OPEN-SOURCE SCRIPT

nPOC Levels by Tyler

### Explanation of the Pine Script

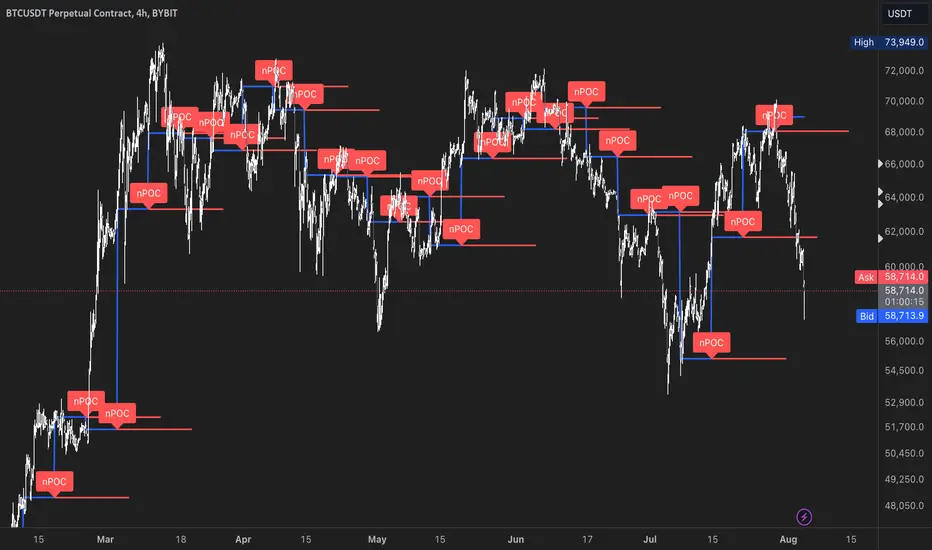

This Pine Script identifies and displays weekly naked Points of Control (nPOCs) on a TradingView chart. An nPOC represents a Point of Control (POC) from a previous week that has not been revisited by price action in subsequent weeks. These nPOCs are extended to the right as horizontal lines, indicating potential support or resistance levels.

#### Script Overview

1. **Indicator Declaration:**

```pinescript

//version=5

indicator("Weekly nPOCs", overlay=true)

```

- The script is defined as a version 5 Pine Script.

- The `indicator` function sets the script's name ("Weekly nPOCs") and specifies that the indicator should be overlaid on the price chart (`overlay=true`).

2. **Function to Calculate POC:**

```pinescript

f_poc(_hl2, _vol) =>

var float[] vol_profile = na

if (na(vol_profile))

vol_profile := array.new_float(100, 0.0)

_bin_size = (high - low) / 100

for i = 0 to 99

if _hl2 >= low + i * _bin_size and _hl2 < low + (i + 1) * _bin_size

array.set(vol_profile, i, array.get(vol_profile, i) + _vol)

max_volume = array.max(vol_profile)

poc_index = array.indexof(vol_profile, max_volume)

poc_price = low + poc_index * _bin_size + _bin_size / 2

poc_price

```

- The function `f_poc` calculates the Point of Control (POC) for a given period.

- It takes two parameters: `_hl2` (the average of the high and low prices) and `_vol` (volume).

- A volume profile array (`vol_profile`) is initialized to store volume data across different price bins.

- The price range between the high and low is divided into 100 bins (`_bin_size`).

- The function iterates over each bin, accumulating the volumes for prices within each bin.

- The bin with the maximum volume is identified as the POC (`poc_price`).

3. **Variables to Store Weekly Data:**

```pinescript

var float poc = na

var float prev_poc = na

var line[] poc_lines = na

if na(poc_lines)

poc_lines := array.new_line(0)

```

- `poc` stores the current week's POC.

- `prev_poc` stores the previous week's POC.

- `poc_lines` is an array to store lines representing nPOCs. The array is initialized if it is `na` (not initialized).

4. **Calculate Weekly POC:**

```pinescript

is_new_week = ta.change(time('W')) != 0

if (is_new_week)

prev_poc := poc

poc := f_poc(hl2, volume)

if not na(prev_poc)

line new_poc_line = line.new(x1=bar_index, y1=prev_poc, x2=bar_index + 100, y2=prev_poc, color=color.red, width=2)

label.new(x=bar_index, y=prev_poc, text="nPOC", style=label.style_label_down, color=color.red, textcolor=color.white)

array.push(poc_lines, new_poc_line)

```

- `is_new_week` checks if the current bar is the start of a new week using the `ta.change(time('W'))` function.

- If it's a new week, the previous week's POC is stored in `prev_poc`, and the current week's POC is calculated using `f_poc`.

- If `prev_poc` is not `na`, a new line (`new_poc_line`) representing the nPOC is created, extending it to the right (for 100 bars).

- A label is created at the `prev_poc` level, marking it as "nPOC".

