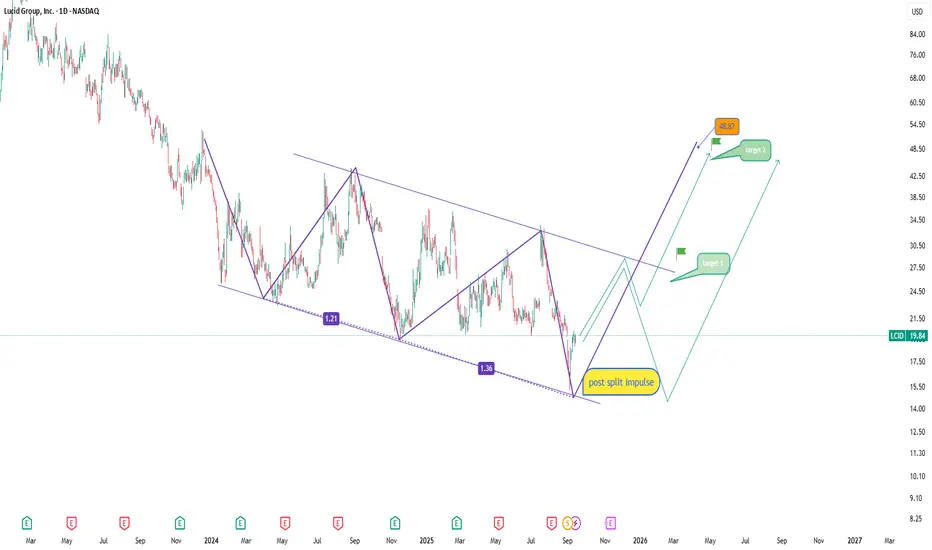

Lucid stock has absorbed the post-split selloff and is now showing signs of recovery. On the daily chart, price has moved out of the descending channel and consolidated above 19.50. The bullish scenario points to a first target at 27.00, where strong resistance is located. A breakout there could pave the way toward 48.00–49.00, marking a potential mid-term trend reversal.

EMAs are starting to turn upward, while volume is picking up, signaling increased buying interest. The key support lies in the 18.00–19.00 zone. As long as this area holds, the bullish case remains valid.

From a fundamental perspective, Lucid benefits from strong EV sector demand and continued backing from major investors in Saudi Arabia. Production challenges and high costs remain risks, but overall EV market growth provides optimism.

EMAs are starting to turn upward, while volume is picking up, signaling increased buying interest. The key support lies in the 18.00–19.00 zone. As long as this area holds, the bullish case remains valid.

From a fundamental perspective, Lucid benefits from strong EV sector demand and continued backing from major investors in Saudi Arabia. Production challenges and high costs remain risks, but overall EV market growth provides optimism.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。