OPEN-SOURCE SCRIPT

更新済 [MAD] Self-Optimizing RSI

Overview

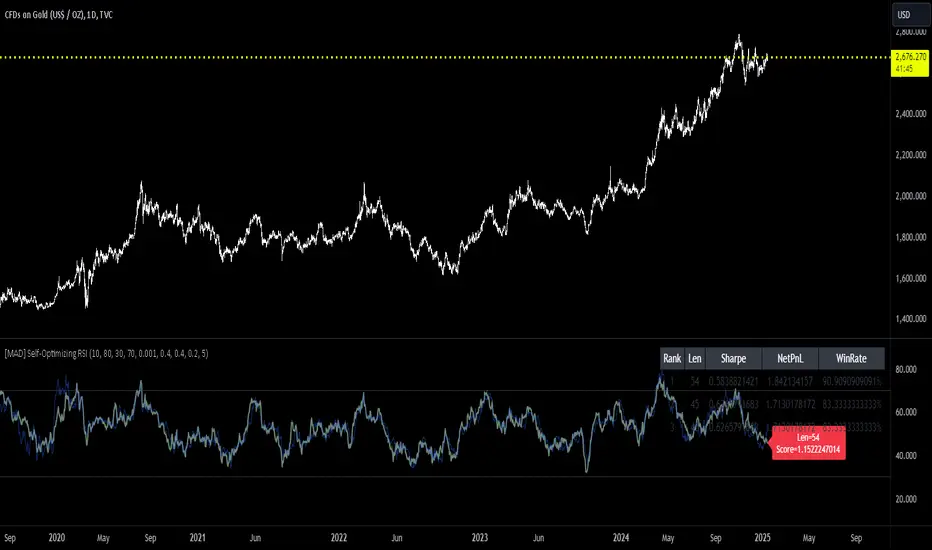

This script evaluates multiple RSI lengths within a specified range, calculates performance metrics for each, and identifies the top 3 configurations based on a custom scoring system. It then plots the three best RSI curves and optionally displays a summary table and label.

How It Works

The script calculates a custom RSI for each length in the [Min RSI Length .. Max RSI Length] range.

It simulates entering a long position when RSI crosses below the Buy Value and exits when RSI crosses above the Sell Value.

Each trade's return is stored in the relevant StatsContainer.

Metrics Computation

After all bars have been processed,

* Net Profit,

* Sharpe Ratio, and

* Win Rate

are computed for each RSI length.

A weighted score is then derived using the input weights.

Top 3 Identification

The script finds the three RSI lengths with the highest scores.

The RSI lines for these top 3 lengths are plotted in different colors.

If enabled, a table listing the top 3 results (Rank, RSI length, Sharpe, NetPnL, Win Rate) is shown.

If enabled, a label with the highest-scoring RSI length and its score is placed on the final bar.

Usage Tips

Adjust Min RSI Length and Max RSI Length to explore a narrower or wider range of periods.

Be aware, to high settings will slow down the calculation.

Experiment with different RSI Buy Value and RSI Sell Value settings if you prefer more or fewer trade signals.

Confirm that Min Trades Required aligns with the desired confidence level for the computed metrics.

Modify Weight: Sharpe, Weight: NetProfit, and Weight: WinRate to reflect which metrics are most important.

Troubleshooting

If metrics remain - or NaN, confirm enough trades (Min Trades Required) have occurred.

If no top 3 lines appear, it could mean no valid trades were taken in the specified range, or the script lacks sufficient bars to calculate RSI for some lengths. In this case set better buyvalue and sellvalues in the inputs

Disclaimer

Past performance is not indicative of future results specialy as this indicator can repaint based on max candles in memory which are limited by your subscription

This script evaluates multiple RSI lengths within a specified range, calculates performance metrics for each, and identifies the top 3 configurations based on a custom scoring system. It then plots the three best RSI curves and optionally displays a summary table and label.

How It Works

The script calculates a custom RSI for each length in the [Min RSI Length .. Max RSI Length] range.

It simulates entering a long position when RSI crosses below the Buy Value and exits when RSI crosses above the Sell Value.

Each trade's return is stored in the relevant StatsContainer.

Metrics Computation

After all bars have been processed,

* Net Profit,

* Sharpe Ratio, and

* Win Rate

are computed for each RSI length.

A weighted score is then derived using the input weights.

Top 3 Identification

The script finds the three RSI lengths with the highest scores.

The RSI lines for these top 3 lengths are plotted in different colors.

If enabled, a table listing the top 3 results (Rank, RSI length, Sharpe, NetPnL, Win Rate) is shown.

If enabled, a label with the highest-scoring RSI length and its score is placed on the final bar.

Usage Tips

Adjust Min RSI Length and Max RSI Length to explore a narrower or wider range of periods.

Be aware, to high settings will slow down the calculation.

Experiment with different RSI Buy Value and RSI Sell Value settings if you prefer more or fewer trade signals.

Confirm that Min Trades Required aligns with the desired confidence level for the computed metrics.

Modify Weight: Sharpe, Weight: NetProfit, and Weight: WinRate to reflect which metrics are most important.

Troubleshooting

If metrics remain - or NaN, confirm enough trades (Min Trades Required) have occurred.

If no top 3 lines appear, it could mean no valid trades were taken in the specified range, or the script lacks sufficient bars to calculate RSI for some lengths. In this case set better buyvalue and sellvalues in the inputs

Disclaimer

Past performance is not indicative of future results specialy as this indicator can repaint based on max candles in memory which are limited by your subscription

リリースノート

Typo in the table, thx for notifyingオープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

telegram - @djmad_0815

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

telegram - @djmad_0815

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。