OPEN-SOURCE SCRIPT

Daily Investments Index Scalp

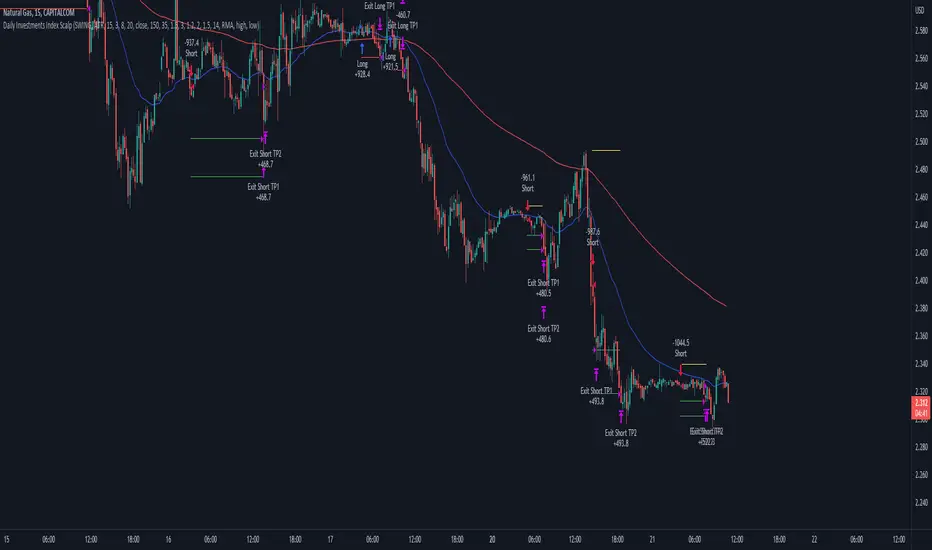

This strategy is based on the DIDI index with our own confirmations and calculated SL/TP .

You can change every setting if you want it to use for another pair, but this is fine tuned for NATURALGAS

The entries are taken when:

Long:

- Buy signal from the DIDI indicator

- Long EMA is underneath the Short EMA

- Price must be Above the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

Short:

- Sell signal from the DIDI indicator

- Long EMA is Above the Short EMA

- Price must be Below the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

It's fairly simple, and i think you can use this base so extend your own strategy

Good luck :)

If you have any questions, feel free to comment

You can change every setting if you want it to use for another pair, but this is fine tuned for NATURALGAS

The entries are taken when:

Long:

- Buy signal from the DIDI indicator

- Long EMA is underneath the Short EMA

- Price must be Above the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

Short:

- Sell signal from the DIDI indicator

- Long EMA is Above the Short EMA

- Price must be Below the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

It's fairly simple, and i think you can use this base so extend your own strategy

Good luck :)

If you have any questions, feel free to comment

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。