OPEN-SOURCE SCRIPT

Global Inflation Indicator

🔹 Overview:

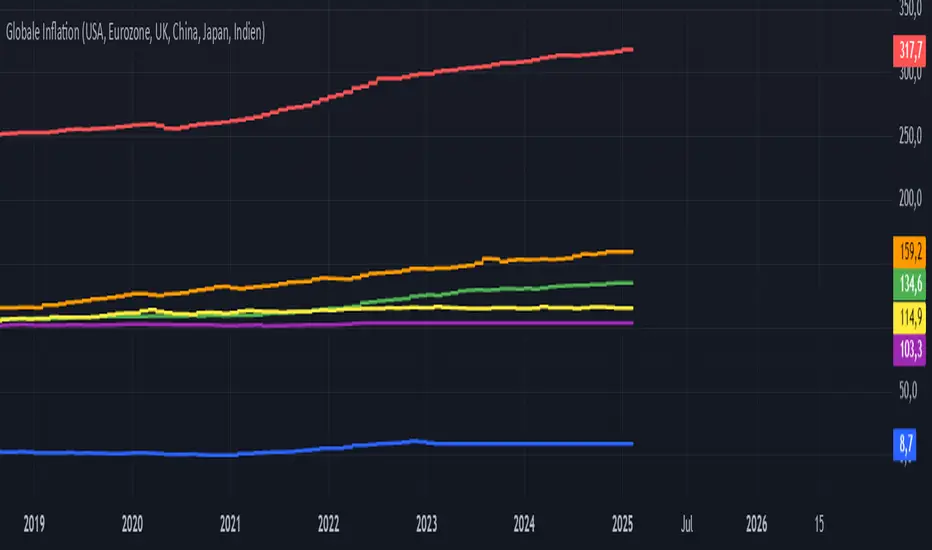

The Global Inflation Indicator is a macro-analysis tool designed to track and compare inflation trends across major economies. It pulls Consumer Price Index (CPI) data from multiple regions, helping traders and investors analyze how inflation impacts global markets, particularly gold, forex, and commodities.

📊 Key Features:

✅ Tracks inflation in six major economies:

🇺🇸 USA (CPIAUCSL) – Key driver for USD and gold prices

🇪🇺 Eurozone (CPHPTT01EZM659N) – Euro inflation impact

🇬🇧 United Kingdom (GBRCPIALLMINMEI) – GBP & economic trends

🇨🇳 China (CHNCPIALLMINMEI) – Emerging market impact

🇯🇵 Japan (JPNCPIALLMINMEI) – Yen & inflation control policies

🇮🇳 India (INDCPIALLMINMEI) – Key gold-consuming economy

✅ Real-time Inflation Trends:

Provides a visual comparison of inflation levels in different regions.

Helps traders identify inflationary cycles & their effect on global assets.

✅ Macro-Driven Trading Decisions:

Gold & Forex Correlation: High inflation may increase demand for gold.

Interest Rate Expectations: Central banks respond to inflation shifts.

Currency Strength: Inflation impacts USD, EUR, GBP, JPY, CNY, INR.

📉 How to Use It:

Gold traders can assess inflation trends to predict potential price movements.

Forex traders can compare inflation effects on major currency pairs (EUR/USD, USD/JPY, GBP/USD, etc.).

Stock investors can evaluate how inflation affects central bank policies and interest rates.

📌 Conclusion:

The Global Inflation Indicator is a powerful tool for macroeconomic analysis, providing real-time insights into global inflation trends. By integrating this indicator into your gold, forex, and commodity trading strategies, you can make more informed investment decisions in response to economic changes.

The Global Inflation Indicator is a macro-analysis tool designed to track and compare inflation trends across major economies. It pulls Consumer Price Index (CPI) data from multiple regions, helping traders and investors analyze how inflation impacts global markets, particularly gold, forex, and commodities.

📊 Key Features:

✅ Tracks inflation in six major economies:

🇺🇸 USA (CPIAUCSL) – Key driver for USD and gold prices

🇪🇺 Eurozone (CPHPTT01EZM659N) – Euro inflation impact

🇬🇧 United Kingdom (GBRCPIALLMINMEI) – GBP & economic trends

🇨🇳 China (CHNCPIALLMINMEI) – Emerging market impact

🇯🇵 Japan (JPNCPIALLMINMEI) – Yen & inflation control policies

🇮🇳 India (INDCPIALLMINMEI) – Key gold-consuming economy

✅ Real-time Inflation Trends:

Provides a visual comparison of inflation levels in different regions.

Helps traders identify inflationary cycles & their effect on global assets.

✅ Macro-Driven Trading Decisions:

Gold & Forex Correlation: High inflation may increase demand for gold.

Interest Rate Expectations: Central banks respond to inflation shifts.

Currency Strength: Inflation impacts USD, EUR, GBP, JPY, CNY, INR.

📉 How to Use It:

Gold traders can assess inflation trends to predict potential price movements.

Forex traders can compare inflation effects on major currency pairs (EUR/USD, USD/JPY, GBP/USD, etc.).

Stock investors can evaluate how inflation affects central bank policies and interest rates.

📌 Conclusion:

The Global Inflation Indicator is a powerful tool for macroeconomic analysis, providing real-time insights into global inflation trends. By integrating this indicator into your gold, forex, and commodity trading strategies, you can make more informed investment decisions in response to economic changes.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。