OPEN-SOURCE SCRIPT

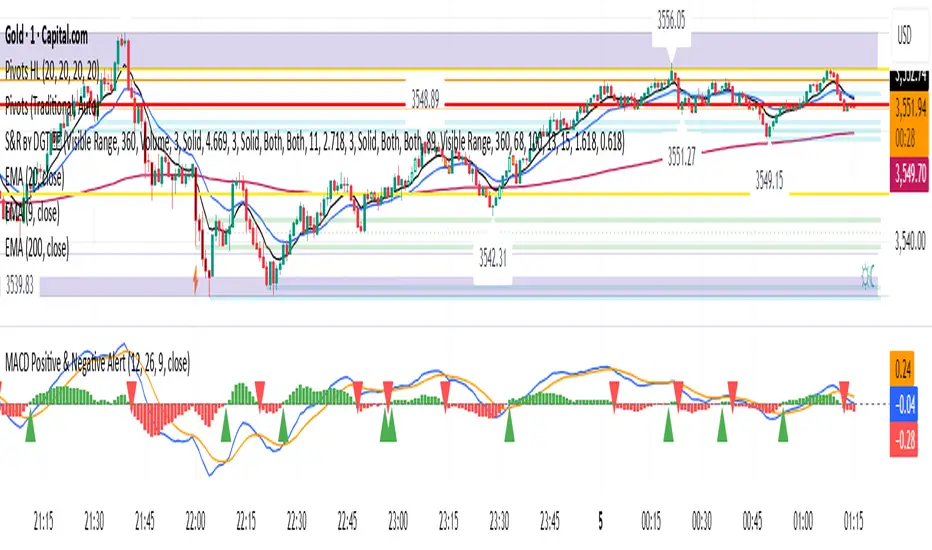

MACD Positive & Negative Alert

The MACD (Moving Average Convergence Divergence) is a momentum and trend-following indicator that helps traders identify the strength and direction of a trend, spot potential reversals, and fine-tune entry/exit timing.

Core Components

- MACD Line:

The difference between the 12-period and 26-period EMA (Exponential Moving Averages). This line highlights shifts in momentum and identifies the prevailing trend direction.

- Signal Line:

A 9-period EMA of the MACD line, acting as a trigger for buy/sell signals. When the MACD line crosses above the signal line, it suggests a bullish signal; when it crosses below, it suggests a bearish one.

- Histogram:

Shows the difference between the MACD line and the signal line as a bar graph. The histogram helps traders gauge the strength of the momentum and can warn of possible reversals. A rapidly growing histogram means strengthening momentum, while a shrinking one indicates weakening momentum.

Main Uses

- Trend Identification:

A positive MACD value typically signals a bullish trend, while a negative value signals a bearish trend.

- Momentum Analysis:

Divergences between MACD and price can warn of upcoming reversals. Increasing MACD histogram bars confirm strong momentum; shrinking bars suggest consolidation or reversal.

- Signal Generation:

Crossovers between the MACD line and the signal line generate trade signals—bullish (buy) if the MACD moves above the signal, bearish (sell) if it falls below l.

Example Interpretation

- MACD Crossover:

If the MACD line crosses above the signal line, it's often considered a buy signal; a cross below is a sell signal.

- Zero Line Cross:

If the MACD histogram moves from below zero to above, this is considered a bullish momentum shift; above zero to below is a bearish move.

The MACD is most effective in trending markets and should ideally be used alongside additional indicators for robust trading decisions.

Core Components

- MACD Line:

The difference between the 12-period and 26-period EMA (Exponential Moving Averages). This line highlights shifts in momentum and identifies the prevailing trend direction.

- Signal Line:

A 9-period EMA of the MACD line, acting as a trigger for buy/sell signals. When the MACD line crosses above the signal line, it suggests a bullish signal; when it crosses below, it suggests a bearish one.

- Histogram:

Shows the difference between the MACD line and the signal line as a bar graph. The histogram helps traders gauge the strength of the momentum and can warn of possible reversals. A rapidly growing histogram means strengthening momentum, while a shrinking one indicates weakening momentum.

Main Uses

- Trend Identification:

A positive MACD value typically signals a bullish trend, while a negative value signals a bearish trend.

- Momentum Analysis:

Divergences between MACD and price can warn of upcoming reversals. Increasing MACD histogram bars confirm strong momentum; shrinking bars suggest consolidation or reversal.

- Signal Generation:

Crossovers between the MACD line and the signal line generate trade signals—bullish (buy) if the MACD moves above the signal, bearish (sell) if it falls below l.

Example Interpretation

- MACD Crossover:

If the MACD line crosses above the signal line, it's often considered a buy signal; a cross below is a sell signal.

- Zero Line Cross:

If the MACD histogram moves from below zero to above, this is considered a bullish momentum shift; above zero to below is a bearish move.

The MACD is most effective in trending markets and should ideally be used alongside additional indicators for robust trading decisions.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。