OPEN-SOURCE SCRIPT

Z-Score Volume with CVD Clustering

Script Title:

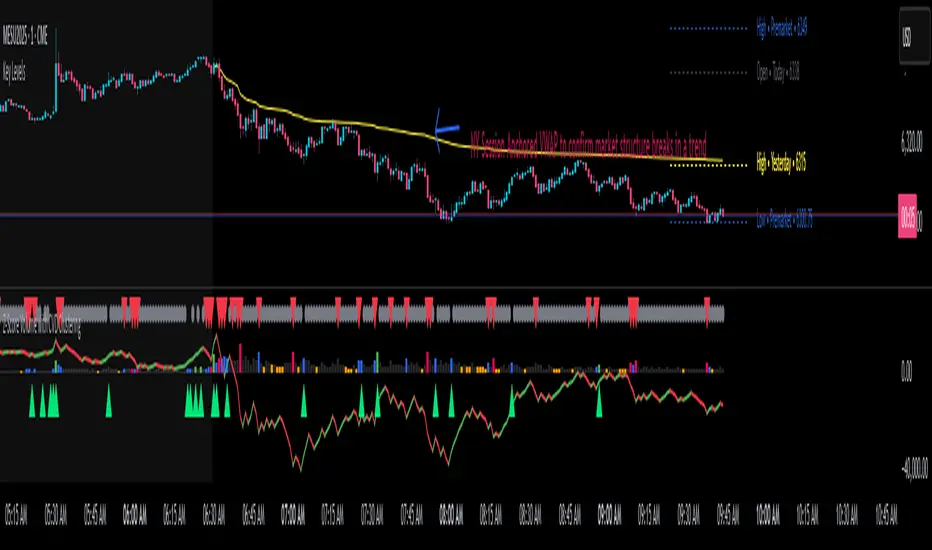

Z-Score Volume with CVD Clustering & NY VWAP

📘 Description:

This indicator combines statistical volume analysis with order flow confirmation to detect high-probability trade zones and volume-based divergences.

📌 Components:

Z-Score of Volume: Identifies statistically significant volume surges or drops relative to a moving average baseline.

Cumulative Volume Delta (CVD): Gauges net buying vs. selling pressure using high-frequency bid/ask delta.

K-Means Clustering: Applies clustering logic to classify each bar into:

Cluster 2 – Strong Bullish: Z-Score and CVD both strong

Cluster 1 – Divergence / Bull Trap: Z-Score high, but weak CVD

Cluster 0 – Neutral / Noise: No clear alignment

Anchored VWAP (NY Session Open): Confirms market structure and institutional trend bias from 9:30 AM ET forward.

🎯 Suggested Applications:

✅ 1. Trend Continuation Entries (Add-ons):

Look to add to positions when:

Cluster 2 signal occurs

Price is above the NY session VWAP

Price structure has broken out of prior day high/low or range

⚠️ 2. Divergence Detection (Fade Traps):

Cluster 1 signals a bearish divergence (e.g., high volume but weak CVD).

Especially useful when price is failing to stay above VWAP.

Useful for early exits or reversal setups.

📊 3. Volume Profile Confirmation:

Combine with fixed or session-based volume profile tools.

Use Z-Score clusters to confirm volume spikes into low-volume nodes (LVNs) or during imbalance transitions.

📍 4. VWAP Structure Confirmation:

Anchored VWAP acts as a dynamic reference point.

Helps confirm acceptance vs. rejection zones at key institutional levels.

📈 Visuals & Alerts:

Color-coded volume bars show intensity of Z-Score & CVD confluence

CVD Line plots real-time delta bias with green/red coloring

Cluster-based shape markers highlight key bars for actionable signals

Optional: Add alerts for Cluster 2 above VWAP or Cluster 1 below VWAP

⚙️ Customization Options:

Adjustable Z-Score length

Custom anchor timeframe for CVD (e.g., 1D or sessions)

Adjustable max lookback depth

Toggle VWAP inclusion

Extendable to include additional filters: RSI, structure break alerts, etc.

🔧 Ideal Use Cases:

NY session intraday traders (ES, NQ, CL, 6E, FX pairs)

Breakout traders wanting order flow confirmation

Mean reversion traders spotting fake moves

Volume-based scalpers looking for edge on short-term order imbalance

Z-Score Volume with CVD Clustering & NY VWAP

📘 Description:

This indicator combines statistical volume analysis with order flow confirmation to detect high-probability trade zones and volume-based divergences.

📌 Components:

Z-Score of Volume: Identifies statistically significant volume surges or drops relative to a moving average baseline.

Cumulative Volume Delta (CVD): Gauges net buying vs. selling pressure using high-frequency bid/ask delta.

K-Means Clustering: Applies clustering logic to classify each bar into:

Cluster 2 – Strong Bullish: Z-Score and CVD both strong

Cluster 1 – Divergence / Bull Trap: Z-Score high, but weak CVD

Cluster 0 – Neutral / Noise: No clear alignment

Anchored VWAP (NY Session Open): Confirms market structure and institutional trend bias from 9:30 AM ET forward.

🎯 Suggested Applications:

✅ 1. Trend Continuation Entries (Add-ons):

Look to add to positions when:

Cluster 2 signal occurs

Price is above the NY session VWAP

Price structure has broken out of prior day high/low or range

⚠️ 2. Divergence Detection (Fade Traps):

Cluster 1 signals a bearish divergence (e.g., high volume but weak CVD).

Especially useful when price is failing to stay above VWAP.

Useful for early exits or reversal setups.

📊 3. Volume Profile Confirmation:

Combine with fixed or session-based volume profile tools.

Use Z-Score clusters to confirm volume spikes into low-volume nodes (LVNs) or during imbalance transitions.

📍 4. VWAP Structure Confirmation:

Anchored VWAP acts as a dynamic reference point.

Helps confirm acceptance vs. rejection zones at key institutional levels.

📈 Visuals & Alerts:

Color-coded volume bars show intensity of Z-Score & CVD confluence

CVD Line plots real-time delta bias with green/red coloring

Cluster-based shape markers highlight key bars for actionable signals

Optional: Add alerts for Cluster 2 above VWAP or Cluster 1 below VWAP

⚙️ Customization Options:

Adjustable Z-Score length

Custom anchor timeframe for CVD (e.g., 1D or sessions)

Adjustable max lookback depth

Toggle VWAP inclusion

Extendable to include additional filters: RSI, structure break alerts, etc.

🔧 Ideal Use Cases:

NY session intraday traders (ES, NQ, CL, 6E, FX pairs)

Breakout traders wanting order flow confirmation

Mean reversion traders spotting fake moves

Volume-based scalpers looking for edge on short-term order imbalance

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。