OPEN-SOURCE SCRIPT

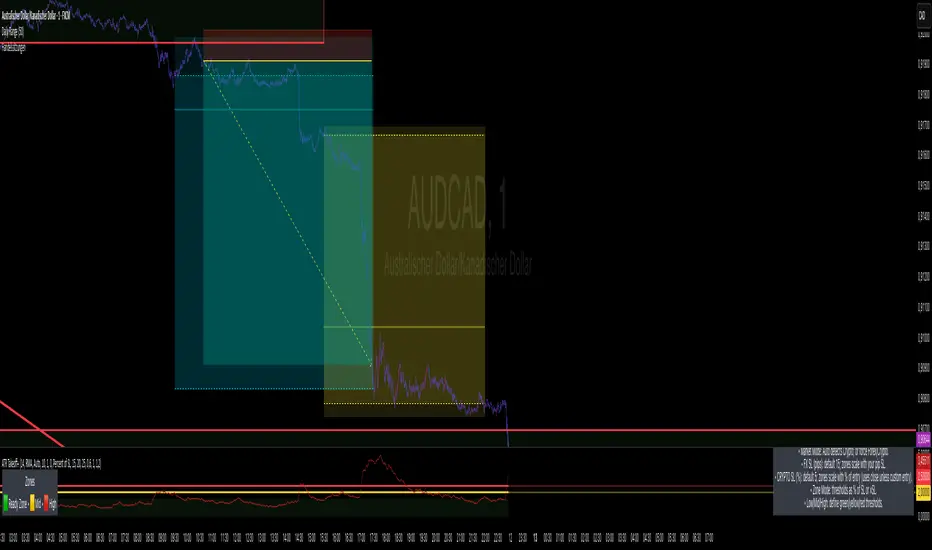

更新済 1m Scalping ATR (with SL & Zones)

A universal ATR indicator that anchors volatility to your stop-loss.

Read any market (FX, JPY pairs, Gold/Silver, indices, crypto) consistently—regardless of pip/point conventions and timeframe.

Why this indicator?

Classic ATR is absolute (pips/points) and feels different across markets/TFs. ATR Takeoff normalizes ATR to your stop-loss in pips and highlights clear zones for “quiet / ideal / too volatile,” so you instantly know if a 10-pip SL fits current conditions.

Key features

Auto pip detection (FX, JPY, XAU/XAG, indices, BTC/ETH).

Selectable ATR source: chart timeframe or fixed ATR TF (e.g., “15”, “30”, “60”).

Display modes:

Percent of SL – ATR relative to SL in %, great for M1 (typical 10–30%).

Multiple of SL – ATR as a multiple of SL (e.g., 0.6× / 1.0× / 1.2×).

Panel zones:

Green = “Ready for takeoff” (≤ Low), Yellow = reference (Mid), Red = too volatile (≥ High).

Status badge (top-right): Quiet / ATR ok / Wild, current ATR/SL value, ATR TF used.

Direction-agnostic: Works the same for longs and shorts.

Inputs (at a glance)

Length / Smoothing (RMA/SMA/EMA/WMA): ATR base settings.

Your Stop-Loss (Pips): Reference SL (e.g., 10).

ATR Timeframe (empty = chart): Use chart TF or a fixed TF.

Display Mode: “Percent of SL” or “Multiple of SL.”

Low/Mid/High (Percent Mode): Zone thresholds in % of SL.

Low/Mid/High (Multiple Mode): Zone thresholds in ×SL.

Recommended defaults

Length 14, Smoothing RMA, SL 10 pips

Display Mode: Percent of SL

Low/Mid/High (%): 15 / 20 / 25

ATR Timeframe: empty (= chart) for reactive, or “30” for smoother M30 context with M1 entries.

How to use

Set SL (pips). 2) Choose display mode. 3) Optionally pick ATR TF.

Interpretation:

≤ Low (green): setups allowed.

≈ Mid (yellow): neutral reference.

≥ High (red): too volatile → adjust SL/size or wait.

Note: Auto-pip relies on common ticker naming; verify on exotic symbols.

Disclaimer: For research/education. Not financial advice.

Read any market (FX, JPY pairs, Gold/Silver, indices, crypto) consistently—regardless of pip/point conventions and timeframe.

Why this indicator?

Classic ATR is absolute (pips/points) and feels different across markets/TFs. ATR Takeoff normalizes ATR to your stop-loss in pips and highlights clear zones for “quiet / ideal / too volatile,” so you instantly know if a 10-pip SL fits current conditions.

Key features

Auto pip detection (FX, JPY, XAU/XAG, indices, BTC/ETH).

Selectable ATR source: chart timeframe or fixed ATR TF (e.g., “15”, “30”, “60”).

Display modes:

Percent of SL – ATR relative to SL in %, great for M1 (typical 10–30%).

