OPEN-SOURCE SCRIPT

Andean Oscillator (Version 3.0 Sr.K)

Andean Oscillator (Version 3.0 Sr.K)

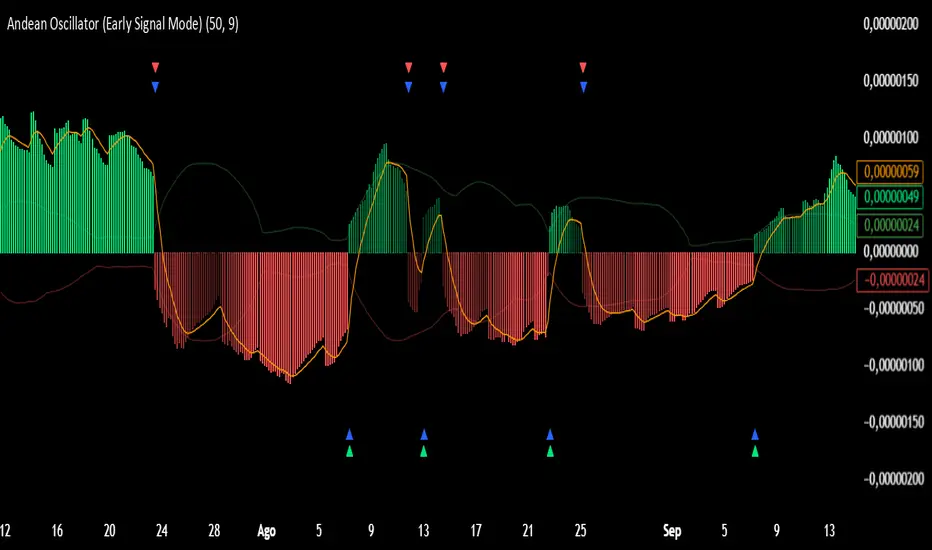

This indicator is a momentum-based oscillator that measures the balance between bullish and bearish pressure.

🔧 How it works:

It calculates two adaptive envelopes around price and derives a "bullish" and "bearish" component.

The oscillator value is simply Bull - Bear, showing which side dominates.

A signal line (EMA of the oscillator) smooths the raw value.

Optionally, ±1σ levels are plotted to highlight statistically strong moves.

📊 What you see:

Histogram: Positive bars = bullish momentum, negative bars = bearish.

Orange Line: Signal line (EMA) used to confirm or anticipate reversals.

Zero Line: The equilibrium point. Crosses of this level signal a shift in market bias.

Green / Red Triangles: Buy and sell signals, either when crossing zero or crossing the signal line (depending on selected mode).

⚡ Early Signal Mode:

When enabled, signals trigger earlier — at the crossover between the oscillator and its signal line — allowing traders to enter potential reversals before a full zero-cross confirmation.

✅ Use cases:

Identify momentum shifts before price reversals.

Spot potential long/short setups with reduced lag.

Combine with price action or support/resistance for confirmation.

⚠️ Note: This is a tool for discretionary/manual trading. It does not open or close trades automatically. Always confirm with your own analysis and risk management.

This indicator is a momentum-based oscillator that measures the balance between bullish and bearish pressure.

🔧 How it works:

It calculates two adaptive envelopes around price and derives a "bullish" and "bearish" component.

The oscillator value is simply Bull - Bear, showing which side dominates.

A signal line (EMA of the oscillator) smooths the raw value.

Optionally, ±1σ levels are plotted to highlight statistically strong moves.

📊 What you see:

Histogram: Positive bars = bullish momentum, negative bars = bearish.

Orange Line: Signal line (EMA) used to confirm or anticipate reversals.

Zero Line: The equilibrium point. Crosses of this level signal a shift in market bias.

Green / Red Triangles: Buy and sell signals, either when crossing zero or crossing the signal line (depending on selected mode).

⚡ Early Signal Mode:

When enabled, signals trigger earlier — at the crossover between the oscillator and its signal line — allowing traders to enter potential reversals before a full zero-cross confirmation.

✅ Use cases:

Identify momentum shifts before price reversals.

Spot potential long/short setups with reduced lag.

Combine with price action or support/resistance for confirmation.

⚠️ Note: This is a tool for discretionary/manual trading. It does not open or close trades automatically. Always confirm with your own analysis and risk management.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。