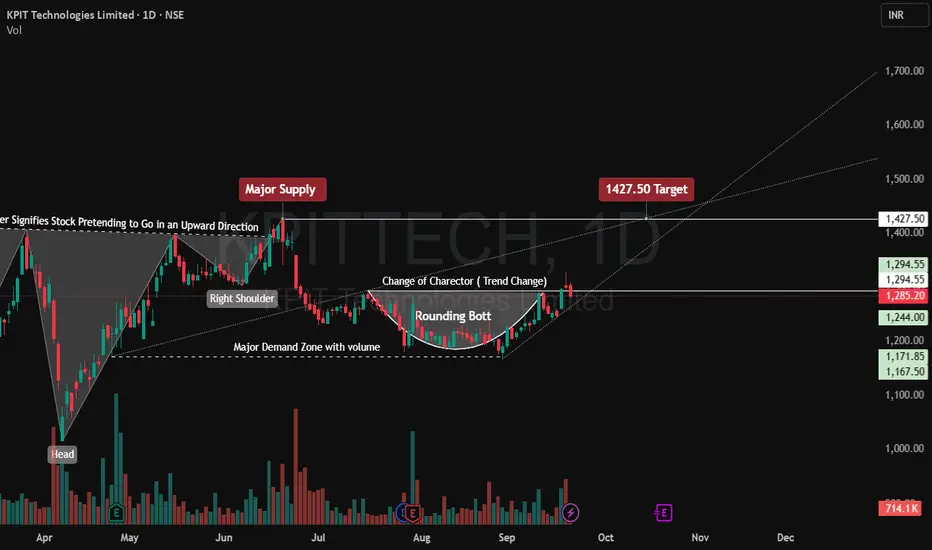

Logical Buy Projection

Trend Context

Trend Context

- Strong trend change confirmation after Rounding Bottom.(Near Term)

- Inverse H&S pattern indicates a bullish reversal structure.(Failed to breakout)

- Volume supports accumulation in the demand zone.

Entry Zone - Around ₹1,280–₹1,300 (CMP, near breakout of rounding bottom neckline).

- Safer entry on retest of ₹1,244–₹1,260 (demand-supported zone).

Targets

Target 1: ₹1,350 (near-term supply retest)

Target 2: ₹1,427.50 (chart projection / neckline breakout target)

Extended Target: ₹1,500+ if momentum sustains (continuation after H&S breakout).

Stop-Loss (SL) - Conservative SL: Below ₹1,167 (demand invalidation).

- Tight SL (for traders): Below ₹1,244 (last support zone).

Summary Projection - Buy Zone: ₹1,280–₹1,300

- Stop-Loss: ₹1,167 (safe) / ₹1,244 (tight)

- Targets: ₹1,350 → ₹1,427.50 → ₹1,500+

Disclaimer:tinyurl.com/59ypbsrh

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。