Macro Alert: The Stealth Flight 2 Alts (Tariffs, Gold & Privacy)

🚨 MACRO ALERT: The Silent Surge — Altcoins Accumulating Undetected Since April

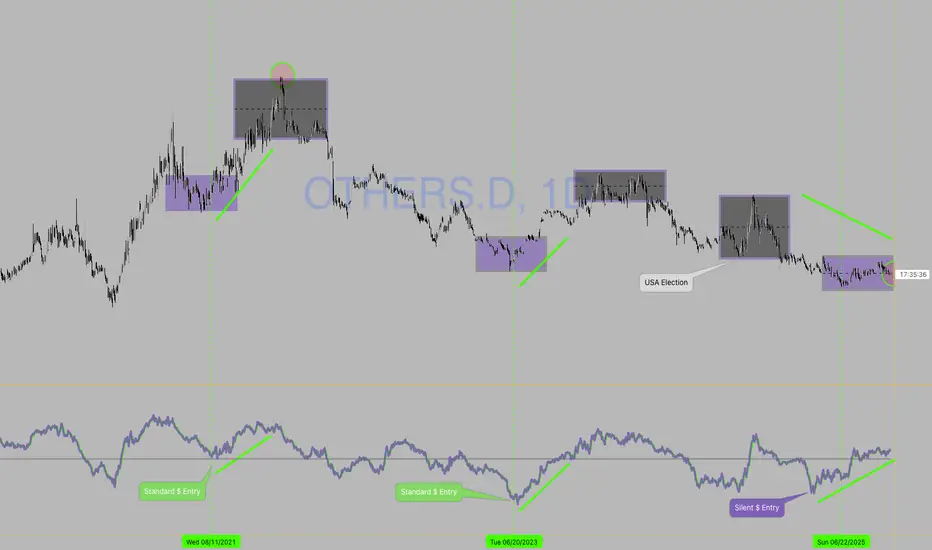

Chart: CRYPTOCAP:OTHERS.D

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 The Setup

While the mainstream remains fixated on Bitcoin's swings, a quiet but significant capital rotation into altcoins is underway. This move, largely undetected by the broader market, is being fueled by shifting global macroeconomic tides and a growing institutional hunt for wealth preservation and financial privacy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔴 THE CRISIS: Multiple System Failures Converging

🏦 BIS Warning: Global Liquidity Crisis

↓

🇯🇵 Japan: Unsustainable debt from fiscal stimulus

🇫🇷 France: 0.6% growth in 2025, economic stagnation

↓

💸 Coordinated failure of fiat monetary policy

⛓️ Government Attacks on Safe Havens

↓

🇺🇸 U.S. Gold Tariffs: 39% on major imports

Physical metals face capital controls & taxation attacks

Traditional assets no longer safe from state control

🔒 Even Crypto Has Centralization Issues

↓

📜 GENIUS Act: Stablecoins expand M2 money supply (monetizing debt via blockchain)

🏢 XRP: Concentrated token control raises manipulation concerns

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🟢 THE SOLUTION: Where Capital Is Flowing

Smart money is seeking assets with:

• TRUE decentralization

• Privacy features

• Fixed supply

• Institutional-grade infrastructure

The Data Confirms It:

🔐 Privacy Coins (XMR, ZEC): +71.6% in 2025

📊 CRYPTOCAP:BTC: +27.1%

📊 CRYPTOCAP:ETH: +33.4%

📈 OTHERS.D: Rising quietly

This is sophisticated money moving in, not retail FOMO.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💥 The Macro Catalyst: Why This Is Happening Now

⚡ Gold Under Attack: The recent 39% U.S. tariff on major gold imports has rattled the traditional safe-haven market, creating artificial scarcity and signaling a broader trend of government control over monetary assets. When even physical metals face intervention, capital seeks alternatives outside increasingly controlled systems.

🚨 The BIS Warning Nobody Is Discussing:

The Bank for International Settlements is quietly sounding alarms on global liquidity risks:

• 🇯🇵 Japan's fiscal stimulus → unsustainable debt levels

• 🇫🇷 France → 0.6% growth (stagnation)

• 💸 Result: Coordinated fiat monetary policy failure

🪤 The Stablecoin Trap:

The U.S. GENIUS Act is expanding M2 money supply through the back door via stablecoins:

→ Legitimizing stablecoin issuance backed by Treasury bonds

→ Monetizing debt while calling it "innovation"

→ This isn't decentralization—it's the Fed with a blockchain wrapper

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Macro Pressure → Altcoin Opportunities

😰 Worried About: Wealth Confiscation/Control

💡 Consider: Financial Sovereignty & Privacy

🔍 Examples: CRYPTOCAP:XMR , CRYPTOCAP:ZEC

📈 Catalyst: Zcash surged 150%+ on institutional demand (Grayscale Trust)

😰 Worried About: Currency Devaluation & Inflation

💡 Consider: Scarce, Decentralized Stores of Value

🔍 Examples: Altcoins with fixed supplies + robust decentralized governance

🔑 Key: Assets that can't be inflated or controlled by single entities

😰 Worried About: Traditional Finance Instability

💡 Consider: Institutional-Grade Blockchain Infrastructure

🔍 Examples: HBAR (corporate governance) & XRP (cross-border payments)

⚠️ Note: Focus on real-world utility beyond speculation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

What to Watch For

✅ Confirmation: Strong, high-volume breakout above recent range high on CRYPTOCAP:OTHERS.D

🔍 The Privacy Pulse: Continued strength in privacy coins ( CRYPTOCAP:XMR , CRYPTOCAP:ZEC , XVG.D) is a key leading indicator. Note: Privacy coins face regulatory challenges and have been delisted from some major exchanges.

