OPEN-SOURCE SCRIPT

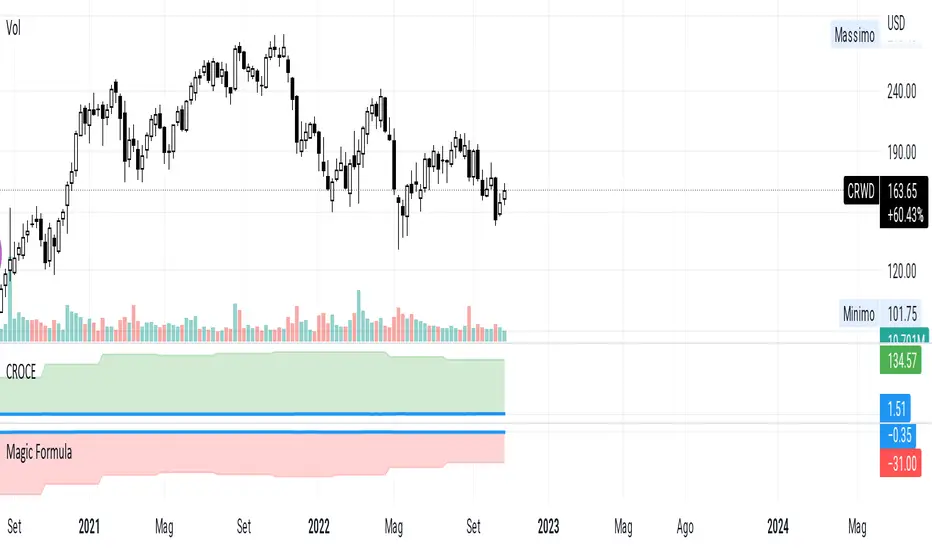

CROCE

Using free cash flow instead of ebit, to be able to evaluate stocks that are not yet profitable.

the formulas are

fcf ttm / (not financial operating working capital - Cash + Net Property Plant and Equipment)

and

fcf yield on Enterprice Value

Example CRWD negative ebit, but cash creation, in this case the expenses in research and development go to affect the ebit.

the formulas are

fcf ttm / (not financial operating working capital - Cash + Net Property Plant and Equipment)

and

fcf yield on Enterprice Value

Example CRWD negative ebit, but cash creation, in this case the expenses in research and development go to affect the ebit.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。