OPEN-SOURCE SCRIPT

Pivot Percentile Trend - Strategy [presentTrading]

█ Introduction and How it is Different

The "Pivot Percentile Trend - Strategy" from PresentTrading represents a paradigm shift in technical trading strategies. What sets this strategy apart is its innovative use of pivot percentiles, a method that goes beyond traditional indicator-based analyses. Unlike standard strategies that might depend on single-dimensional signals, this approach takes a multi-layered view of market movements, blending percentile calculations with SuperTrend indicators for a more nuanced and dynamic market analysis.

This strategy stands out for its ability to process multiple data points across various timeframes and pivot lengths, thereby capturing a broader and more detailed picture of market trends. It's not just about following the price; it's about understanding its position in the context of recent historical highs and lows, offering a more profound insight into potential market movements.

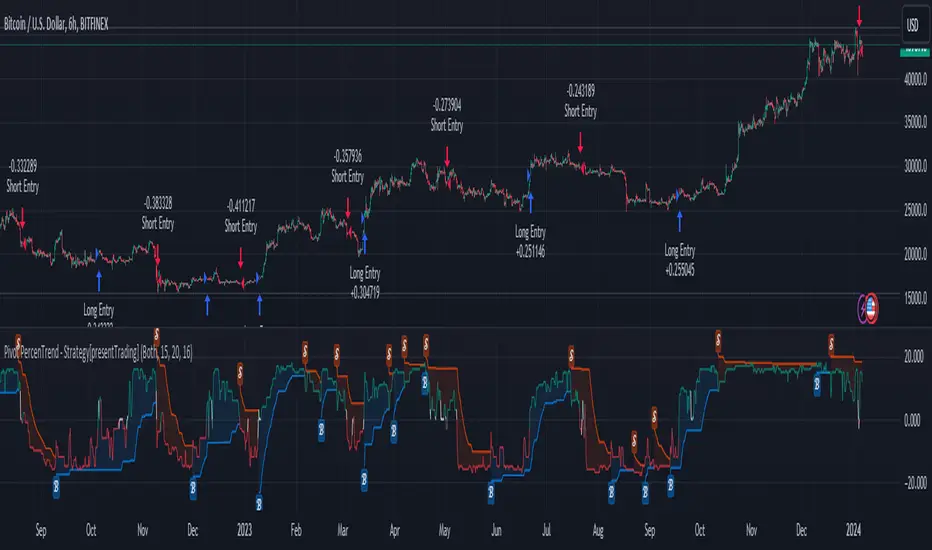

BTC 6h L/S

Where traditional methods might react to market changes, the Pivot Percentile Trend strategy anticipates them, using a calculated approach to identify trend strengths and weaknesses. This foresight gives traders a significant advantage, allowing for more strategic decision-making and potentially increasing the chances of successful trades.

In essence, this strategy introduces a more comprehensive and proactive approach to trading, harnessing the power of advanced percentile calculations combined with the robustness of SuperTrend indicators. It's a strategy designed for traders who seek a deeper understanding of market dynamics and a more calculated approach to their trading decisions.

Local picture

█ Strategy, How It Works: Detailed Explanation

🔶 Percentile Calculations

- The strategy employs percentile calculations to assess the relative position of current market prices against historical data.

- For a set of lengths (e.g., `length * 1`, `length * 2`, up to `length * 7`), it calculates the 75th percentile for high values (`percentilesHigh`) and the 25th percentile for low values (`percentilesLow`).

- These percentiles provide a sense of where the current price stands compared to recent price ranges.

Length - 10

Length - 15

🔶 SuperTrend Indicator

- The SuperTrend indicator is a key component, providing trend direction signals.

- It uses the `currentTrendValue`, derived from the difference between bull and bear strengths calculated from the percentile data.

* used the Supertrend toolkit by EliCobra

🔶 Trend Strength Counts

- The strategy calculates counts of bullish and bearish indicators based on comparisons between the current high and low against high and low percentiles.

- `countBull` and `countBear` track the number of times the current high is above the high percentiles and the current low is below the low percentiles, respectively.

- Weak bullish (`weakBullCount`) and bearish (`weakBearCount`) counts are also determined by how often the current lows and highs fall within the percentile range.

*The idea of this strength counts mainly comes from 'Trend Strength Over Time' federalTacos5392b

🔶 Trend Value Calculation

- The `currentTrendValue` is a crucial metric, computed as `bullStrength - bearStrength`.

- It indicates the market's trend direction, where a positive value suggests a bullish trend and a negative value indicates a bearish trend.

🔶 Trade Entry and Exit Logic

- The entry points for trades are determined by the combination of the trend value and the direction indicated by the SuperTrend indicator.

- For a long entry (`shouldEnterLong`), the `currentTrendValue` must be positive and the SuperTrend indicator should show a downtrend.

- Conversely, for a short entry (`shouldEnterShort`), the `currentTrendValue` should be negative with the SuperTrend indicating an uptrend.

- The strategy closes positions when these conditions reverse.

█ Trade Direction

The strategy is versatile, allowing traders to choose their preferred trading direction: long, short, or both. This flexibility enables traders to tailor their strategies to their market outlook and risk appetite.

█ Default Settings and Customization

1. Trade Direction: Selectable as Long, Short, or Both, affecting the type of trades executed.

2. Indicator Source: Pivot Percentile Calculations, key for identifying market trends and reversals.

3. Lengths for Percentile Calculation: Various configurable lengths, influencing the scope of trend analysis.

4. SuperTrend Settings: ATR Length 20, Multiplier 18, affecting indicator sensitivity and trend detection.

5. Style Options: Custom colors for bullish (green) and bearish (red) trends, aiding visual interpretation.

6. Additional Settings: Includes contrarian signals and UI enhancements, offering strategic and visual flexibility.

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

Watch patiently/ then trade

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。

オープンソーススクリプト

TradingViewの精神に則り、このスクリプトの作者はコードをオープンソースとして公開してくれました。トレーダーが内容を確認・検証できるようにという配慮です。作者に拍手を送りましょう!無料で利用できますが、コードの再公開はハウスルールに従う必要があります。

Watch patiently/ then trade

免責事項

この情報および投稿は、TradingViewが提供または推奨する金融、投資、トレード、その他のアドバイスや推奨を意図するものではなく、それらを構成するものでもありません。詳細は利用規約をご覧ください。