❌ Invalidation: Break and close below key support zone (April low structure) would suggest macro fears haven't overcome broader market uncertainty.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 The Bottom Line

The gold tariff is a symptom of a larger disease: eroding trust in neutral, non-government monetary assets. This is forcing a "regime change" in capital allocation.

As this realization dawns on more investors, the quiet accumulation in altcoins—particularly those offering privacy, sovereignty, and real-world utility—could explode into the next major market narrative.

💭 Smart money is moving early. The question is: will you recognize this shift before it becomes obvious?

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ Disclaimer: This is macroeconomic observational analysis and is not financial advice. Always conduct your own research (DYOR) and manage risk appropriately.

Cheers!

Chart: CRYPTOCAP:OTHERS.D

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 The Setup

While the mainstream remains fixated on Bitcoin's swings, a quiet but significant capital rotation into altcoins is underway. This move, largely undetected by the broader market, is being fueled by shifting global macroeconomic tides and a growing institutional hunt for wealth preservation and financial privacy.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔴 THE CRISIS: Multiple System Failures Converging

🏦 BIS Warning: Global Liquidity Crisis

↓

🇯🇵 Japan: Unsustainable debt from fiscal stimulus

🇫🇷 France: 0.6% growth in 2025, economic stagnation

↓

💸 Coordinated failure of fiat monetary policy

⛓️ Government Attacks on Safe Havens

↓

🇺🇸 U.S. Gold Tariffs: 39% on major imports

Physical metals face capital controls & taxation attacks

Traditional assets no longer safe from state control

🔒 Even Crypto Has Centralization Issues

↓

📜 GENIUS Act: Stablecoins expand M2 money supply (monetizing debt via blockchain)

🏢 XRP: Concentrated token control raises manipulation concerns

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🟢 THE SOLUTION: Where Capital Is Flowing

Smart money is seeking assets with:

• TRUE decentralization

• Privacy features

• Fixed supply

• Institutional-grade infrastructure

The Data Confirms It:

🔐 Privacy Coins (XMR, ZEC): +71.6% in 2025

📊 CRYPTOCAP:BTC: +27.1%

📊 CRYPTOCAP:ETH: +33.4%

📈 OTHERS.D: Rising quietly

This is sophisticated money moving in, not retail FOMO.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💥 The Macro Catalyst: Why This Is Happening Now

⚡ Gold Under Attack: The recent 39% U.S. tariff on major gold imports has rattled the traditional safe-haven market, creating artificial scarcity and signaling a broader trend of government control over monetary assets. When even physical metals face intervention, capital seeks alternatives outside increasingly controlled systems.

🚨 The BIS Warning Nobody Is Discussing:

The Bank for International Settlements is quietly sounding alarms on global liquidity risks:

• 🇯🇵 Japan's fiscal stimulus → unsustainable debt levels

• 🇫🇷 France → 0.6% growth (stagnation)

• 💸 Result: Coordinated fiat monetary policy failure

🪤 The Stablecoin Trap:

The U.S. GENIUS Act is expanding M2 money supply through the back door via stablecoins:

→ Legitimizing stablecoin issuance backed by Treasury bonds

→ Monetizing debt while calling it "innovation"

→ This isn't decentralization—it's the Fed with a blockchain wrapper

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Macro Pressure → Altcoin Opportunities

😰 Worried About: Wealth Confiscation/Control

💡 Consider: Financial Sovereignty & Privacy

🔍 Examples: CRYPTOCAP:XMR , CRYPTOCAP:ZEC

📈 Catalyst: Zcash surged 150%+ on institutional demand (Grayscale Trust)

😰 Worried About: Currency Devaluation & Inflation

💡 Consider: Scarce, Decentralized Stores of Value

🔍 Examples: Altcoins with fixed supplies + robust decentralized governance

🔑 Key: Assets that can't be inflated or controlled by single entities

😰 Worried About: Traditional Finance Instability

💡 Consider: Institutional-Grade Blockchain Infrastructure

🔍 Examples: HBAR (corporate governance) & XRP (cross-border payments)

⚠️ Note: Focus on real-world utility beyond speculation

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

What to Watch For

✅ Confirmation: Strong, high-volume breakout above recent range high on CRYPTOCAP:OTHERS.D

🔍 The Privacy Pulse: Continued strength in privacy coins ( CRYPTOCAP:XMR , CRYPTOCAP:ZEC , XVG.D) is a key leading indicator. Note: Privacy coins face regulatory challenges and have been delisted from some major exchanges.

❌ Invalidation: Break and close below key support zone (April low structure) would suggest macro fears haven't overcome broader market uncertainty.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 The Bottom Line

The gold tariff is a symptom of a larger disease: eroding trust in neutral, non-government monetary assets. This is forcing a "regime change" in capital allocation.

As this realization dawns on more investors, the quiet accumulation in altcoins—particularly those offering privacy, sovereignty, and real-world utility—could explode into the next major market narrative.

💭 Smart money is moving early. The question is: will you recognize this shift before it becomes obvious?

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ Disclaimer: This is macroeconomic observational analysis and is not financial advice. Always conduct your own research (DYOR) and manage risk appropriately.

Cheers!

Cheers!

Aiggy

Aiggy

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Cheers!

Aiggy

Aiggy

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。