Multiple of SL – ATR as a multiple of SL (e.g., 0.6× / 1.0× / 1.2×).

Panel zones:

Green = “Ready for takeoff” (≤ Low), Yellow = reference (Mid), Red = too volatile (≥ High).

Status badge (top-right): Quiet / ATR ok / Wild, current ATR/SL value, ATR TF used.

Direction-agnostic: Works the same for longs and shorts.

Inputs (at a glance)

Length / Smoothing (RMA/SMA/EMA/WMA): ATR base settings.

Your Stop-Loss (Pips): Reference SL (e.g., 10).

ATR Timeframe (empty = chart): Use chart TF or a fixed TF.

Display Mode: “Percent of SL” or “Multiple of SL.”

Low/Mid/High (Percent Mode): Zone thresholds in % of SL.

Low/Mid/High (Multiple Mode): Zone thresholds in ×SL.

Recommended defaults

Length 14, Smoothing RMA, SL 10 pips

Display Mode: Percent of SL

Low/Mid/High (%): 15 / 20 / 25

ATR Timeframe: empty (= chart) for reactive, or “30” for smoother M30 context with M1 entries.

How to use

Set SL (pips). 2) Choose display mode. 3) Optionally pick ATR TF.

Interpretation:

≤ Low (green): setups allowed.

≈ Mid (yellow): neutral reference.

≥ High (red): too volatile → adjust SL/size or wait.

Note: Auto-pip relies on common ticker naming; verify on exotic symbols.

Disclaimer: For research/education. Not financial advice.

リリースノート

ATR Takeoff+ (v2.0) — SL-Anchored ATR for FX & CryptoWhat it is

ATR Takeoff+ turns the classic ATR into an actionable, *stop-loss–anchored* volatility gauge that stays consistent across markets and timeframes.

* **Forex mode:** You define your stop distance in **pips** (default **15 pips**).

* **Crypto mode:** You define your stop distance as **% of entry** (default **5%**).

* The indicator converts ATR to the same unit and compares it to your SL, giving you **uniform zones**:

* 🟩 **Ready Zone** (≤ Low) – conditions are suitable for your default SL

* 🟨 **Mid** – neutral reference

* 🟥 **High** (≥ High) – too volatile for your default SL

Whenever you change your SL (pips or %), the **green band and the yellow/red lines update instantly**.

---

Why it helps

* **Consistency:** Judge volatility relative to *your* risk, not absolute values.

* **Cross-market:** FX and Crypto “feel” the same despite different price scales.

* **Fast decisions:** A compact badge shows state (**ATR ok / Neutral / Too volatile**), market type (FOREX/CRYPTO), and current ATR (in pips for FX, price units for Crypto).

---

How it works (under the hood)

* **ATR core:** Standard TR smoothed by your chosen MA (RMA/SMA/EMA/WMA; default RMA, length 14).

* **FX:** ATR is converted to **pips** using symbol conventions (incl. JPY, metals/indices heuristics).

* **Crypto:** Your SL% × entry (close or optional custom entry) → **absolute price distance**. ATR is compared to that distance.

* **Zones:** You can define thresholds as **% of SL** (intuitive) or **×SL** (multiples).

---

Inputs (key settings)

* **ATR Lookback (bars)** – ATR period (default 14).

* **ATR MA Type** – RMA/SMA/EMA/WMA (default RMA).

* **Market Mode** – *Auto* (detects common crypto tickers) or force **Forex/Crypto**.

* **FX: Stop-Loss (Pips)** – Your standard SL in pips (default **15**).

* **CRYPTO: Stop-Loss % of Entry** – Your SL as % (default **5**).

* **CRYPTO: Use custom entry price? / Custom entry** – Fix the entry price for exact SL distance; otherwise close is used.

* **Zone Mode** – **Percent of SL** or **Multiple of SL**.

* **Low / Mid / High** – Thresholds for the green band top, yellow reference, and red limit.

* **Show legend / Show Help Panel** – Small on-chart guides.

**Tip:** Start with **Percent of SL** and thresholds **15 / 20 / 25%**. For multiples, try **0.60× / 1.00× / 1.20×**.

---

Recommended workflow

1. Set your baseline SL (FX pips or Crypto %).

2. Choose **Zone Mode** and threshold style that matches your management.

3. Trade your setup **only when ATR ≤ Low** (green band), be cautious around **Mid**, stand down or adapt risk when **ATR ≥ High**.

---

Notes & limitations

*Symbol heuristics for pips are sensible defaults; exotic symbols may need manual judgment.

*Indicator is **direction-agnostic**; combine with your entry model (breakout/structure/FVG/OB, sessions, etc.).

**Disclaimer:** For research/education only. Not financial advice. Always manage risk.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。