OPEN-SOURCE SCRIPT

Rainbow Fisher - AYNET

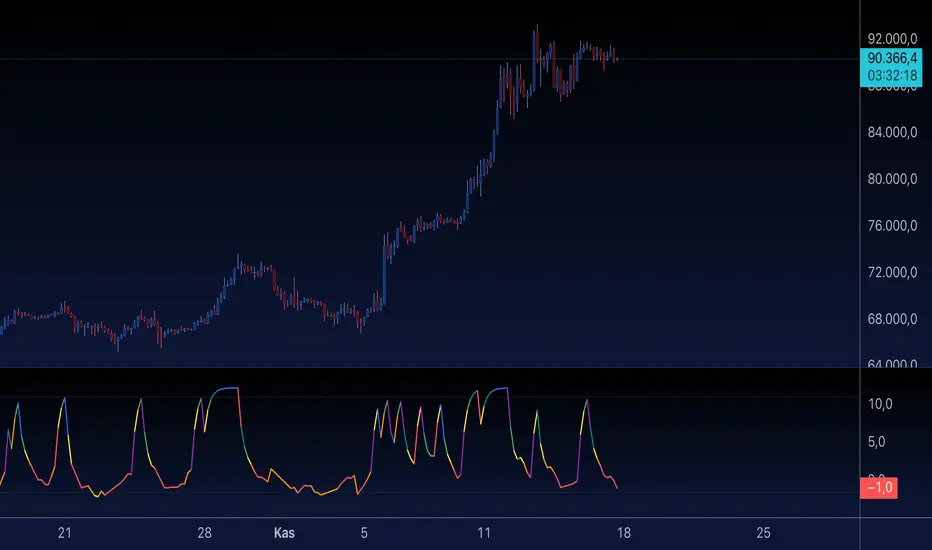

The Rainbow Fisher Indicator is inspired by John Ehlers' work on the Fisher Transform, a tool designed to normalize price movements and highlight overbought and oversold conditions. This script combines Ehlers' Fisher Transform with a rainbow visualization for enhanced trend analysis.

Summary of the Code

Fisher Transform Calculation:

The indicator calculates the Fisher Transform based on normalized high-low price data (hl2), which emphasizes turning points in market trends.

Rainbow Visualization:

The Fisher line is dynamically colored using a rainbow gradient to visually represent the magnitude and direction of market movements.

Overbought/Oversold Levels:

Configurable horizontal lines mark thresholds (1.5 for overbought and -1.5 for oversold by default), helping traders identify extremes in price action.

Signal Labels:

Labels are displayed when the Fisher line crosses the overbought or oversold levels, providing clear visual cues for potential market reversals.

Acknowledgment:

This indicator is an homage to John Ehlers' groundbreaking work in digital signal processing for financial markets.

How to Use

Trend Reversal Detection:

Use the overbought and oversold levels to identify potential turning points in market trends.

Momentum Analysis:

Observe the rainbow-colored Fisher line for directional cues and the strength of price movements.

Customization

Adjust the Fisher Transform length to refine sensitivity.

Modify overbought/oversold levels to align with your trading strategy.

Enable or disable the rainbow effect for simplicity or added clarity.

Let me know if you’d like further refinements or additional features! 🌈

Summary of the Code

Fisher Transform Calculation:

The indicator calculates the Fisher Transform based on normalized high-low price data (hl2), which emphasizes turning points in market trends.

Rainbow Visualization:

The Fisher line is dynamically colored using a rainbow gradient to visually represent the magnitude and direction of market movements.

Overbought/Oversold Levels:

Configurable horizontal lines mark thresholds (1.5 for overbought and -1.5 for oversold by default), helping traders identify extremes in price action.

Signal Labels:

Labels are displayed when the Fisher line crosses the overbought or oversold levels, providing clear visual cues for potential market reversals.

Acknowledgment:

This indicator is an homage to John Ehlers' groundbreaking work in digital signal processing for financial markets.

How to Use

Trend Reversal Detection:

Use the overbought and oversold levels to identify potential turning points in market trends.

Momentum Analysis:

Observe the rainbow-colored Fisher line for directional cues and the strength of price movements.

Customization

Adjust the Fisher Transform length to refine sensitivity.

Modify overbought/oversold levels to align with your trading strategy.

Enable or disable the rainbow effect for simplicity or added clarity.

Let me know if you’d like further refinements or additional features! 🌈

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。