a broader sentiment shift from consolidation to redistribution.

In the event that the $86,000–$83,000 region is breached, the likelihood increases that Bitcoin will seek liquidity and establish a more sustainable reversal base around $77,000–$74,000. This area aligns with a major higher-timeframe demand zone, where institutional buying has historically entered the market. A macro reversal from this level would create the structural foundation necessary for Bitcoin to regain bullish momentum and potentially begin its next leg toward a new all-time high.

Should Bitcoin decisively close below $88,000, the next key area to monitor lies between $86,000 and $83,000. This zone represents a broader accumulation block where previous buying activity initiated upward impulses. A reaction here would indicate that long-term participants are still defending their positions. However, if this demand fails to provide sufficient support, the market could transition into a deeper corrective phase, reflecting a broader sentiment shift from consolidation to redistribution.

In the event that the $86,000–$83,000 region is breached, the likelihood increases that Bitcoin will seek liquidity and establish a more sustainable reversal base around $77,000–$74,000. This area aligns with a major higher-timeframe demand zone, where institutional buying has historically entered the market. A macro reversal from this level would create the structural foundation necessary for Bitcoin to regain bullish momentum and potentially begin its next leg toward a new all-time high.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。