- The new line is added to the `poc_lines` array.

5. **Remove Old Lines:**

```pinescript

if array.size(poc_lines) > 52

line.delete(array.shift(poc_lines))

```

- This section ensures that only the last 52 weeks of nPOCs are kept to avoid cluttering the chart.

- If the `poc_lines` array contains more than 52 lines, the oldest line is deleted using `array.shift`.

6. **Plot the Current Week's POC as a Reference:**

```pinescript

plot(poc, title="Current Weekly POC", color=color.blue, linewidth=2, style=plot.style_line)

```

- The current week's POC is plotted as a blue line on the chart for reference.

#### Summary

This script calculates and identifies weekly Points of Control (POCs) and marks them as nPOCs if they remain untouched by subsequent price action. These nPOCs are displayed as horizontal lines extending to the right, providing traders with potential support or resistance levels. The script also manages the number of lines plotted to maintain a clear and uncluttered chart.

This Pine Script identifies and displays weekly naked Points of Control (nPOCs) on a TradingView chart. An nPOC represents a Point of Control (POC) from a previous week that has not been revisited by price action in subsequent weeks. These nPOCs are extended to the right as horizontal lines, indicating potential support or resistance levels.

#### Script Overview

1. **Indicator Declaration:**

```pinescript

//version=5

indicator("Weekly nPOCs", overlay=true)

```

- The script is defined as a version 5 Pine Script.

- The `indicator` function sets the script's name ("Weekly nPOCs") and specifies that the indicator should be overlaid on the price chart (`overlay=true`).

2. **Function to Calculate POC:**

```pinescript

f_poc(_hl2, _vol) =>

var float[] vol_profile = na

if (na(vol_profile))

vol_profile := array.new_float(100, 0.0)

_bin_size = (high - low) / 100

for i = 0 to 99

if _hl2 >= low + i * _bin_size and _hl2 < low + (i + 1) * _bin_size

array.set(vol_profile, i, array.get(vol_profile, i) + _vol)

max_volume = array.max(vol_profile)

poc_index = array.indexof(vol_profile, max_volume)

poc_price = low + poc_index * _bin_size + _bin_size / 2

poc_price

```

- The function `f_poc` calculates the Point of Control (POC) for a given period.

- It takes two parameters: `_hl2` (the average of the high and low prices) and `_vol` (volume).

- A volume profile array (`vol_profile`) is initialized to store volume data across different price bins.

- The price range between the high and low is divided into 100 bins (`_bin_size`).

- The function iterates over each bin, accumulating the volumes for prices within each bin.

- The bin with the maximum volume is identified as the POC (`poc_price`).

3. **Variables to Store Weekly Data:**

```pinescript

var float poc = na

var float prev_poc = na

var line[] poc_lines = na

if na(poc_lines)

poc_lines := array.new_line(0)

```

- `poc` stores the current week's POC.

- `prev_poc` stores the previous week's POC.

- `poc_lines` is an array to store lines representing nPOCs. The array is initialized if it is `na` (not initialized).

4. **Calculate Weekly POC:**

```pinescript

is_new_week = ta.change(time('W')) != 0

if (is_new_week)

prev_poc := poc

poc := f_poc(hl2, volume)

if not na(prev_poc)

line new_poc_line = line.new(x1=bar_index, y1=prev_poc, x2=bar_index + 100, y2=prev_poc, color=color.red, width=2)

label.new(x=bar_index, y=prev_poc, text="nPOC", style=label.style_label_down, color=color.red, textcolor=color.white)

array.push(poc_lines, new_poc_line)

```

- `is_new_week` checks if the current bar is the start of a new week using the `ta.change(time('W'))` function.

- If it's a new week, the previous week's POC is stored in `prev_poc`, and the current week's POC is calculated using `f_poc`.

- If `prev_poc` is not `na`, a new line (`new_poc_line`) representing the nPOC is created, extending it to the right (for 100 bars).

- A label is created at the `prev_poc` level, marking it as "nPOC".

- The new line is added to the `poc_lines` array.

5. **Remove Old Lines:**

```pinescript

if array.size(poc_lines) > 52

line.delete(array.shift(poc_lines))

```

- This section ensures that only the last 52 weeks of nPOCs are kept to avoid cluttering the chart.

- If the `poc_lines` array contains more than 52 lines, the oldest line is deleted using `array.shift`.

6. **Plot the Current Week's POC as a Reference:**

```pinescript

plot(poc, title="Current Weekly POC", color=color.blue, linewidth=2, style=plot.style_line)

```

- The current week's POC is plotted as a blue line on the chart for reference.

#### Summary

This script calculates and identifies weekly Points of Control (POCs) and marks them as nPOCs if they remain untouched by subsequent price action. These nPOCs are displayed as horizontal lines extending to the right, providing traders with potential support or resistance levels. The script also manages the number of lines plotted to maintain a clear and uncluttered chart.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。