OPEN-SOURCE SCRIPT

更新済 [Floride] 4 Layers of Bollinger Shadow

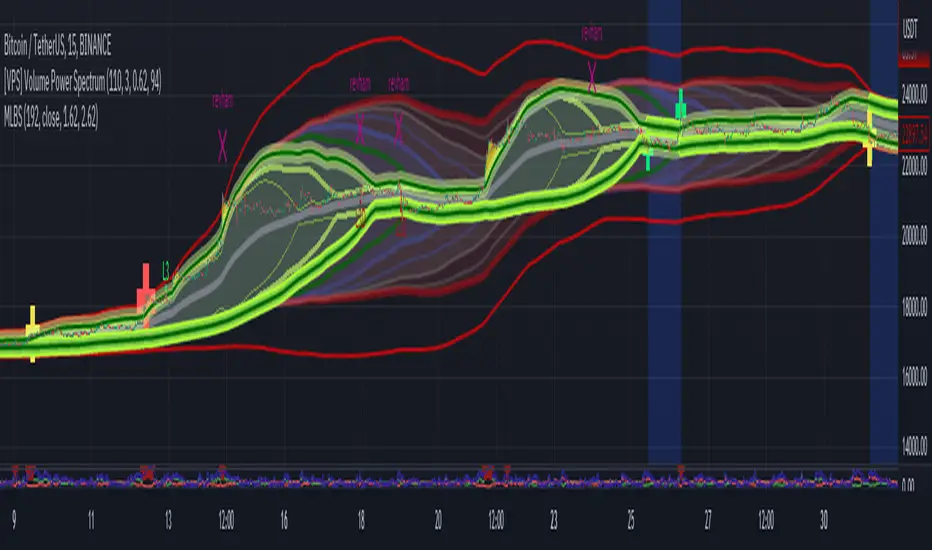

This is the indicator I named 4LBS. That means four layers of bollinger shadow.

This is an indicator that I made to see how far past prices could affect the future prices.

And I found some very interesting and beautiful things about it, and I wanted to share them with you, so I publish this indicator.

*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-

Hello, nice to meet you all. my name as a trader is Floride.

First of all, I am not good at English, so there may be many grammatically incorrect sentences below.

I ask for your understanding in advance. Thanks for your understanding.

*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-*-

What is it?

bollinger Bands usually has one moving average line. And there's two bands that uses same period value of standard deviation as the former MA. And this indicator, by the way, has a 4 shadow bands

that uses twice,three,four,five time the value of the MA's period.

Appearance -

This indicator has four layers, and there are also other layers between them.

You can turn on or off all the shadow layers.

Uses of Indicator and Examples

examples of actual use

1. market strongness diagnosis

-It seems all layers of shadow has some degree resist/support forces.

This indicator has the 4th layer - "L4". (indicated by red lines).

I saw emergence of volatility quite frequently when this last layer breaks through.

When price breaks through this area or line, shade appear on the L4 layer in red. and red cross appear on the that point. This is I called Marlin signal.

If you saw red color shadow in this indicator, then the market may have quite high volatility.

(of course, there's not 100%. Please be careful about this.)

But I've also checked in quite several markets. when this volatility emerges, then also that market seems to started to building quite directional power afterwards.

I mean, after the marlin signal, market tends to have bigger volatility, and tends to go one direction.

again, it's not 100%. but probability is quite high.

But maybe depending on the type of market you need some adjustment.

Recommended values are M2-1.618, M3-2.618

Or M2-1, M3-2. default value is M2-1.618, M3-2.618

and also, if prices breakthrough the channels, or layers, It tends to break through the at once, in first bar. In other words, if price don't break through the first or second candle, it's very likely that the price won't break through channel for the time being.

2. market weakness diagnosis

Usually, without external momentum, the price converges to the average value and does not deviate from the band. And if price fails to break through the most inner first layer-"L1 - the green channel", In that case, the market is usually assumed to be weak, or has low volatility.

- you can set alarms on tuna, marlin signal. and you don't have to watch chart all the time.

3. Signals

I put two signals in this indicator.

One has the name "Tuna," and the second has the name "Marlin."

As you can already tell from the name's feeling, tuna is a weaker signal and marlin is a stronger signal.

Actual example of a signal

1. Tuna signal

- When the tuna signal appears, you can guess that the current market is generally not weak. or has quite good directional force. or medium volatility.

Below is important.

- If a tuna signal appears, there is a possibility that a marlin will appear later.

- In my opinion, it might be wise not to have a position without a tuna signal.

- Almost all of the marlin signal appeared shortly after the tuna signal appeared.

2. Marlin signal

- When marlin signal appears, with a high probability, volatility can increase large.

- In the backtesting of the stock, in some cases, the market moved quite frequently in the direction of the marlin signal.

- The emergence of marlin can be seen as a pretty strong indication of the emergences of direction.

リリースノート

Just slighetest name's changeリリースノート

ver 1.03- Now All 4 different layers have different color with each other.

- The scale magnification issue has been addressed.

- Now you can on and off all shade at once.

リリースノート

- Now when tuna signal appear, there's blue shade appear.- some minor color change.

リリースノート

- LMARLIN signal now appears only once at a time.リリースノート

- "Alt trend" option added.リリースノート

- charting page updatedリリースノート

* "A slight visual change"オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。