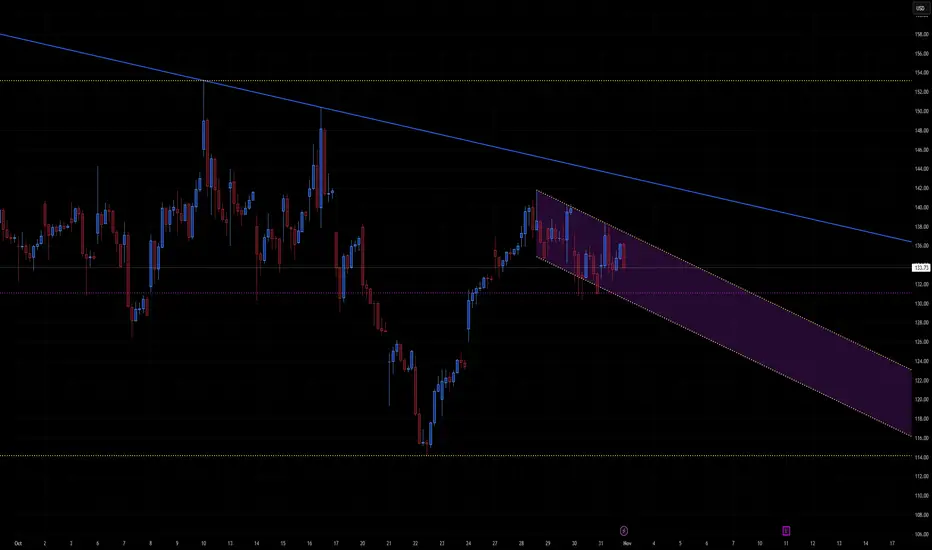

A descending parallel channel (purple shaded region) starting from the recent local high.

Current price near 133.7 USD, trading mid-channel.

Major horizontal supports around 130 and 116 (yellow dotted lines).

Overhead resistance near 138–140 USD and the top of the falling channel (~136–137 USD short-term).

This indicates controlled pullback within a bearish channel after a strong prior rebound — a typical flag pattern structure, which can resolve in either direction.

📈 Bullish Scenario

Setup:

Price has stabilized inside the descending channel and could stage a rebound if momentum returns.

Confirmation Triggers:

Break and daily close above 136–138 USD (channel breakout).

Volume pickup confirming accumulation rather than short covering.

Upside Targets:

144–146 USD → short-term resistance zone (top of previous consolidation).

150–154 USD → major target and measured-move projection from the flag pattern.

Catalysts:

Broader market risk-on sentiment (tech rebound, softer yields).

Positive company-specific or sector news.

Invalidation:

Daily close below 130 USD, re-entering lower half of channel.

📉 Bearish Scenario

Setup:

If price keeps respecting the descending channel and fails to reclaim 136–138 USD, the downtrend continues.

Confirmation Triggers:

Breakdown below 130 USD (support + midpoint of channel).

Bearish continuation with increasing volume.

Downside Targets:

122–124 USD → lower channel boundary (first logical support).

116 USD → key horizontal support and measured-move objective.

108–110 USD → extended bearish target if momentum accelerates.

Catalysts:

Market rotation out of growth / risk assets.

Rising yields or stronger dollar.

Invalidation:

Break and sustained close above 138 USD.

⚖️ Neutral / Range-Bound Outlook

Until price escapes 130–138 USD, expect choppy sideways trading within the channel.

Momentum indicators (RSI, volume) likely to flatten, signaling indecision before a larger move.

🧩 Summary Table

Bias Confirmation Target Zone Invalidation Notes

Bullish Close > 138 USD 144 → 150 → 154 USD < 130 USD Breakout of flag

Bearish Close < 130 USD 122 → 116 → 110 USD > 138 USD Continuation down

Neutral Range 130–138 USD — — Coiling phase

🕒 2–3 Week Projection

Bullish path: Price stabilizes 132–133 → breaks above 136 → targets 144 by mid-November.

Bearish path: Rejection at 136 → slips below 130 → tests 122–124 within next two weeks.

Current price near 133.7 USD, trading mid-channel.

Major horizontal supports around 130 and 116 (yellow dotted lines).

Overhead resistance near 138–140 USD and the top of the falling channel (~136–137 USD short-term).

This indicates controlled pullback within a bearish channel after a strong prior rebound — a typical flag pattern structure, which can resolve in either direction.

📈 Bullish Scenario

Setup:

Price has stabilized inside the descending channel and could stage a rebound if momentum returns.

Confirmation Triggers:

Break and daily close above 136–138 USD (channel breakout).

Volume pickup confirming accumulation rather than short covering.

Upside Targets:

144–146 USD → short-term resistance zone (top of previous consolidation).

150–154 USD → major target and measured-move projection from the flag pattern.

Catalysts:

Broader market risk-on sentiment (tech rebound, softer yields).

Positive company-specific or sector news.

Invalidation:

Daily close below 130 USD, re-entering lower half of channel.

📉 Bearish Scenario

Setup:

If price keeps respecting the descending channel and fails to reclaim 136–138 USD, the downtrend continues.

Confirmation Triggers:

Breakdown below 130 USD (support + midpoint of channel).

Bearish continuation with increasing volume.

Downside Targets:

122–124 USD → lower channel boundary (first logical support).

116 USD → key horizontal support and measured-move objective.

108–110 USD → extended bearish target if momentum accelerates.

Catalysts:

Market rotation out of growth / risk assets.

Rising yields or stronger dollar.

Invalidation:

Break and sustained close above 138 USD.

⚖️ Neutral / Range-Bound Outlook

Until price escapes 130–138 USD, expect choppy sideways trading within the channel.

Momentum indicators (RSI, volume) likely to flatten, signaling indecision before a larger move.

🧩 Summary Table

Bias Confirmation Target Zone Invalidation Notes

Bullish Close > 138 USD 144 → 150 → 154 USD < 130 USD Breakout of flag

Bearish Close < 130 USD 122 → 116 → 110 USD > 138 USD Continuation down

Neutral Range 130–138 USD — — Coiling phase

🕒 2–3 Week Projection

Bullish path: Price stabilizes 132–133 → breaks above 136 → targets 144 by mid-November.

Bearish path: Rejection at 136 → slips below 130 → tests 122–124 within next two weeks.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。