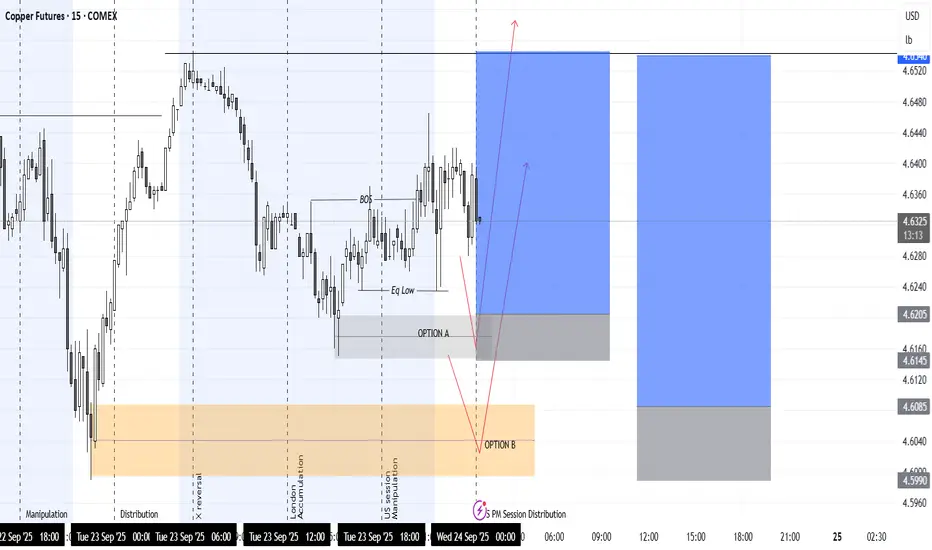

Market Context

Current price: 4.6320/lb

Recent BOS (break of structure) marked, suggesting prior bearish leg was countered.

Price consolidating around equilibrium after BOS.

Zones

Option A (grey box ~4.620–4.625)

→ A smaller demand/OB zone just below current price.

→ If respected, we could see a quick bullish continuation targeting the upper liquidity pools (blue boxes).

Option B (orange box ~4.600–4.608)

→ Deeper discount OB/demand zone.

→ If price sweeps liquidity through Option A, this zone could be the “true” accumulation point before reversal up.

Directional Bias

Chart marks liquidity run + expansion higher as primary scenario.

Arrows show:

Scenario 1: Price bounces off Option A → quick long.

Scenario 2: Price dips into Option B → deeper liquidity grab before reversal.

Bullish target zones (blue) extend 4.650–4.680.

Session Labels

London accumulation, US session manipulation, PM session distribution → classic ICT intraday model.

Suggests NY PM session might complete distribution cycle before expansion.

Current price: 4.6320/lb

Recent BOS (break of structure) marked, suggesting prior bearish leg was countered.

Price consolidating around equilibrium after BOS.

Zones

Option A (grey box ~4.620–4.625)

→ A smaller demand/OB zone just below current price.

→ If respected, we could see a quick bullish continuation targeting the upper liquidity pools (blue boxes).

Option B (orange box ~4.600–4.608)

→ Deeper discount OB/demand zone.

→ If price sweeps liquidity through Option A, this zone could be the “true” accumulation point before reversal up.

Directional Bias

Chart marks liquidity run + expansion higher as primary scenario.

Arrows show:

Scenario 1: Price bounces off Option A → quick long.

Scenario 2: Price dips into Option B → deeper liquidity grab before reversal.

Bullish target zones (blue) extend 4.650–4.680.

Session Labels

London accumulation, US session manipulation, PM session distribution → classic ICT intraday model.

Suggests NY PM session might complete distribution cycle before expansion.

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。