OPEN-SOURCE SCRIPT

更新済 Volume Statistics - Intraweek

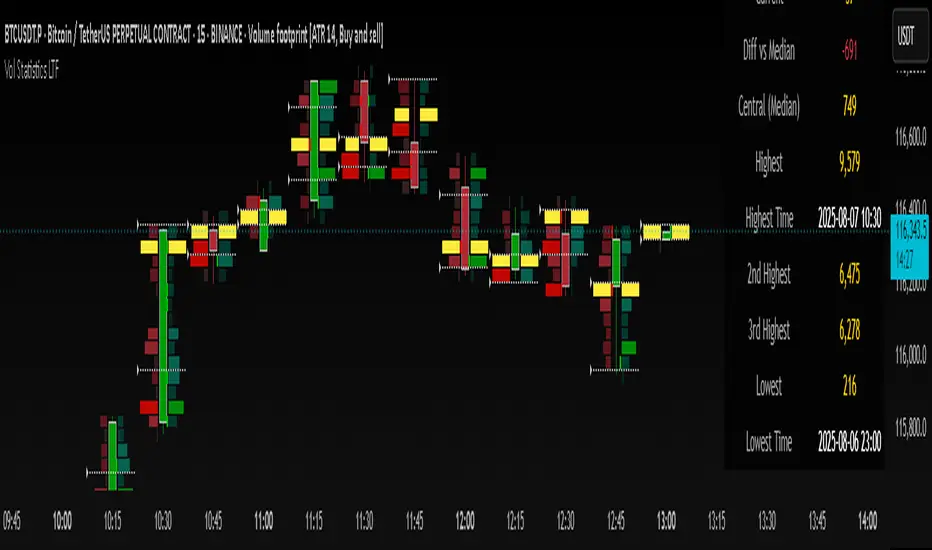

Volume Statistics - Intraweek: For Orderflow Traders

This tool is designed for traders using volume footprint charts and orderflow methods.

Why it matters:

In orderflow trading, you care about the quality of volume behind each move. You’re not just watching price; you’re watching how much aggression is behind that price move. That’s where this indicator helps.

What to look at:

* Current Volume shows you how much volume is trading right now.

* Central Volume (median or average over 24h or 7D) gives you a baseline for what's normal volume VS abnormal volume.

* The Diff vs Central tells you immediately if current volume is above or below normal.

How this helps:

* If volume is above normal, it suggested elevated levels of buyer or seller aggression. Look for strong follow-through or continuation.

* If volume is below normal, it may signal low interest, passive participation, a lack of conviction, or a fake move.

* Use this context to decide if what you're seeing in the footprint (imbalances, absorption, traps) is actually worth acting on.

Extra context:

* The highest and lowest volume levels and their timestamps help you spot prior key reactions.

* Second and third highest bars help you see other major effort points in the recent window.

Comment with any suggestions on how to improve this indicator.

This tool is designed for traders using volume footprint charts and orderflow methods.

Why it matters:

In orderflow trading, you care about the quality of volume behind each move. You’re not just watching price; you’re watching how much aggression is behind that price move. That’s where this indicator helps.

What to look at:

* Current Volume shows you how much volume is trading right now.

* Central Volume (median or average over 24h or 7D) gives you a baseline for what's normal volume VS abnormal volume.

* The Diff vs Central tells you immediately if current volume is above or below normal.

How this helps:

* If volume is above normal, it suggested elevated levels of buyer or seller aggression. Look for strong follow-through or continuation.

* If volume is below normal, it may signal low interest, passive participation, a lack of conviction, or a fake move.

* Use this context to decide if what you're seeing in the footprint (imbalances, absorption, traps) is actually worth acting on.

Extra context:

* The highest and lowest volume levels and their timestamps help you spot prior key reactions.

* Second and third highest bars help you see other major effort points in the recent window.

Comment with any suggestions on how to improve this indicator.

リリースノート

Updated order of table for better flowリリースノート

Removed Intraweek from table to save spaceリリースノート

- Updated the table to be more clearly labeled

- Added function for time to sync with layout time VS UTC by default

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。