OPEN-SOURCE SCRIPT

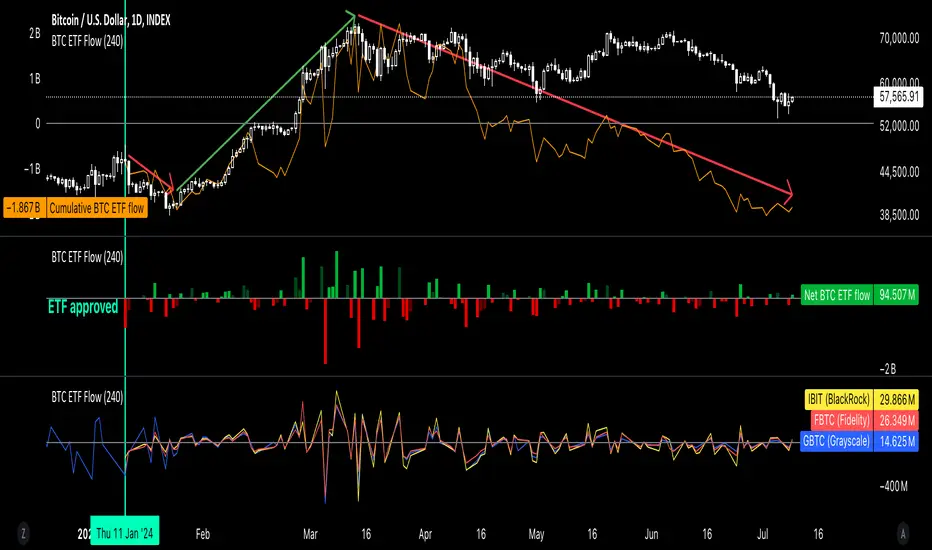

Bitcoin ETF Flow Tracker

GM 💎

Just as tracking global liquidity flows helps us anticipate movements in crypto, I believe that monitoring institutional activity would also offer us additional edge in investing since their large-scale trades and strategic moves could result in significant changes in BTC price trends.

Hence why I created this indicator to help us track:

1. Total Cumulative Flow of the 8 biggest US BTC ETFs (top pane),

2. Total Net Flow of those institutions in both low and high timeframes (middle pane), and

3. Individual BTC ETF Flow (bottom pane).

*Recommended timeframes for analysis: 4H, 12H or 1D

*Color code of Total Net Flow:

Bright Green: strong positive total net flow

Dark Green: weakening positive total net flow

Bright Red: strong negative total net flow

Dark Red: weakening negative total net flow

*Top 8 biggest US BTC ETFs (in no particular order):

1. Grayscale Bitcoin Trust

2. BlackRock's iShares Bitcoin Trust

3. Fidelity Wise Origin Bitcoin Fund

4. ARK 21Shares Bitcoin ETF

5. Bitwise Bitcoin ETF

6. Invesco Galaxy Bitcoin ETF

7. VanEck Bitcoin Trust

8. Franklin Bitcoin ETF

*Recommended institutions to track: number 1, 2, 3 since they've been the most active and have had the highest flow within this space.

Just as tracking global liquidity flows helps us anticipate movements in crypto, I believe that monitoring institutional activity would also offer us additional edge in investing since their large-scale trades and strategic moves could result in significant changes in BTC price trends.

Hence why I created this indicator to help us track:

1. Total Cumulative Flow of the 8 biggest US BTC ETFs (top pane),

2. Total Net Flow of those institutions in both low and high timeframes (middle pane), and

3. Individual BTC ETF Flow (bottom pane).

*Recommended timeframes for analysis: 4H, 12H or 1D

*Color code of Total Net Flow:

Bright Green: strong positive total net flow

Dark Green: weakening positive total net flow

Bright Red: strong negative total net flow

Dark Red: weakening negative total net flow

*Top 8 biggest US BTC ETFs (in no particular order):

1. Grayscale Bitcoin Trust

2. BlackRock's iShares Bitcoin Trust

3. Fidelity Wise Origin Bitcoin Fund

4. ARK 21Shares Bitcoin ETF

5. Bitwise Bitcoin ETF

6. Invesco Galaxy Bitcoin ETF

7. VanEck Bitcoin Trust

8. Franklin Bitcoin ETF

*Recommended institutions to track: number 1, 2, 3 since they've been the most active and have had the highest flow within this space.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。