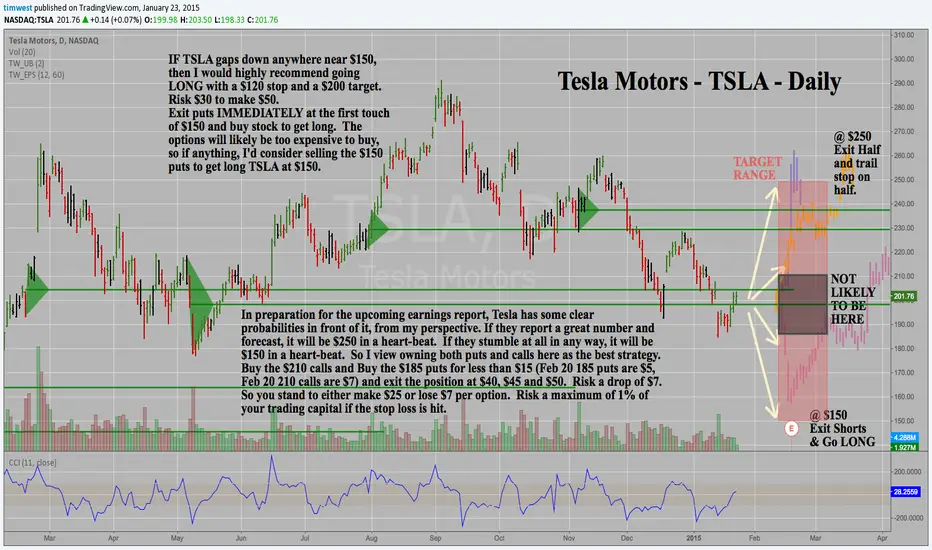

In preparation for the upcoming earnings report, Tesla has some clear probabilities in front of it, from my perspective. If they report a great number and forecast, it will be $250 in a heart-beat. If they stumble at all in any way, it will be $150 in a heart-beat. So I view owning both puts and calls here as the best strategy. Buy the $210 calls and Buy the $185 puts for less than $15 (Feb 20 185 puts are $5, Feb 20 210 calls are $7 for a total of $12 currently) and exit the position at $40, $45 and $50. Risk a drop of $7. So you stand to either make $30+ or lose $7 per option (Options represent 100 shares of stock, so the smallest risk here is $700 for one strangle). Risk a maximum of 1% of your trading capital if the stop loss is hit.

IF TSLA gaps down anywhere near $150, then I would highly recommend going LONG with a $120 stop and a $200 target. Risk $30 to make $50. Exit puts IMMEDIATELY at the first touch of $150 and buy stock to get long. The options will likely be too expensive to buy, so if anything, I'd consider selling the $150 puts to get long TSLA at $150.

Why am I publishing this now since earnings are so far off? Because I feel strongly about this trade now and think this is a reasonable risk/reward and if oil rallies back up, then TSLA will lift now. If oil melts down further, then TSLA will sink. If Oil holds steady AND TSLA has a great forecast for Model-X, then TSLA will skyrocket. I think it is safe to bet AGAINST TSLA staying at this price over the longer term when a YEAR AGO I thought TSLA was a good bet to go sideways. (See previous forecasts).

OH - And we need a new button here at Tradingview to click on BOTH "LONG" and "SHORT".... I'll choose LONG just because I'm cheering for TSLA, but I don't want to have my comment be considered NEUTRAL!

Cheers.

Tim 12:50PM EST Friday, January 23, 2015

IF TSLA gaps down anywhere near $150, then I would highly recommend going LONG with a $120 stop and a $200 target. Risk $30 to make $50. Exit puts IMMEDIATELY at the first touch of $150 and buy stock to get long. The options will likely be too expensive to buy, so if anything, I'd consider selling the $150 puts to get long TSLA at $150.

Why am I publishing this now since earnings are so far off? Because I feel strongly about this trade now and think this is a reasonable risk/reward and if oil rallies back up, then TSLA will lift now. If oil melts down further, then TSLA will sink. If Oil holds steady AND TSLA has a great forecast for Model-X, then TSLA will skyrocket. I think it is safe to bet AGAINST TSLA staying at this price over the longer term when a YEAR AGO I thought TSLA was a good bet to go sideways. (See previous forecasts).

OH - And we need a new button here at Tradingview to click on BOTH "LONG" and "SHORT".... I'll choose LONG just because I'm cheering for TSLA, but I don't want to have my comment be considered NEUTRAL!

Cheers.

Tim 12:50PM EST Friday, January 23, 2015

Subscribe to my indicator package KEY HIDDEN LEVELS $10/mo or $100/year and join me in the trading room KEY HIDDEN LEVELS here at TradingView.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。

Subscribe to my indicator package KEY HIDDEN LEVELS $10/mo or $100/year and join me in the trading room KEY HIDDEN LEVELS here at TradingView.com

免責事項

これらの情報および投稿は、TradingViewが提供または保証する金融、投資、取引、またはその他の種類のアドバイスや推奨を意図したものではなく、またそのようなものでもありません。詳しくは利用規約をご覧ください。