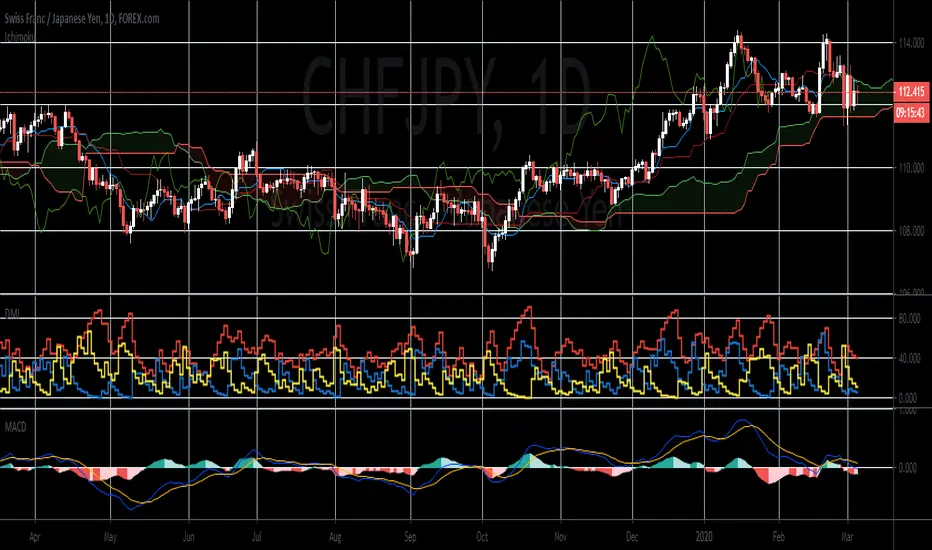

The pair will bounce back from a critical support line, sending it higher towards its previous high. The Swiss Franc stole the spotlight from the Japanese yen as the ideal safe-haven currency among G10 currencies. The Japanese government in February posted its fourth-quarter 2019 GDP growth, which disappointed its investors. Gross domestic product growth came crashing after the figure showed the country growing at -1.6%. If Japan posted another negative growth rate for Q1 2020, Tokyo would enter a technical recession. In Europe, the EU’s economic powerhouses were also experiencing a slowdown in growth. Germany, France, and Italy posted stagnant and negative growth. Germany grew zero percent, while France and Italy entered the negative territory at -0.1% and -0.3%, respectively. Thus, the luster of the Swiss franc as a safe-haven asset outshines all currencies. The country has the lowest interest rate in the world.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。