OPEN-SOURCE SCRIPT

Moving Average Cross trade PL

Abstract

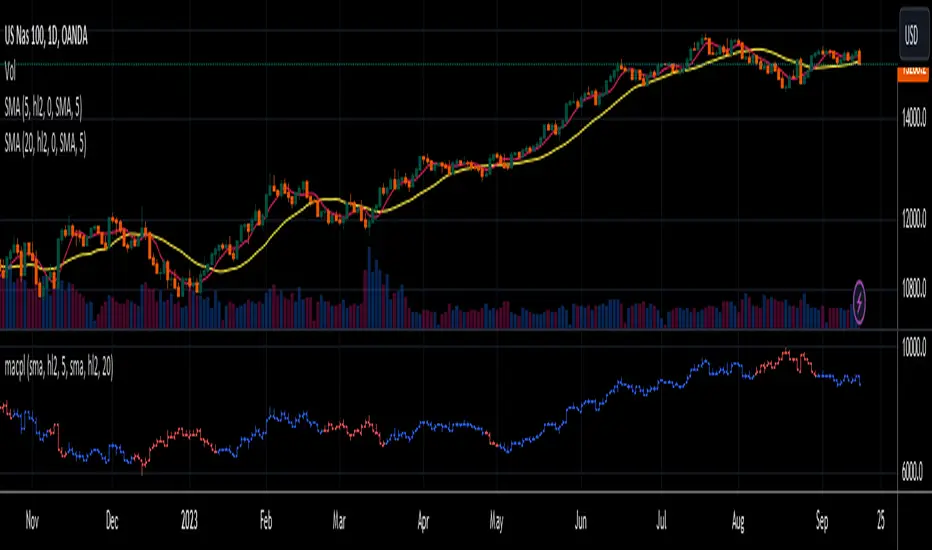

This script evaluates the potential trading proceeding and loss of the moving average cross strategy and plot it as a chart.

We can use it as a reference to whether we follow the original trading signals or not.

Introduction

Moving average cross is a popular trading strategy.

The strategy suggests traders buy when the short term moving average is above the long term moving average and sell when the short term moving average is below the long term moving average.

However, just like the most technical indicators, the signals are not always accurate.

This problem causes traders don't have sufficient confidence to trade with these signals.

On the other hand, the natural risk management suggests us only invest after major risks are past.

Therefore, we wait until many counterexamples of trading signals are past.

What will happen if we imagine that following a specific trading signal is a fund?

We can evaluate the potential trading proceeding and loss and plot it as a chart.

And then, we can measure how much loss may encounter in many worst cases and regard it as a reference to whether we follow the original trading signals or not.

How it works

1. Determine the instruments and time frames we are interested in.

2. Determine the long term moving average and the short term moving average.

3. The strategy suggests traders buy when the short term moving average is above the long term moving average and sell when the short term moving average is below the long term moving average.

4. The potential trading proceeding and loss is plotted as a chart.

5. There are two colors in the chart. One is when the short term moving average is above the long term moving average and the other is when the short term moving average is below the long term moving average.

6. We can observe the local maximum and the local minimum or apply other indicators we are interested in on the numbers it provides.

Parameters

x_type1 = How to compute the short term moving average. The option diff means the price several days ago.

x_src1 = How to summarize the price of a trading day. It depends on the open, high, low or close prices.

x_ma1 = How many days included in the short term moving average. When it is 1, the signal becomes when the price is above or below a single moving average.

x_type2 = How to compute the long term moving average

x_src2 = How to summarize the price of a trading day. It depends on the open, high, low or close prices.

x_ma2 = How many days included in the long term moving average

Conclusion

This indicator can quantize the potential trading proceeding and loss and can imply when following the original trading signals is good or not.

Combining the instruments which are long term investible and use this indicator to avoid potential risks, we can make proceeding better than holding the major stock markets.

This script evaluates the potential trading proceeding and loss of the moving average cross strategy and plot it as a chart.

We can use it as a reference to whether we follow the original trading signals or not.

Introduction

Moving average cross is a popular trading strategy.

The strategy suggests traders buy when the short term moving average is above the long term moving average and sell when the short term moving average is below the long term moving average.

However, just like the most technical indicators, the signals are not always accurate.

This problem causes traders don't have sufficient confidence to trade with these signals.

On the other hand, the natural risk management suggests us only invest after major risks are past.

Therefore, we wait until many counterexamples of trading signals are past.

What will happen if we imagine that following a specific trading signal is a fund?

We can evaluate the potential trading proceeding and loss and plot it as a chart.

And then, we can measure how much loss may encounter in many worst cases and regard it as a reference to whether we follow the original trading signals or not.

How it works

1. Determine the instruments and time frames we are interested in.

2. Determine the long term moving average and the short term moving average.

3. The strategy suggests traders buy when the short term moving average is above the long term moving average and sell when the short term moving average is below the long term moving average.

4. The potential trading proceeding and loss is plotted as a chart.

5. There are two colors in the chart. One is when the short term moving average is above the long term moving average and the other is when the short term moving average is below the long term moving average.

6. We can observe the local maximum and the local minimum or apply other indicators we are interested in on the numbers it provides.

Parameters

x_type1 = How to compute the short term moving average. The option diff means the price several days ago.

x_src1 = How to summarize the price of a trading day. It depends on the open, high, low or close prices.

x_ma1 = How many days included in the short term moving average. When it is 1, the signal becomes when the price is above or below a single moving average.

x_type2 = How to compute the long term moving average

x_src2 = How to summarize the price of a trading day. It depends on the open, high, low or close prices.

x_ma2 = How many days included in the long term moving average

Conclusion

This indicator can quantize the potential trading proceeding and loss and can imply when following the original trading signals is good or not.

Combining the instruments which are long term investible and use this indicator to avoid potential risks, we can make proceeding better than holding the major stock markets.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。