OPEN-SOURCE SCRIPT

更新済 Master Correlation Table

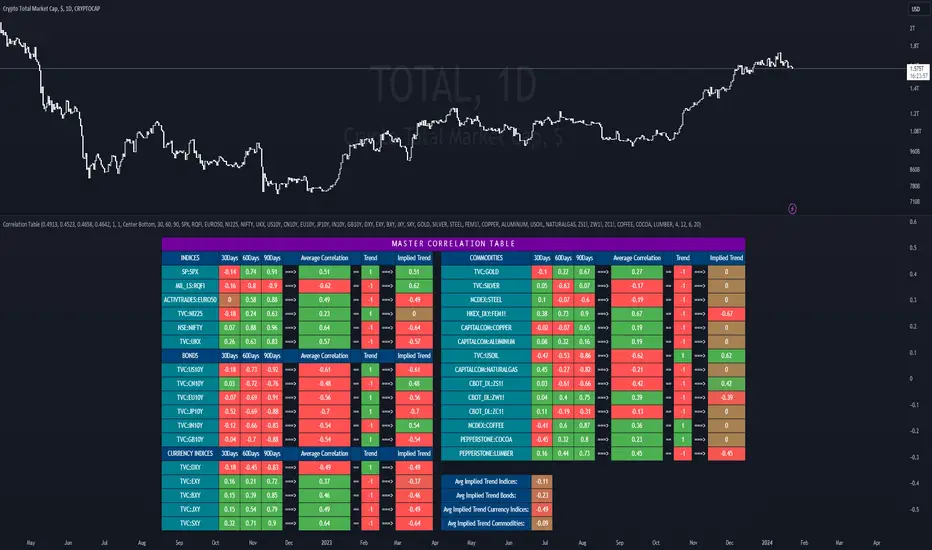

This indicator features macroeconomic correlation from 4 areas: Stock Indices, Bond Yields, Currency Indices and Commodities.

Assets used in this Correlation Table are split into two kinds:

- Large Economies: Stock Indices, Bond Yields and Currency Indices from 3 largest economies in the world (US, China, EU) are always included in the Average Implied Trend calculation.

- Strong/Weak: Assets that don't belong to previous kind and all commodities, these are filtered based on their current correlation strength, if their strength is weaker than the average they are not included in the Average Implied Trend calculation.

Values for correlation strength filter were determined from personal research and are set as default in code, they can be customized or fully removed (set to 0).

This Correlation Table only includes major Commodities and Stock Indices, Bond Yields, Currency Indices from Top 10 countries ranked by GDP that also have impact in the world.

All the tickers used are fully customizable along with the table colors to the user's liking.

Credits to IkkeOmar for the Normalized Kama Oscillator

Credits to Mukuro-Hoshimiya for core codes of this indicator

Assets used in this Correlation Table are split into two kinds:

- Large Economies: Stock Indices, Bond Yields and Currency Indices from 3 largest economies in the world (US, China, EU) are always included in the Average Implied Trend calculation.

- Strong/Weak: Assets that don't belong to previous kind and all commodities, these are filtered based on their current correlation strength, if their strength is weaker than the average they are not included in the Average Implied Trend calculation.

Values for correlation strength filter were determined from personal research and are set as default in code, they can be customized or fully removed (set to 0).

This Correlation Table only includes major Commodities and Stock Indices, Bond Yields, Currency Indices from Top 10 countries ranked by GDP that also have impact in the world.

All the tickers used are fully customizable along with the table colors to the user's liking.

Credits to IkkeOmar for the Normalized Kama Oscillator

Credits to Mukuro-Hoshimiya for core codes of this indicator

リリースノート

Automated the filter process and added option to choose your own filter values.リリースノート

Fixed filter error with commoditiesオープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。