OPEN-SOURCE SCRIPT

更新済 Volume Zone Oscillator by [VanHelsig]

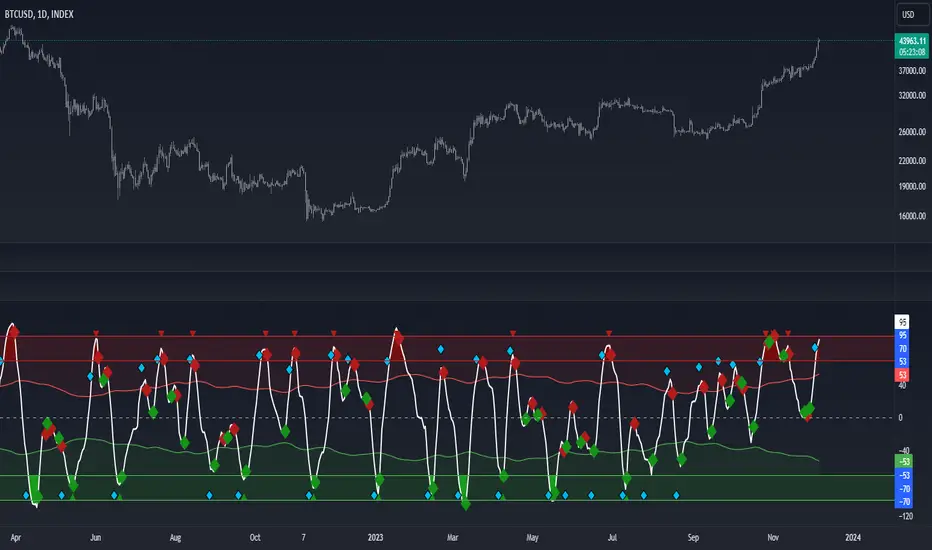

Volume Zone Oscillator

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

How volume zone oscillator work:

Like other VZO it uses the same principle of calculation Volume direction divided on total volume and then scaled to 100 and -100.

When we have positive momentum close > close[loockback] we have value of positive Volume, other way we have -volume negative one. <- this called a volume direction

Total volume is simply moving average with source of volume

And then MA with source of volume direction divided on MA of total colume and scaled it from 100 to -100

Basically we have few signals what VZO can show:

-Strong buy in oversold zone and strong sell in overbought zone. (Triangles at the top red and at the bottom green)

-Local Buy and Sell (Green and red Robustnesses)

-Posibility of trend change (Blue robustness)

Also you can webhook alerts to your spread sheet that sends values 1 for buys signals and -1 for sell signals in a range of 1 to 10 days

Here you can see marked signals on the chart

リリースノート

Updated calculations and backtested. リリースノート

-リリースノート

BackTest BTC Index (BackTest of local buys and local sells) BackTest ETH Index

https://www.tradingview.com/x/Dxb8cWuv/

リリースノート

Organazide code, changed default inputsオープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。