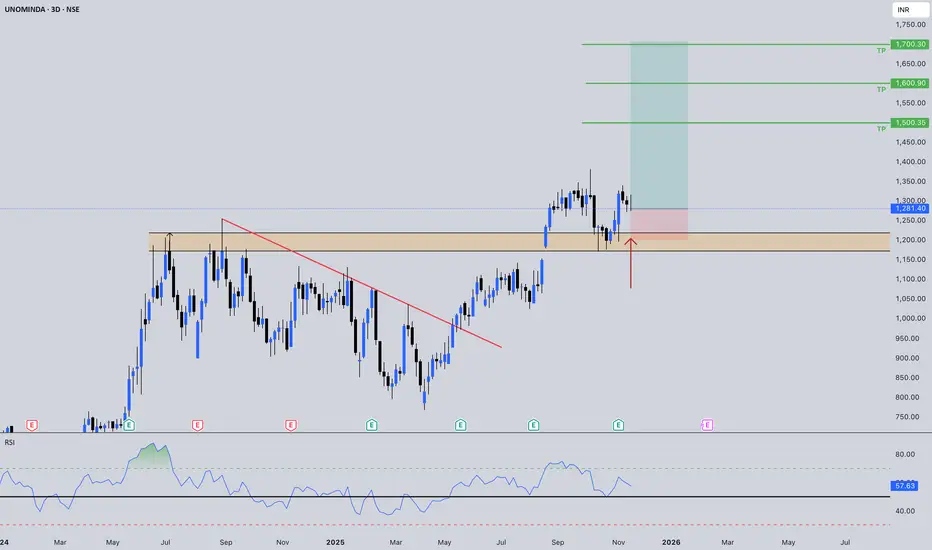

Price shows a text-book breakout and retest of a multi-month consolidation high, signaling a potential acceleration phase in the Auto Components space.

🔍 Technical Snapshot (3-Day Chart)

Metric: Breakout Zone

Value: ₹1,180–₹1,250

Interpretation: Critical horizontal resistance flipped to support (yellow box); retest is currently in play.[3]

Metric: TP1 (Major Target)

Value: ₹1,500

Interpretation: Initial measured move and psychological resistance.

Metric: TP2 (Moon Zone)

Value: ₹1,700

Interpretation: Next Fibonacci/structure target, implying deeper extension if momentum sustains.

Metric: Key Support

Value: ₹1,180

Interpretation: Floor of the breakout retest zone and critical risk management line.

Metric: RSI

Value: 57.03

Interpretation: Healthy momentum above 50 but not overbought, leaving room for further rally.

Metric: Pattern

Value: Multi-Month Base Breakout + Retest

Interpretation: Strong continuation structure, functionally similar to a Cup and Handle breakout.

-----

🧠 AI-Powered Insights & Fundamentals

Fundamental Strength:

Uno Minda Ltd. posted Q2 FY26 revenue growth of roughly 13–14% YoY to around ₹4,800–4,830 crore, with net profit up about 21–24% YoY, confirming strong earnings momentum behind the price action.

Valuation Check:

The stock trades at a rich P/E multiple (high relative to sector), which is typical for perceived leaders but implies heavy reliance on continued earnings delivery.

Historical Pattern Match:

Recent technical commentary highlighted a Cup & Handle–style breakout with initial targets in the ₹1,350–₹1,400 area, broadly aligning with the current projected upside zone from this retest.

Institutional Flow:

Recent disclosures show healthy institutional participation, with FIIs and insurers increasing stakes into FY26 even as some mutual funds trimmed marginally, keeping net institutional conviction positive.

-----

#📈 Statistical Edge (Auto Ancillary Sector)

Retest Success:

Clean retests of multi-month breakout zones in leading auto ancillary names have historically led to sustained trend moves toward projected targets, especially when the broader sector is in an up-cycle.

RSI Setup:

An RSI zone around 55–60 typically acts as a springboard; pushes from this band into 70+ often accompany impulsive follow-through legs in prior UNOMINDA rallies and sector peers.

-----

👣 Institutional Footprints & Volume Action

Acceptance Zone:

Price spent months consolidating below ₹1,250; the drop back into the ₹1,180–₹1,250 band now tests whether former supply has turned into a genuine demand zone.

Microstructure Alert:

The sharp pullback leg should ideally lose downside volume near ₹1,180; signs of volume exhaustion and long lower wicks here would confirm weak selling pressure and absorption by stronger hands.

AI Verdict:

The structure points to a smart-money re-entry pocket: the breakout drew in momentum buyers, and the controlled dip into the prior resistance band offers a second-chance entry for those waiting on confirmation.

-----

🎯 What I'm Watching (Key Triggers)

1. Support Defense:

A bounce and 3-day close back above ₹1,290 to signal the retest is complete and buyers have regained control.[3]

2. Risk Management:

Price needs to hold above the ₹1,180 floor on a closing basis to keep the bullish structure intact.

3. Momentum:

Follow-through should be backed by rising volumes and RSI pushing back toward the 70 zone, confirming an impulse leg rather than a mere dead-cat bounce.

4. Projection:

If the retest holds, the roadmap opens toward ₹1,500 → ₹1,600 → ₹1,700 over the next leg of the trend.

🎯 RRR (Approx):

From the current retest area, a tight stop just below ₹1,180 versus a first target at ₹1,500 offers a risk–reward profile in the 1:2.5+ zone, assuming clean confirmation.

-----

⚠️ Disclaimer:

This is NOT a buy/sell recommendation. The content is for learning purposes only, based on the described chart structure and public data; please do your own research and consider your risk tolerance before investing. #DYOR

🔥 Comment "AUTO" if you are bullish on the Indian Auto Components space heading into Q3/Q4! ✅ 🚀

トレード稼働中

Anubrata Ray ⚡

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

Anubrata Ray ⚡

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。